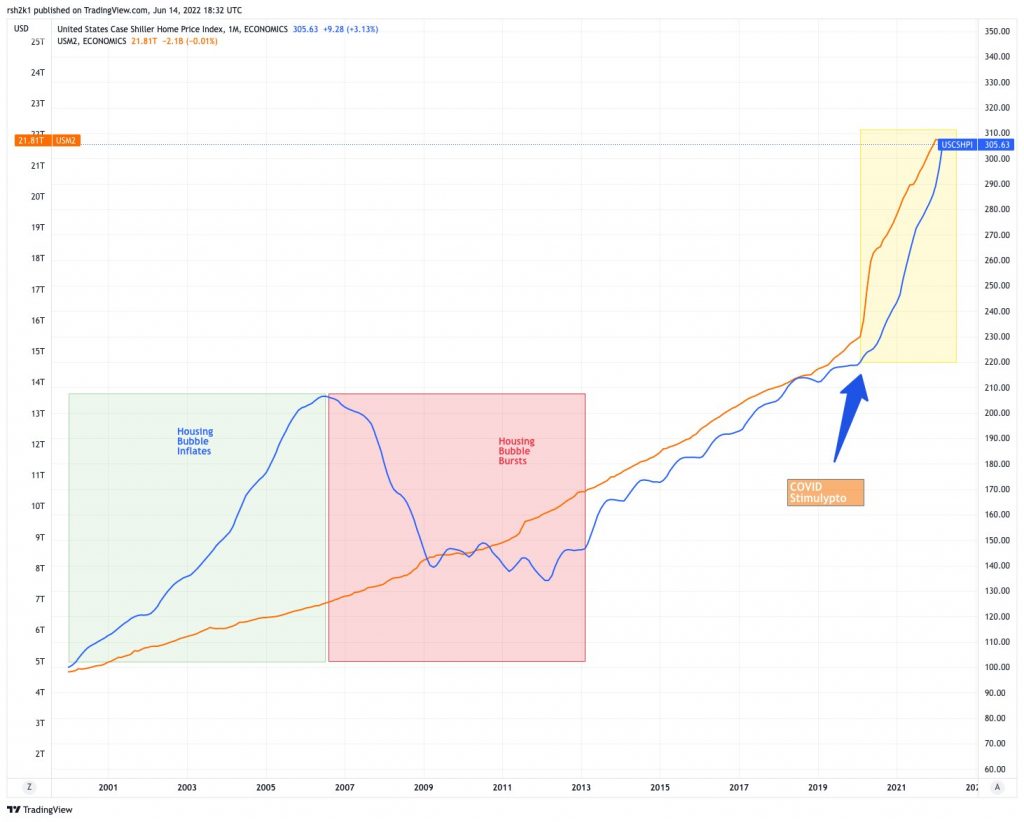

Rob H. noted that home prices have simply followed the flood of money. The M2 definition:

US M2 Money Stock refers to the measure of money supply that includes financial assets held mainly by households such as savings deposits, time deposits, and balances in retail money market mutual funds, in addition to more readily-available liquid financial assets as defined by the M1 measure of money, such as currency, traveler’s checks, demand deposits, and other checkable deposits.

The US M2 Money Stock is critical in understanding and forecasting money supply, inflation, and interest rates in the US. Historically, when the money supply dramatically increased in global economies, there would be a following dramatic increase in prices of goods and services, which would then follow monetary policy with the aim to maintain inflation levels low.

So there you go!

It reminded me of the bank underwriter who was processing the PPP loans. She told me that her supervisor said to approve every one!

A cheap money supply helped, in particular:

https://betterdwelling.com/pandemic-real-estate-boom-due-to-cheap-debt-not-lack-of-supply-us-federal-reserve/