Has there ever been a precedent to our current housing frenzy? Yes – back in the 2000-2005 era, which a new blogging guy coined, ‘The Golden Age of Real Estate’ (bubbleinfo.com was three months old). Note the S&P Index:

Date: December 25, 2005

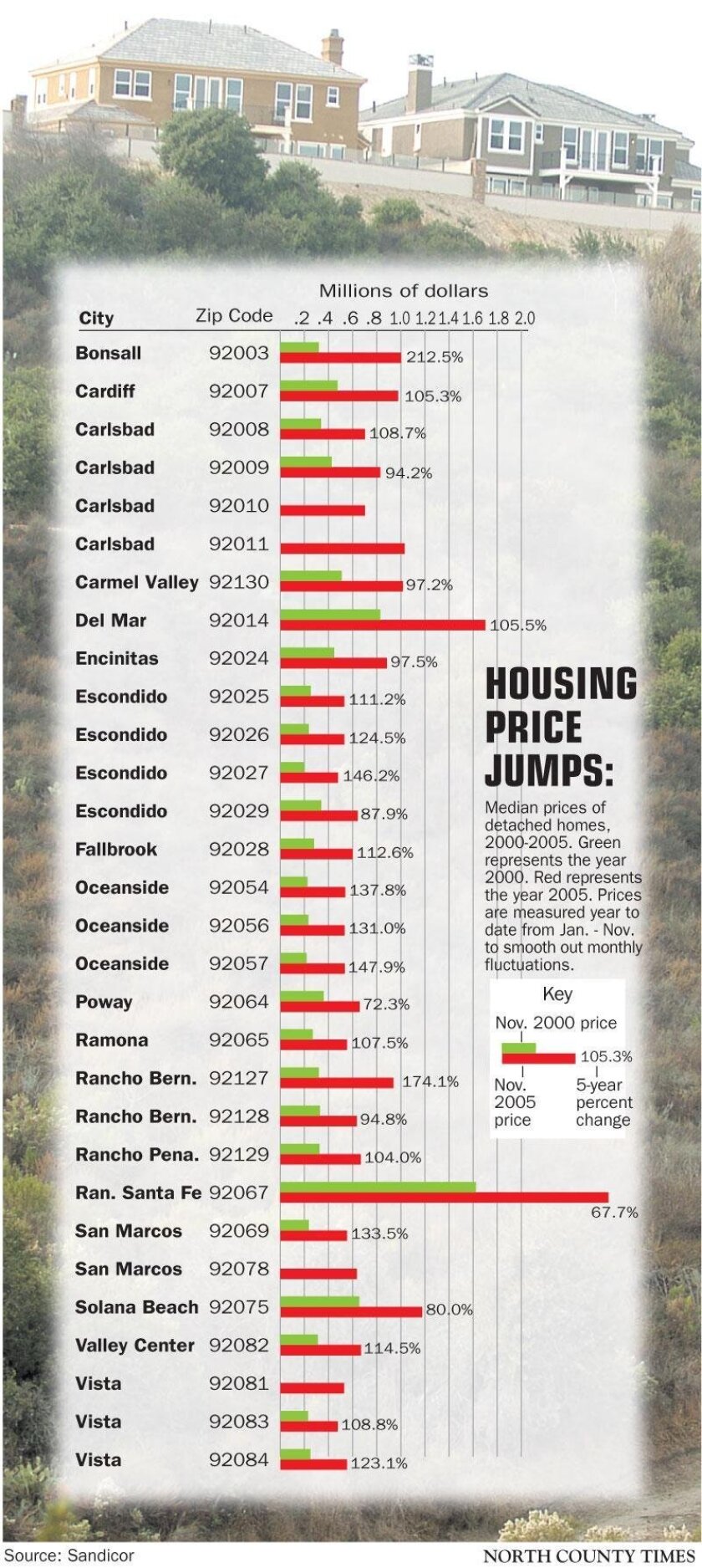

The median price of a single-family home in North County, and in California as a whole, has roughly doubled in the last five years. That familiar statistic implies that virtually anyone who bought in 2000 and sold five years later reaped a profit.

California and the rest of the U.S. benefited from low interest rates, enabling people to buy more expensive homes than they otherwise would have been able to afford, said Jim Klinge, a Carlsbad-based Realtor.

And in San Diego County, price increases of about 20 percent a year became expected, encouraging people to buy at any cost, in the expectation of sure profits.

By comparison, other investments didn’t look so good in the aftermath of the collapse of the stock market bubble, which began in 2000. For example, the Standard & Poors index of 500 stocks closed on Nov 1, 2000, at 1,429.40. As of Nov. 1, 2005, the S&P500 closed at 1,202.76. (today it’s at 4,480).

The real estate increases fueled spending by homeowners, who got ready cash from their rising home equity. A strong economy, with lower unemployment than the state and national averages, helped people buy, turning the county into one of the hottest real estate markets in America.

That market cooled down this year, with most months posting only single-digit gains over the same month in 2004. (November, with a 14 percent year-over-year increase in North County single-home median prices, was an exception.)

Real estate professionals have said the slowdown was inevitable since prices, along with factors such as the ratio of monthly mortgage payments to rental payments, have gotten far out of whack. A study by Torto Wheaton Research this year found that San Diego County’s rental-to-buy payment ratio was 40 percent, the lowest of any of the major markets it studied.

“I think we’ll look on these last five years as the golden age of real estate,” Klinge said. “The increases in the median price, both locally and countywide, have been astonishing for Realtors and buyers and sellers alike. We won’t see this again for the foreseeable future.”

But the gains weren’t evenly distributed. Depending on where the home is located, that potential profit varies from marginal —— in percentage terms, but not necessarily in dollars —— to outstanding.

As 2006 is about to begin, Klinge said prospective buyers should think long term. With prices as high as they are, the potential for quick gains that lured “flippers” to buy houses only to sell them a short while later is nearly gone.

With more sellers on the market, the buy-at-all-costs mentality of a short while ago has vanished, Klinge said. Homes will still sell, but at a slower rate and a lower price. Sellers can’t count on big profits, and prices could even fall at times, he said.

“I would say the market is going to be completely driven by buyers buying a house to live in,” Klinge said. “So if you’re going to buy a house, make sure it’s going to last you for years.”

Link to Full Article

I have been a Bubbleinfo reader since 2006. I still live in the same house in North County. The videos of the murky green swimming pools and vacant homes were classics. Mortgages were at 6-7% then. Mortgage payments at 2006 levels are almost the same at today’s prices with a 3.25% mortgage and houses have doubled. The recent price increase over the past 12 months have made today’s payments slightly higher on the same home when compared to 2005.

Today’s market is controlled by the wealthy investors and people with (stock options, equity in current home, and rich parents providing down payment). Try saving $150,000 for a down payment with a household income of $150-$200k in San Diego and no stock options or stock incentives. Good luck with that. Covid and remote working has been a boom for North County real estate fueled those seeking refuge from the plight in the Bay Area and Los Angeles urban areas (not talking about Palo Alto and Malibu for people that want to debate). How many people do you know that want to move to Los Angeles from San Diego? I know of 1.

JTR has been right for 16 years people.

JTR has been right for 16 years people.

Thank you North County Guy for your warm thoughts – and thanks for being here since 2006! I appreciate your comments over the years too.

RE: Rates.

I could mention the usual “I remember when they were double-digit” speech, but let’s also note that in 2006 the start rate on the neg-am loans was 3.99%. It lasted for one month, and then started adjusting upward!