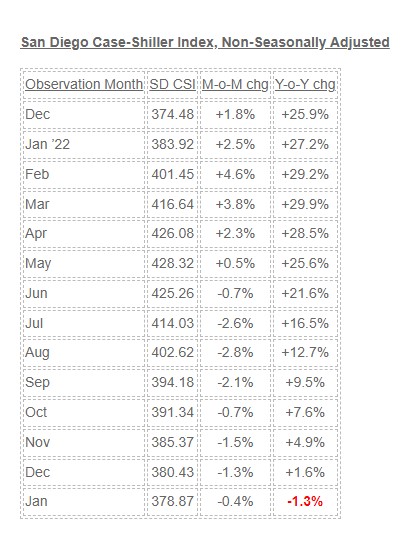

Here we go – the first negative year-over-year reading!

The index will probably stay negative for another one or two readings, then level off and maybe rise during the spring – but we won’t know until summer due to the lag in reporting.

Any gain during the spring selling season will likely be given back in the second half of the year as seasonality creeps back in – even though the consensus will be that the higher rates and recession finally crushed real estate by 2024.

This is funny how the reporter got it right about there being too few homes for sale. But then the quote from the expert that followed made no mention of inventory. Most of the country is blind to what’s really going on because the doom, real or imagined, is ingrained daily by the psuedo-experts – which causes potential sellers to wait it out:

Prices were lower year over year in San Francisco (-7.6%), Seattle (-5.1%), Portland, Oregon (-0.5%) and San Diego (-1.4%). They were flat in Phoenix.

Miami, Tampa and Atlanta again saw the hottest annual price gains of the top 20 cities. Miami prices were up 13.8%, Tampa prices up 10.5%, and Atlanta prices rose 8.4%. All 20 cities, however, reported lower prices in the year ending January 2023 versus the year ending December 2022.

Homebuyers may be seeing more flexible sellers this spring, but there are still too few homes available for sale. Mortgage lending may also tighten in light of pressure on the banking system.

“More expensive, less available borrowing, especially with an unclear economic outlook, is likely to continue to limit buyer demand. Though home sales are expected to rebound in line with seasonal trends, this spring’s sales pace is expected to remain lower than last year, as uncertainty and high costs limit activity,” said Hannah Jones, economic data analyst for Realtor.com.

Can you maybe describe the rental market and the forecast for rents for the near and distant future? Thanks.

I’m not much of a rental guy but…..

The Under-$1,000,000 market is red hot, which probably means high rents are forcing tenants to buy. At the entry-level, buyers can get in with 3% down and have a payment that is only a $1,000 to $2,000 higher than their rent.

Those who are paying $7,000+ in rent are probably having more trouble saving the larger 20% down, and they may think that prices might get softer while they wait – so no rush. Those landlords are giddy about their good fortune of renting their house for double what they used to get, so they aren’t bumping rents or looking for new tenants.

I think the trend will be flat everything. Flat home prices, rents, construction costs, service costs – how can they go any higher? If that happens, it will be the best thing ever because consumers will be looking at quality instead of price.

It will be a bouncy, rocky, turbulent flat though.