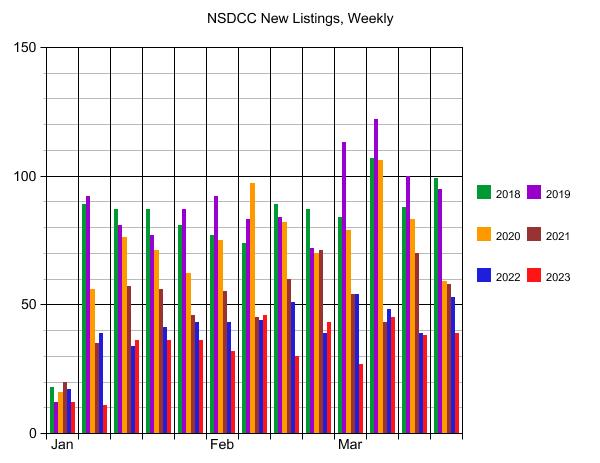

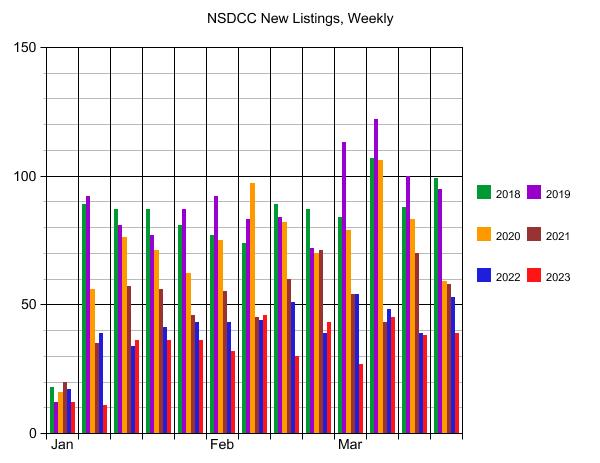

Until there is a significant increase in inventory, we won’t know how the current market conditions are affecting the demand, if at all. I thought we’d get off to a sluggish start, but this is shockingly low:

Total NSDCC Detached-Home Listings, First 13 Readings of the Year

2018: 1,067

2019: 1,110

2020: 932

2021: 670

2022: 545

2023: 431

This is how the new listings look on a weekly basis:

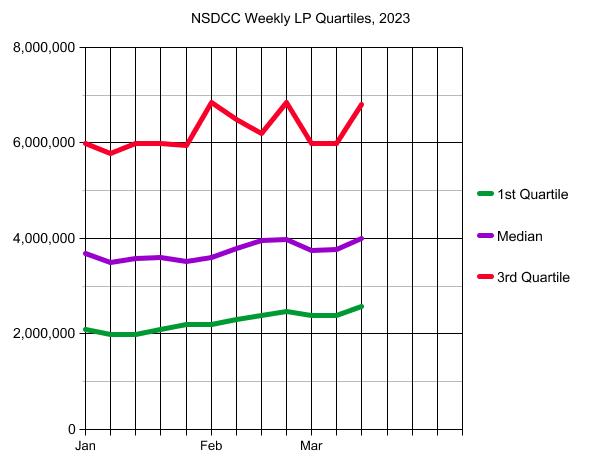

Mortgae rates have improved considerably, and now buyers can get a rate in the fives, instead of the sevens, which sounds attractive. But if there aren’t enough quality listings, who cares?

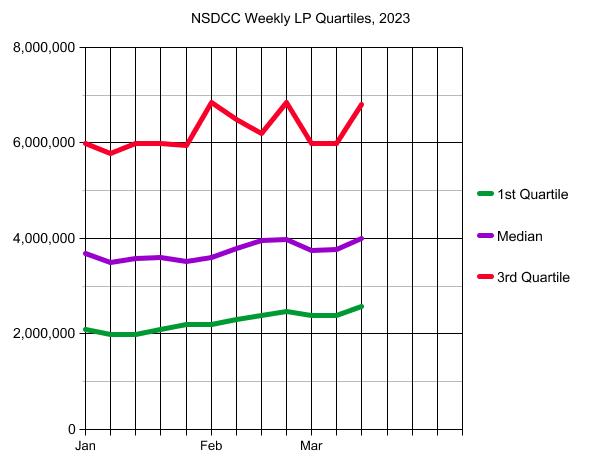

Lower rates should mean that buyers can get a little more for their money, but sellers want to squeeze some of that benefit too:

More listings are needed – let’s go sellers!

