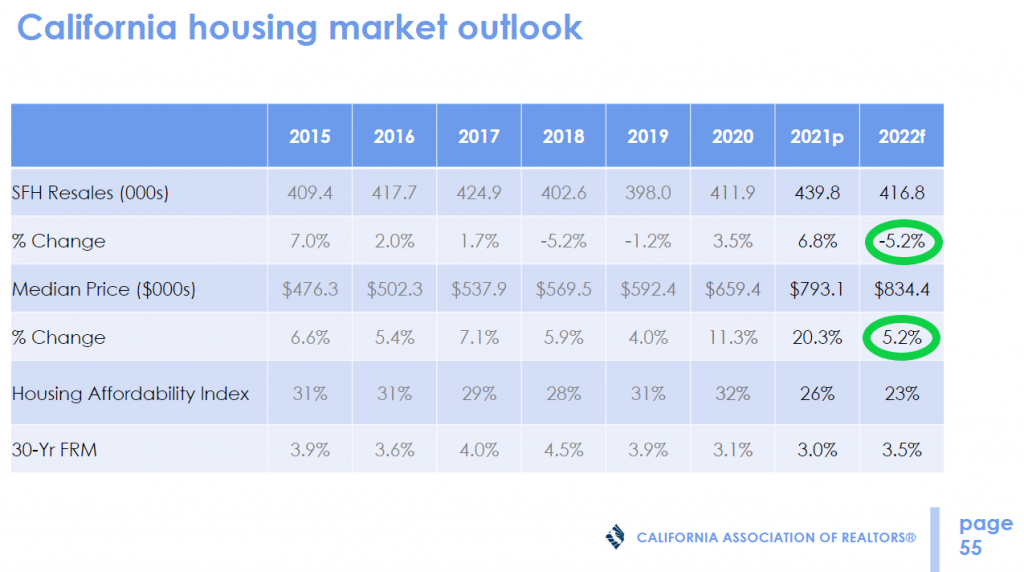

The association is predicting that home sales in California will drop next year, but has a typical guess for the statewide median sales price – expecting a 5.2% rise in 2022:

2022

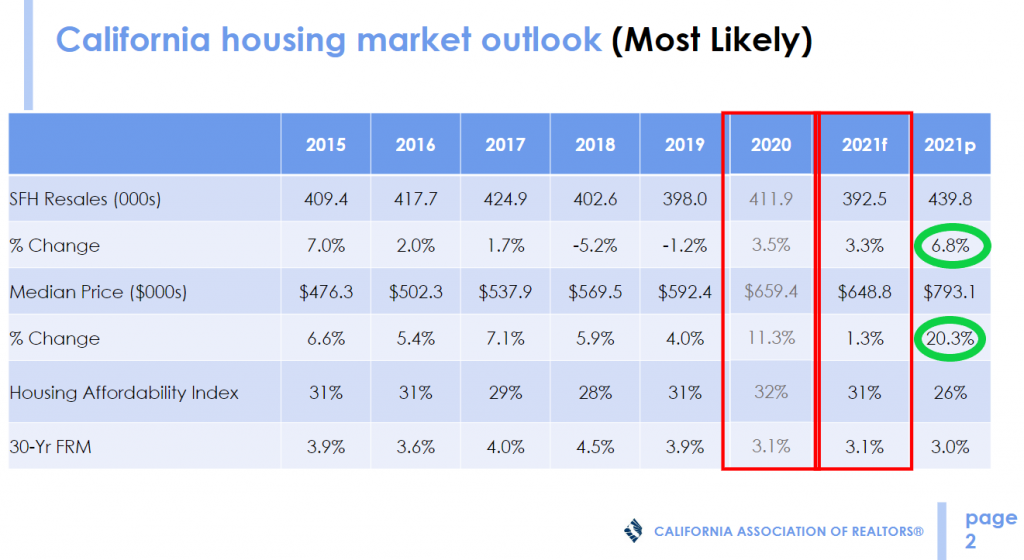

Their predictions for this year were terrible – they thought pricing would go nearly flat in 2021 (in red box), and instead we had the biggest gain ever (p is projected):

2021

These were my guesses for this year:

MY 2021 PREDICTIONS:

- We will have 10% more NSDCC listings than we had in 2020.

- We will have 10% more sales.

- We will have a 10% increase in the NSDCC median sales price.

Here’s how this year looks through the first three quarters of 2021:

| Year | |||

| 2019 | |||

| 2020 | |||

| 2021 |

NSDCC inventory DROPPED 16%, yet sales ROSE 15% this year! Pricing is +32%!

