Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

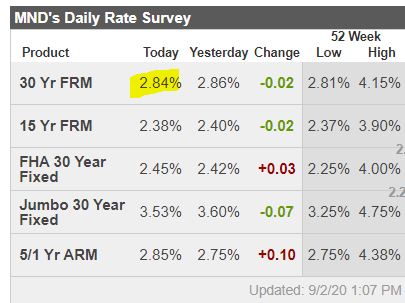

Rates at my credit union this morning:

-1.875% (15-yr Fixed Purchase)

-2.750% (15-yr Fixed Refinance)

-2.375% (30-yr Fixed Purchase)

-3.250% (30-yr Fixed Refinance)

Wish we could buy another house, Jim, but not much inventory out there! 🙂

Who ever thought we’d see mortgage rates lower than the inflation rate?????

Mortgage rates have improved noticeably in the past few business days, largely due to the delay of a new fee announced earlier this month.

Ironically, that same fee is the reason rates are about to move higher, just as many lenders are back within striking distance of all-time lows.

The fee applies to all refinances sold to the housing agencies Fannie Mae and Freddie Mac on or after December 1st. That may seem like a long time from now, but those sales tend to take place weeks after a loan actually closes. In fact, several lenders have already reintroduced the fee on loans locked for 60 days or more. For other lenders, it’s only a matter of time. Most lenders will announce their game plan for reintroducing the fee, but at least a few will just flip the switch with no advance notice.

How do you know if the fee applies to you? Simply put: it applies to almost every conventional refinance (not FHA/VA, Jumbo, or any other loans that don’t meet Fannie/Freddie guidelines).

Exceptions include loan amounts under $125k as well as HomeReady/Home Possible programs. And yes, there’s technically an exception if you’re refinancing a construction loan to long-term financing, but let’s be real. That’s only really a refi on a technicality.

The initial announcement of the fee sent shockwaves through the industry due to its heavy-handed implementation (i.e. it retroactively punished lenders to the tune of hundreds of millions of dollars on loans that were already locked). Unsurprisingly, lenders responded defensively as far as rates were concerned–raising costs to offset the big unexpected expense at the end of the month. After the delay was announced, things have steadily moved back in the right direction.

Does this mean rates won’t ever get back to all-time lows? Not at all. That’s almost exactly as possible as it was before the fee was announced. The only difference is that rates will have to drop roughly 0.125% (one eighth of one percent) farther than they otherwise would have.

http://www.mortgagenewsdaily.com/consumer_rates/953791.aspx