The $0 – $1,500,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

22 |

$719/sf |

75 |

15 |

| Jan 9 |

26 |

$687/sf |

50 |

14 |

| Jan 16 |

23 |

$701/sf |

52 |

20 |

| Jan 23 |

25 |

$751/sf |

60 |

21 |

| Jan 30 |

23 |

$788/sf |

45 |

25 |

| Feb 6 |

18 |

$750/sf |

59 |

24 |

| Feb 13 |

18 |

$770/sf |

48 |

26 |

| Feb 20 |

17 |

$778/sf |

49 |

26 |

| Feb 27 |

18 |

$802/sf |

48 |

23 |

| Mar 6 |

22 |

$802/sf |

44 |

14 |

| Mar 13 |

22 |

$747/sf |

45 |

16 |

| Mar 20 |

16 |

$826/sf |

49 |

21 |

The $1,500,000 – $2,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

45 |

$809/sf |

60 |

18 |

| Jan 9 |

55 |

$828/sf |

53 |

19 |

| Jan 16 |

46 |

$838/sf |

53 |

30 |

| Jan 23 |

43 |

$793/sf |

52 |

31 |

| Jan 30 |

40 |

$778/sf |

54 |

34 |

| Feb 6 |

42 |

$814/sf |

46 |

30 |

| Feb 13 |

35 |

$823/sf |

51 |

39 |

| Feb 20 |

34 |

$801/sf |

47 |

40 |

| Feb 27 |

27 |

$846/sf |

33 |

45 |

| Mar 6 |

29 |

$893/sf |

33 |

41 |

| Mar 13 |

32 |

$850/sf |

33 |

39 |

| Mar 20 |

27 |

$872/sf |

36 |

41 |

The $2,000,000 – $3,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

52 |

$869/sf |

69 |

30 |

| Jan 9 |

57 |

$940/sf |

66 |

31 |

| Jan 16 |

50 |

$948/sf |

61 |

36 |

| Jan 23 |

51 |

$949/sf |

58 |

35 |

| Jan 30 |

54 |

$964/sf |

55 |

34 |

| Feb 6 |

60 |

$930/sf |

51 |

42 |

| Feb 13 |

51 |

$1,038/sf |

52 |

47 |

| Feb 20 |

58 |

$1,022/sf |

47 |

46 |

| Feb 27 |

56 |

$1,064/sf |

52 |

49 |

| Mar 6 |

57 |

$995/sf |

50 |

50 |

| Mar 13 |

55 |

$1,015/sf |

53 |

47 |

| Mar 20 |

50 |

$1,011/sf |

58 |

50 |

The $3,000,000 – $4,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

29 |

$1,236/sf |

85 |

6 |

| Jan 9 |

29 |

$1,180/sf |

80 |

5 |

| Jan 16 |

31 |

$1,196/sf |

73 |

8 |

| Jan 23 |

33 |

$1,201/sf |

71 |

7 |

| Jan 30 |

37 |

$1,218/sf |

70 |

6 |

| Feb 6 |

34 |

$1,236/sf |

75 |

12 |

| Feb 13 |

43 |

$1,333/sf |

68 |

11 |

| Feb 20 |

39 |

$1,392/sf |

71 |

18 |

| Feb 27 |

37 |

$1,323/sf |

68 |

22 |

| Mar 6 |

49 |

$1,222/sf |

56 |

20 |

| Mar 13 |

49 |

$1,312/sf |

49 |

22 |

| Mar 20 |

46 |

$1,321/sf |

52 |

25 |

The $4,000,000+ Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 2, 2023 |

121 |

$1,744/sf |

126 |

21 |

| Jan 9 |

119 |

$1,716/sf |

123 |

20 |

| Jan 16 |

