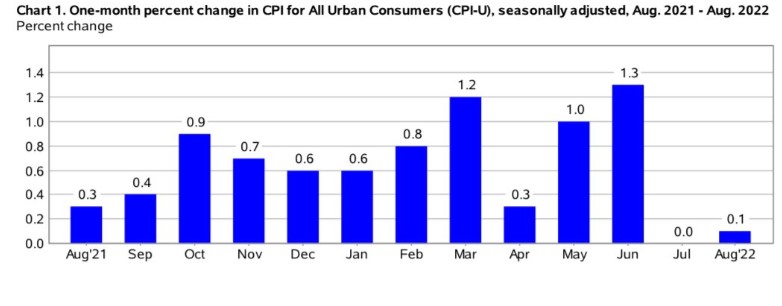

The latest CPI number is out today, and the over-reaction will put more pressure on mortgage rates. They are probably going to be around the 6% range for the foreseeable future.

Let’s predict the NSDCC monthly sales count for the rest of the year.

Today, we have 411 active listings, and we are back to the environment where we can expect that only 60% of those have a chance of selling. It’s probably too late for any active listing to close in September, so let’s sprinkle those 247 probable sales over the next three months, or 82 per month.

There are 152 pendings today, and 111 of those went pending before September 1st. They have released all contingencies on most of those, but let’s say only 100 actually close, and 90 are September closings.

Of the other 41 listings that just went pending, only half of them will close, or 20.

There have been 45 sales already close in September, so adding the two is 90 + 45 = 135 sales this month. Last September we had 269 closings.

NSDCC Monthly Sales, estimated:

September: 135

October: 110

November: 90

December: 90

4Q22 = 290

There will be other new listings over the next three months that will close, and it would be great if every month has 100+ closings – so the above is hopefully the worst-case scenario. But even if we have 300 or more closings in the fourth quarter, look at how that compares to recent NSDCC history:

4Q21 = 636

4Q20 = 977

4Q19 = 681

Even though the month-over-month change in the CPI looks very healthy, the panic will ensue and the real estate markets shut down until February….and probably get off to a slow start then.

People still want to buy, and people still want to sell. Everyone will just be waiting around until February, hoping something will be different!

Mortgage rates require a margin of error above the Fed cost of funds target rate. The higher the FFR the larger the cushion. The more volatile the FFR the larger the margin. The more uncertainty the greater the differential. We see all three more than in decades. Also add in the level of trust mortgage holders have in the Fed.

I’m sticking with my prediction.

Super interesting analysis as always Jim – how do these counts compare to our downturn in 08? Are we there yet?

Past it, and we just had the worst summer ever, as far as the number of NSDCC sales. But we also had the lowest number of listings ever so it’s not that bad.