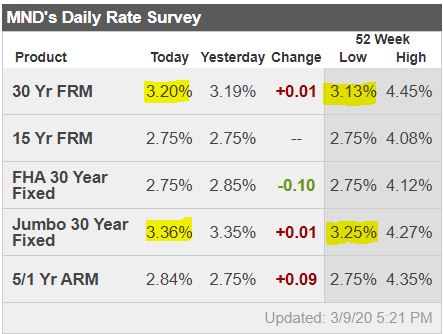

Even though the ten-year yield has plummeted, mortgage rates have been slow to follow – they actually went up a little today. Today, we heard the all-time best excuse, which explained everything:

“We’re too busy“, said the mortgage industry, which is code for ‘we are going to milk this for extra profits!’

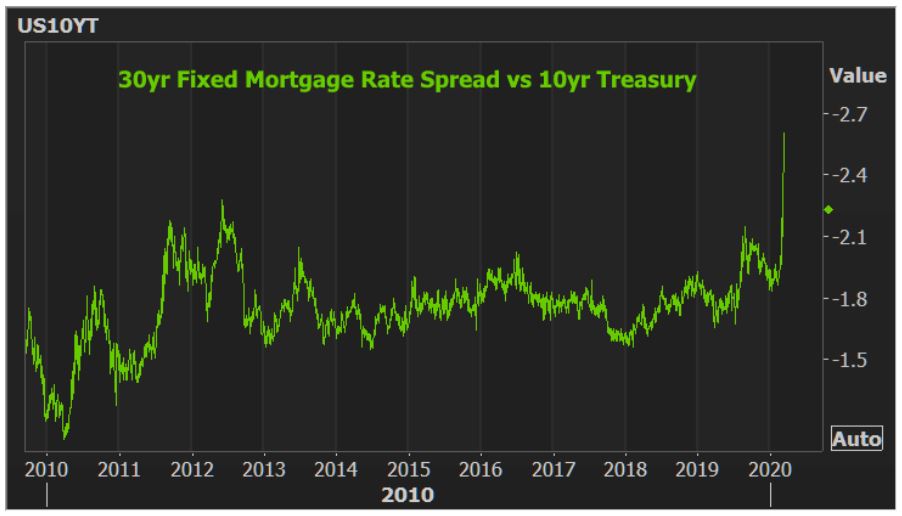

Historically, the conforming mortgage rates could be calculated by adding 1.75% to the 10-yr, but today that would get us 2.25% mortgage rates. Here is their greed meter – unprecedented spread here:

Here’s what Ted said at MND:

Financial markets are in total disarray, some lenders are not accepting new loans or locks, and lock pricing engines are crashing repeatedly due to excessive volume. If this sounds like a mess, it is. While this panic won’t subside overnight, if you like your current pricing and lender is locking loans, why not lock? There’s no logic or reason in this market now, who knows what the mood will be tomorrow/next week?

Futures are in positive territory currently, so it appears we may have seen the worst for now.

If the mortgage industry doesn’t feel like sharing the wealth, then you might as well lock your rate.

Jim,

As you know, I have been in the mortgage business for over 30 years and I have never experienced such a fast drop in rates, nor such low rates! I agree with you, if you can get a 30 year fixed rate in the 2’s…lock it!

In regards to lenders holding on to margin or “pricing to slow volume,” it is the old adage of supply and demand. This is one reason I opened up my own broker shop recently. Now when one lender decides to raise rates outside of market movement, I am able to shop my clients loans to another lender that is more competitive.

My mortgage guy’s offer today (30-year fixed):

3.00% and $1,424 credit toward closing costs.

2.875% , no credit. Last Thursday, it was 3.25 or 3.125% with a

$924 credit.

Everything is ready to for us to just say one word: “lock,” when we

call.

Mahalo, Jim. We’re waiting until Wednesday.

Joel, can we get 2.875% for 1 point yet?

Susie is in Idaho so her rates might be different than here.

Yes, assuming:

– Rate and Term Refi (cash back of not more than 1% of loan balance)

– Owner Occupied

– LTV of <=60%

– Mid credit score of 740+

– 21 day lock

This is for loan amounts <= $510,400.

Boom, there you go!

http://www.4loaninfo.com/