The headline writers are having fun with the current real estate market. They must challenge each other with whom can come up with the most outrageous headline, regardless of what’s in the article.

In this week’s article, he says, “that we’ve officially moved from a housing boom into a “housing correction.”

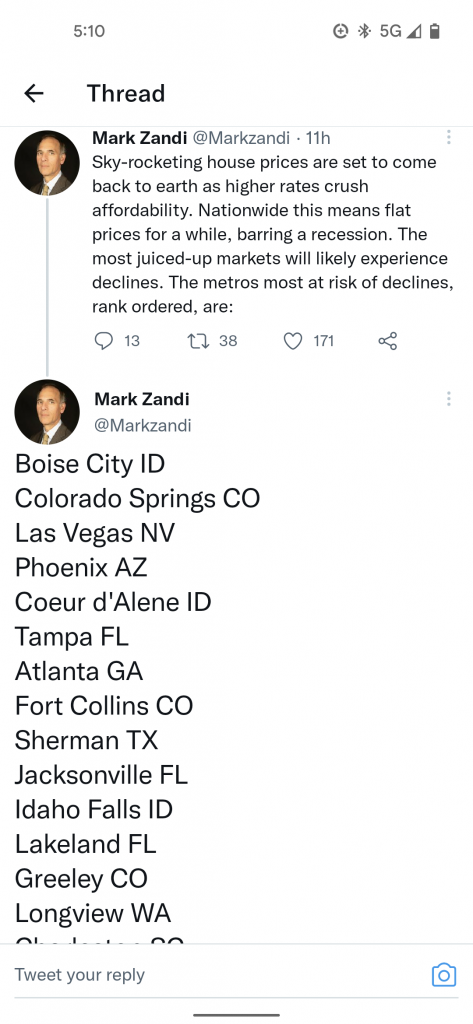

“The housing market has peaked…everything points to a rolling over of the housing market,” Zandi says. “In terms of home sales, they’re falling sharply. Housing demand is coming down fast. Home price growth [will] go flat here pretty quickly; we will see [home] price declines in a significant number of markets.”

But further into the article, they lay out the caveat that you see in every doomer article:

To be clear, Zandi doesn’t see a 2008-style housing bust or foreclosure crisis. While the spike in mortgage rates has pushed the housing market into the upper bounds of affordability, we don’t have the credit issues that plagued us last time. Homeowners are financially better off than they were in the lead-up to the 2008 financial crisis. This time around, Zandi says, we also don’t have widespread subprime mortgages. Also, if nationwide home prices do begin to plummet, he says, the Fed could always ease up on mortgage rates.

That said, Zandi says some regional housing markets have become historically “overvalued” and could see home prices decline 5% to 10% over the coming year. If a recession does come, Zandi says price drops in those markets could grow to between 10% to 20%.

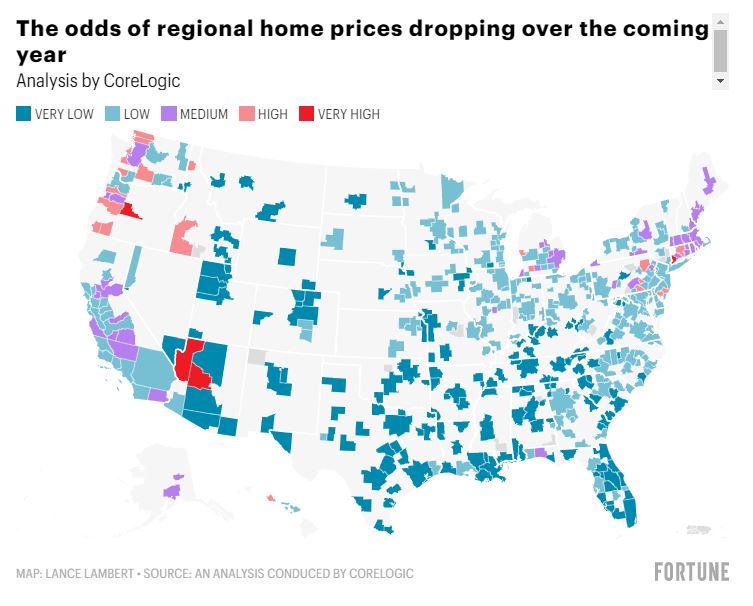

Buried further is the map (above) that shows the areas with the greatest odds of home-price declines. There aren’t many, and none are in California.

None of these analysts want to consider that to have home prices decline, there has to be sellers who will sell for less. It’s much more likely – like 10x more likely – that our market will just stall out as sellers wait it out, rather than take less. They’re not going to give it away!

Jim, OT question here. What do you think about selling a $800k paid off rental house here in south San Diego and buying 2 brand new KB homes in San Antonio Texas for $400k each. Do you have any clients that did this? What about property taxes and management? I think the rent would be about $2k each. Right now I’m getting $2400 rent and the house is very old. https://www.kbhome.com/new-homes-san-antonio/canyon-crest/plan-1792

Thanks,

Bob

It’s a long drive to handle property management. But if you can find a competent professional there to assist you, there are two obvious benefits:

1. Fewer repairs (and probably no repairs in Texas in the first few years).

2. Start your depreciation schedule over again.

KB Home is the worst/cheapest home builder in the history of the world, so expect the absolute standard tract house. Bare minimum.

Kind of seems like prices are still going UP here.

If you’ve got a sub-3% mortgage with inflation running 6%, why sell?

Prices will never go down until foreclosures start happening again.

If you can live in a house for 5+ years making sporadic payments + not lose the house this is what people will do.

Or theyll just use the equity to make enough payments to not lose the house.

“If you’ve got a sub-3% mortgage with inflation running 6%, why sell?”

Exactly.

Plus, sell and go where? Unless you are downsizing aggressively, the payment on your new, smaller place is likely to be the same. What’s the point?

I feel like these breathless “correction” headlines get clicks because renters need a glimmer of hope, and recent buyers are (understandably) worried they bought at the top. Something for everybody!

Prices will never go down until foreclosures start happening again.

If you can live in a house for 5+ years making sporadic payments + not lose the house this is what people will do.

Or theyll just use the equity to make enough payments to not lose the house.

Shadash! Welcome back!