120 |

$1,761/sf |

121 |

26 |

| Jan 23 |

122 |

$1,707/sf |

119 |

27 |

| Jan 30 |

120 |

$1,680/sf |

121 |

30 |

| Feb 6 |

125 |

$1,714/sf |

118 |

28 |

| Feb 13 |

121 |

$1,750/sf |

116 |

32 |

| Feb 20 |

129 |

$1,725/sf |

112 |

33 |

| Feb 27 |

124 |

$1,743/sf |

115 |

31 |

| Mar 6 |

122 |

$1,753/sf |

109 |

28 |

| Mar 13 |

120 |

$1,782/sf |

109 |

32 |

| Mar 20 |

129 |

$1,783/sf |

106 |

28 |

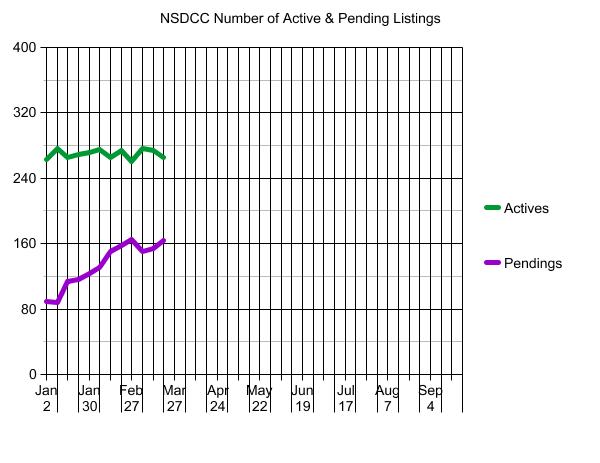

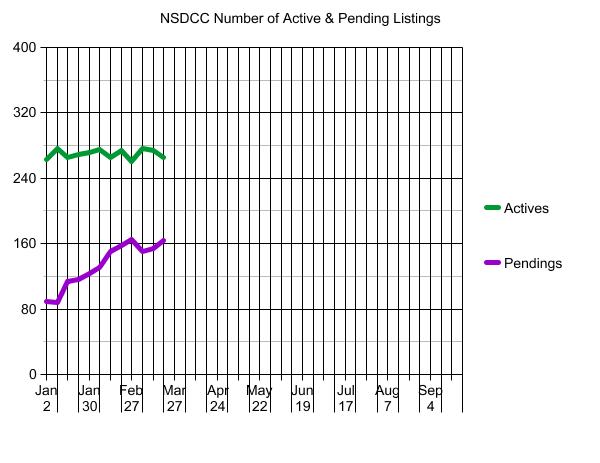

NSDCC Weekly New Listings and New Pendings

| Week |

New Listings |

New Pendings |

Total Actives |

Total Pendings |

| Jan 2, 2023 |

11 |

6 |

263 |

89 |

| Jan 9 |

36 |

15 |

277 |

88 |

| Jan 16 |

36 |

34 |

266 |

114 |

| Jan 23 |

36 |

22 |

269 |

116 |

| Jan 30 |

32 |

25 |

272 |

123 |

| Feb 6 |

46 |

33 |

275 |

131 |

| Feb 13 |

30 |

35 |

265 |

150 |

| Feb 20 |

43 |

34 |

274 |

158 |

| Feb 27 |

27 |

30 |

260 |

165 |

| Mar 6 |

45 |

28 |

276 |

150 |

| Mar 13 |

38 |

38 |

274 |

154 |

| Mar 20 |

39 |

37 |

265 |

164 |

NSDCC Weekly LP Quartiles

| Week |

1st Quartile |

2nd Quartile (Median LP) |

3rd Quartile |

| Jan 2, 2023 |

$2,095,000 |

$3,695,000 |

$5,995,000 |

| Jan 9 |

$1,990,000 |

$3,495,000 |

$5,775,000 |

| Jan 16 |

$2,000,000 |

$3,574,000 |

$5,995,000 |

| Jan 23 |

$2,099,000 |

$3,595,000 |

$5,999,000 |

| Jan 30 |

$2,195,000 |

$3,525,000 |

$5,942,000 |

| Feb 6 |

$2,195,000 |

$3,598,000 |

$6,845,000 |

| Feb 13 |

$2,300,000 |

$3,795,000 |

$6,495,000 |

| Feb 20 |

$2,397,500 |

$3,950,000 |

$6,197,500 |

| Feb 27 |

$2,480,800 |

$3,970,000 |

$6,845,000 |

| Mar 6 |

$2,395,000 |

$3,749,500 |

$5,995,000 |

| Mar 13 |

$2,397,000 |

$3,772,500 |

$5,997,000 |

| Mar 20 |

$2,580,000 |

$3,995,000 |

$6,800,000 |

Today there are 92 NSDCC homes for sale priced over $5,000,000, and 39 of those are priced over $10,000,000!

These updates are great, thanks! If you have the energy, it would be great to duplicate the first chart and exclude $3m+ (which is relevant to very few readers). As you know, the chart looks very different and is quite interesting, showing the evolution from a 2:1 actives to listing ratio to falling below 1:1.

I agree – the Under-$3,000,000 market is really cooking.

The raw data can be found at the bottom of the post each Monday. I have the energy! 😆