Our full-price buyers backed out of their purchase of my new listing in La Costa Oaks due to fear of fire. I was there in 1997 when the last fire blew through La Costa – you may remember me being interviewed by Susan Taylor on NBS that night – so I’m aware of the danger.

While my listing is in the fire zone, but let’s look at it realistically. For this house to catch fire, the new houses in front would have to burn first, and the fire would have to overwhelm the excellent fire-fighting techniques employed by the best fire crew around who are well-prepared for wildfires and would arrive on scene before this house get touched.

You could also get hit by an asteroid, but do you look up at the sky all day? No – go get fire insurance and enjoy life. The California Fair Plan is the last resort for fire insurance and they will always be there for you.

As a result, we’ll be doing open house tomorrow 12-3, come on by!

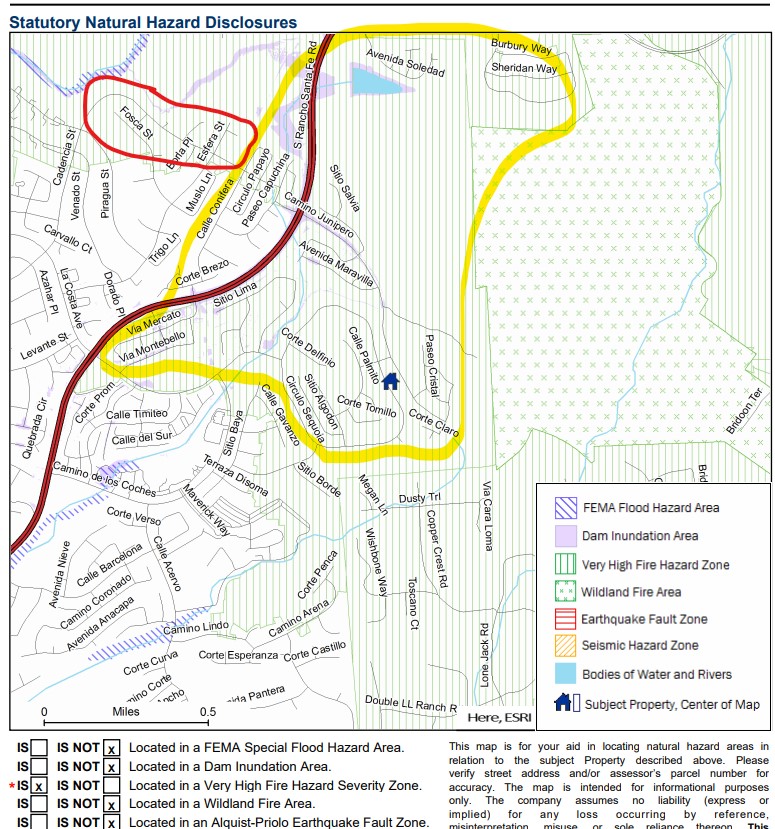

Here is the Natural Hazard Zone Disclosure map – there are hundreds of homes included in the very high fire hazard zone, yet the risk of burning down is extremely unlikely for the vast majority. Where homes burned in the 1996 fire is circled in red, and all of the homes within the yellow border have been built since:

I don’t see that much risk for fire in that location but the San Elijo Hills area I believe it’s extremely dangerous and may one day burn everything down just because the hills are so high and the wind can blow really hard there. I guess it’s OK if I had a jet pack and knew how to use it

See, there are solutions – if you are so worried about fires, how about a jet pack!

Is there a risk of a property being unable be insured due to excessive fire risk?

No the State of California runs the California Fair Plan that provides fire insurance to those within the zone.

Insurance agents can assist you with purchasing a fire insurance policy through the FAIR plan.

The quote for this 4,000sf house is $3,500 to $5,000 per year, depending upon the deductible. If it were me, I’d take the highest deductible because the chance of there being catastrophic damage from fire is extremely low, in my mind. The regular homeowners policy (theft, etc.) costs around $1,700 per year.

$3,500 + $1,700 = $5,200.

The existing policy from Mercury Insurance is $3,500 per year for both, but they declined future coverage.

Speaking from 1982, everyone will have a jet pack by 2022.

Geico is leaving California. A Buffet company. Not the first but part of a flood. It will become impossible to get property insurance for anythig resembling a fair price.

Can’t wait to be selling homes where the buyer ‘assumes’ the seller’s low-rate mortgage…..and their insurance too.

Talk about an All-Inclusive-Trust-Deed!

2008 I backed out of ‘smoking’ (pun) deal for a Big Bear cabin. Only $68,000 for a great location nice little cabin. Now it’s worth about $350k. We backed out because the only fire insurance we could find was Lloyd’s of London for $5300 a year for a cheap little cabin.

Geico isn’t “leaving California”. They are just closing their physical locations and going all digital.

I have had Farmers for property insurance for over 20 years on all my places and they are extremely inexpensive.

The California Fair Plan sounds misguided. The insurance market is sending a clear message about risk that shouldn’t be ignored, and relying on the neighbors house to burn down first is not a good strategy. Climate change predicts increasing wild fires and continued sea level rise, so homebuyers are wise to consider it.

I notice Redfin now maps flood zones and Realtor (.com) rates flood and fire risk.

Maybe they can assume the payments on your ex-wife if you have to sell due to divorce.

The California Fair Plan sounds misguided. The insurance market is sending a clear message about risk that shouldn’t be ignored, and relying on the neighbors house to burn down first is not a good strategy. Climate change predicts increasing wild fires and continued sea level rise, so homebuyers are wise to consider it.

Realistically, the risk of this house burning down is extremely low. In the last 50 years, there has been one fire that burned 43 houses in this area – and every one of them had a wood-shake shingle roof. Those are now outlawed, the defensible space is monitored by the city, and the fire-fighting ability has increased dramatically since then. When everything else is a good fit, for people to choose to not buy this house – or any house – just because of a fear of fire is very unfortunate.

https://www.sandiegouniontribune.com/sdut-harmony-fire-left-haunting-memories-prompted-2006oct21-story.html

The fire-insurance topic is a different matter, and because the government intervened, it probably has a political bent to it now but I don’t know why you say misguided. It’s what a government should do.

“It’s what a government should do.”

I retract my statement about the California Fair Plan, their website says:

“The FAIR Plan is not a state agency, nor is it a public entity. There is no public or taxpayer funding.”

Looks like it just connects you with companies that pool high risk properties to provide a quote. Of course, no matter how crazy or risky something is, someone will insure it. Lloyd’s of London is famous for this. The cost is the issue, and if you google news for California Fair Plan, you will see recent complaints about the cost and coverage.

The plan website says it “offers a temporary solution”, but I’m unclear if rates would decrease after you buy the house and insurance.

I stand corrected. Thanks for checking that out.