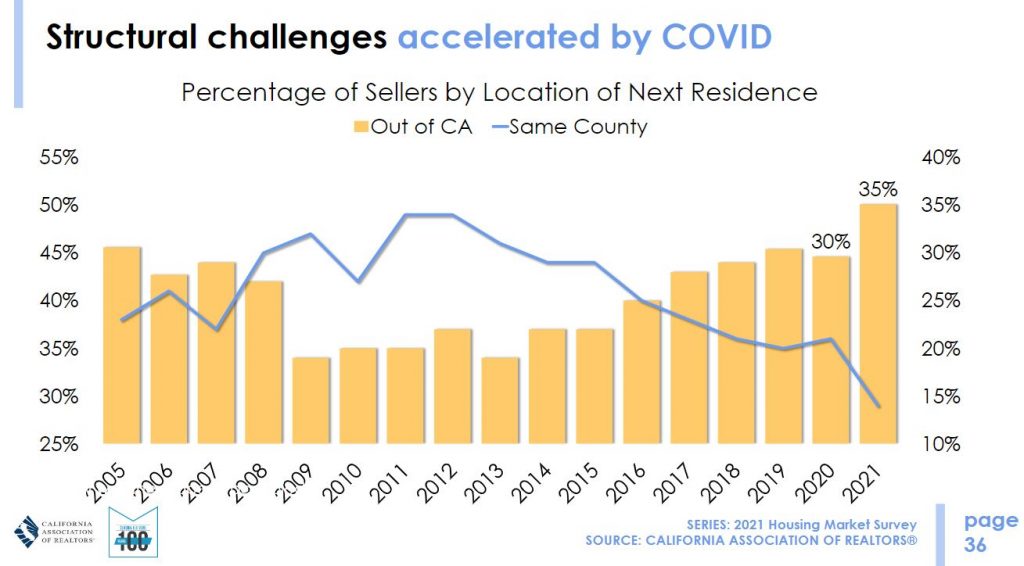

A graph showing how more people need to leave town to make it worth moving:

A CAR consumer survey showed, for example, that 35% of home sellers are moving out of state and fewer than 15% were moving to a home in the same county as their last residence. “I think that pressure to migrate out of the state is going to be just as strong, if not stronger, as housing, affordability gets worse,” CAR Chief Economist Jordan Levine said. “I think that this is a housing-driven phenomenon, and we don’t have a lot of relief in terms of housing affordability.”

From Bill at CR:

Yesterday, Goldman Sachs economist Ronnie Walker wrote a research note forecasting US house prices would increase a further 16% by the end of 2022: The Housing Shortage: Prices, Rents, and Deregulation. This caused quite a stir on twitter. Here is a brief excerpt from the note (emphasis added):

Of all the shortages afflicting the US economy, the housing shortage might last the longest. Earlier this year, we argued that constrained supply and sustainably robust demand would keep the US housing market very tight, pushing up home prices and rents sharply. The boom since then has surpassed even our lofty expectations, with home prices now up 20% over the last year. …

The supply-demand picture that has been the basis for our call for a multi-year boom in home prices remains intact. Housing inventories remain historically tight, while homes remain relatively affordable despite the recent price increases, and surveys of home buying intentions remain at healthy levels. Our model now projects that home prices will grow a further 16% by the end of 2022.

First, this is a projection for the end of next year. The most recent Case-Shiller report was for July, so this projection is for 17 months. This forecast is for an average of about 0.9% per month, well below the 1.5% per month average over the last year.

The Goldman forecast is based on low housing inventories and continuing strong demand.

Fannie and Freddie Forecasts

Fannie Mae and Freddie Mac put out frequent economic forecast, including for house prices. They are forecasting the FHFA price index, as opposed to Case-Shiller, but the indexes are fairly close.

Fannie Mae is currently forecasting house price growth will slow over the next several months, and will increase 5.1% in 2022 (Q4 over Q4). Freddie Mac is forecasting 5.3% growth in 2022. These forecast are for about 9% over the next 17 months – just over half the Goldman Sachs forecast. However, these forecasts expected a fairly sharp slowdown in price increases in Q3 and Q4 2021, and that hasn’t happened yet.

CoreLogic Forecast

A far less optimistic forecast comes from CoreLogic:

Home price gains are projected to slow to a 2.2% increase by August 2022, as ongoing affordability challenges deter some potential buyers.

This model seems way too pessimistic.

Conclusion

The Goldman Sachs forecast is based on two key factors:

Housing inventories remaining “historically tight”, and

Homes remaining “relatively affordable”.

In addition, the Goldman Sachs forecast is for 17 months. If prices increase at 1.5% per month for the rest of 2021 (the same pace as in July), the Goldman forecast would be for about 7.7% in 2022 – not that far above other forecasts.

Inventories are currently very tight, although we are seeing some divergence in markets across the country recently (for example, San Diego is at record lows right now, whereas inventories in Sacramento are up year-over-year). This is why I’m tracking inventory so closely in many local markets.

On “affordability”, this is based on house prices and mortgage rates. Mortgage rates have been increasing, and higher mortgage rates, combined with higher house prices, is making houses less “affordable”.

Demand is driven by household formation. However data on household formation is released with a significant lag. Since both house prices and rents are rising rapidly, there is clearly strong household formation right now (even though population growth is slow). I discussed this in Household Formation Drives Housing Demand

As I noted in 2015, in the 2020s, a large cohort has been moving into the 30 to 39 age group (a key for ownership). The current demographics are now very favorable for home buying – and will remain positive for most of the decade. (See: Housing and Demographics: The Next Big Shift). However, the aging of Millennials suggests a preference for homeownership over renting, and not total demand for housing!

Tight inventories, relatively low mortgage rates, and favorable demographics suggest further price increases ahead. But “a further 16% by the end of 2022” seems high.