Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

Rising taxes and declining real wages.

The jobs we’re creating now don’t have the wages or wage growth to support the cost of carry, even with 2 income households.

Bubble might not pop in 2008 fashion, but if you think there will be a bigger, qualified pool of buyers 5-10-15 years from now you’re on the wrong side of the curve.

I don’t know about that.

It was similar 8 years when we looked forward to today.

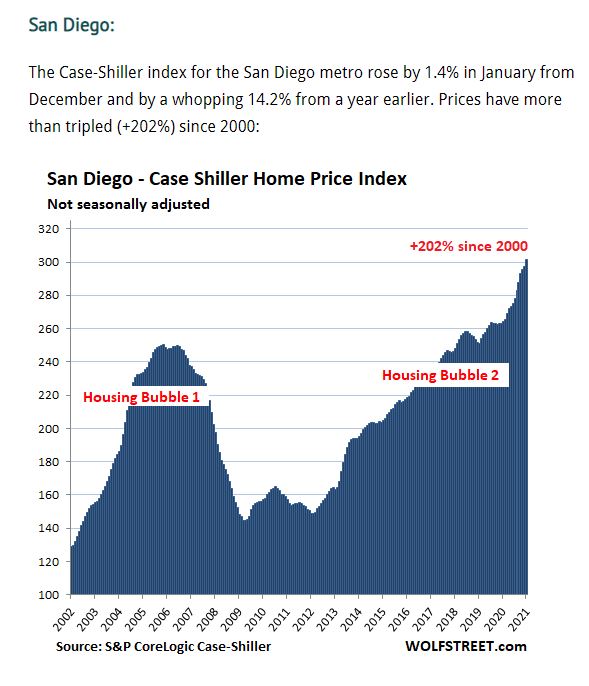

San Diego home prices were already de-coupling from wages…..and the NSDCC median sales price was $839,000 in March, 2013!

It has more than doubled!

Population growth and generational transfers of money could keep it going.

A skyrocketing stock market could also keep real estate going. People cashing out their paper gains for real assets, like real estate. You can’t live in your Amazon stock.

You could also have people cashing out their Bitcoin gains for real assets too.

I’ve said it before on this site: San Diego is a worldwide real estate market. As long as Chinese, Saudis, Russians, etcetera have the money, they’ll keep the market afloat. Local wages are not THE key factor in judging SD affordability

This seems like a product of central banks across the world monetizing debt (the only way we can sustain endless spending) and the related inflation across all asset classes. Equities, housing, bitcoin, lumber, etc. etc. are either in a “bubble” or the dollar is being devalued at a rapid pace.

The unbridled enthusiasm is the warning bell for me. Low-interest rates don’t solve the cost of carry.

An international market that doesn’t have housing the local population can afford looks like DTLA.

Homeless drug camps next to million-dollar condos. Not good for anyone.

We are where Vancouver was several years ago. Look it up.