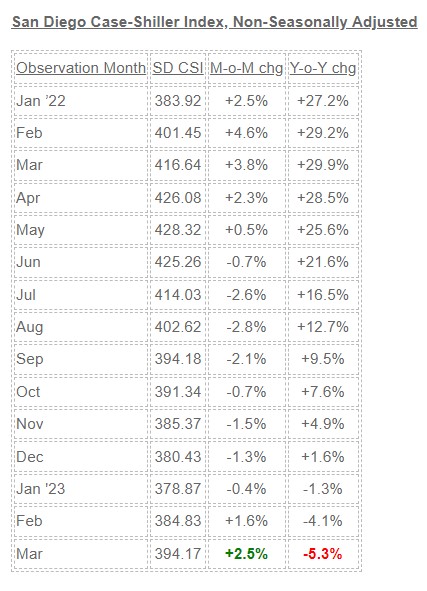

Our YoY change is more negative this month because in early-2022 it was flying – the local Case-Shiller Index went up 11% between January and April last year!

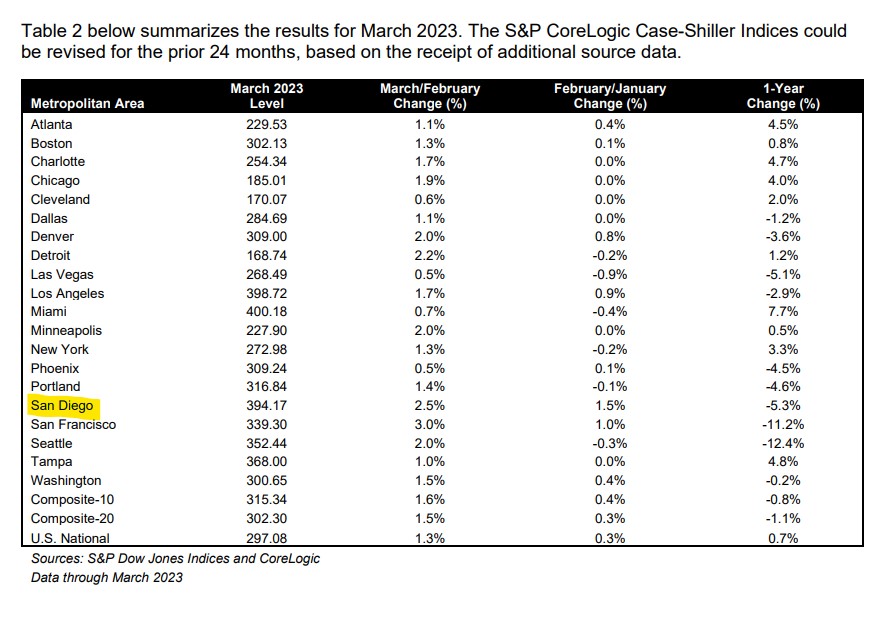

We had the second-highest MoM gain in the country:

Here’s another guy who ignores the seasonal trends and instead just declares that price declines are over:

“The modest increases in home prices we saw a month ago accelerated in March 2023,” said Craig J. Lazzara, managing director at S&P DJI in a release.

“Two months of increasing prices do not a definitive recovery make, but March’s results suggest that the decline in home prices that began in June 2022 may have come to an end.”

Note the headline:

I was in Denver a couple of weeks ago + noticed that there were basements and concrete pads for new buildings all over the place.

Looked almost exactly like 1982. Back then things were booming until they weren’t. Once it starting slowing down builders cut and ran + filed for BK.

I dont think it will happen as quickly this time but the trend is moving in that direction.

San Diego is a little different because theres nowhere to build new properties unlike other cities. But the same market forces will still apply.

Agree – the demand could shut down at any time.

The fewer creampuffs that come on the market, the more discouraged buyers will become.

How long will they sit on the edge of their seat, refreshing their search portal every hour? Making sensible offers that don’t win anything? Keep wondering if they will need to renew their lease one more year?

The buyer exhaustion won’t kill the market – it will wear them down and suck all of the frenzy fever out of them. Eventually, nobody is going to want to pay over list.

eventually nobody is going to want to pay *list*

prices are so far out in front of wages, only wealthy relocators/retirees will be in a position to purchase a house