My guess was that we’d have 10% MORE listings this year, as a result of there being a few more reasons to move – covid letting up, Prop 19, forbearance expiration, etc. Instead, we have covid hanging around, Prop 19 has been a dud, and forbearances have been extended through the year.

With 19% FEWER listings (so far), the impact shifts to pricing, and we see rapidly-rising home prices instead. We need more people leaving, and fewer people coming, to balance it out – and price will fix that too!

Hat tip to CP for sending this in this report from CPL:

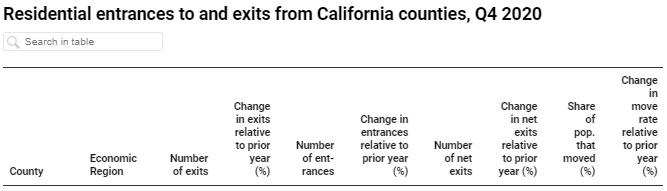

Recent news reports, preliminary data, and anecdotes suggest the COVID-19 pandemic is either causing or accelerating an exodus from California. The extent of any such exodus, and whether it proves to be temporary or permanent, is not yet clear — at least not in data sources traditionally used to quantify residential mobility.

The stakes are high: significant population shifts could affect the size and composition of regional labor markets as well as rent and home values. Some fear that mass departures by the state’s wealthy could reduce local and state tax revenues, potentially affecting the services governments are able to provide for years to come.

This policy brief uses the University of California Consumer Credit Panel (UC-CCP), a new dataset containing residential locations for all Californians with credit history, to track domestic residential moves at a quarterly frequency through the end of 2020.

For the full report of every county in California, click here:

https://www.capolicylab.org/calexodus-are-people-leaving-california/

A move is defined as having a different ZIP code in the next quarter. The data universe for this analysis is individuals in the UC-CCP with credit history; this population is older, more financially advantaged, and less diverse than the population of all adults in California.who had a different zip code on their credit report.

all those people making splashy headlines about leaving CA had been planning their exodus for a long time.

I noticed that redfin added a new feature. The location map of a property now has a box called “Flood Factor”, which you can click to see a rating from 1 to 10. Many homes selling for millions of dollars along the coast are rated as high risk (maybe from sea level rise). Wonder if agents are concerned about this.

Wonder if agents are concerned about this.

Redfin adding a new feature? No, their bait-and-switch is so deceiving that anything else they do is a minor blip.

20′ UHaul truck rental March 28th, 2021:

San Jose, CA to San Jose, TX $4,703.00

San Jose, TX to San Jose, CA $1,102.00