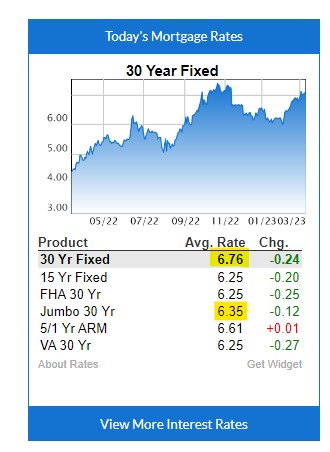

Mortgage rates improving 0.24% in one day is extremely unusual!

In a matter of 48 hours, Silicon Valley Bank has gone from being a company that we’ve never heard about or discussed to the highest profile bank failure since the Great Financial Crisis.

Such developments sound like they should be good for bonds and today was no exception. The news certainly overshadowed today’s jobs report although traders also looked willing to take that in stride (higher headline job creation offset by lower wage growth and higher unemployment).

The net effect was the largest rally in 4 months and one of the 5 biggest rallies of the past decade–at least for Treasuries.

https://www.mortgagenewsdaily.com/markets/mbs-recap-03102023

Volatility in mortgage rates is not a good thing in either direction.

Flat is best-case scenario and keeps the focus on buying the best house not the next house.

How many times do I need to say that it’s seasonal?

While some experts have warned of an impending US housing crash, Nadia Evangelou, senior economist and director of research at the National Association of Realtors, anticipates the opposite.

Home prices and sales will dip this year, but she anticipates a rebound in 2024 with sales rising and limited supplies sparking price gains.

“It seems that home sales activity has bottomed out, and 2023 will be the turning point for the housing market,” Evangelou told Insider. “We don’t expect any housing crash.”

In fact, some indicators are already turning positive. The NAR’s pending home sales index has ticked higher for two consecutive months and saw its largest monthly increase since June 2020.