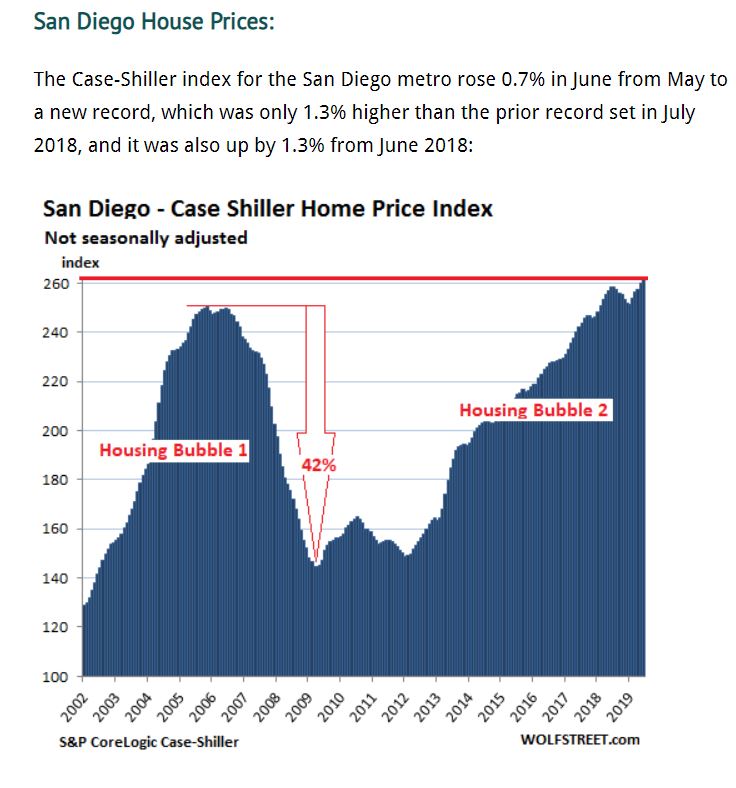

Our Case-Shiller Index did set a new record yesterday, but our Housing Bubble 2 is relatively tame – just 4% above the previous peak of 250.34 in November, 2005.

Compare to others like Seattle (+33% over last peak), San Francisco (+41%), and Denver (+59%) here:

A doubling in 17 years. 4.2%/yr compounded.

For reference, the stock market S&P over the same period, 1300 to 2800 a tiny bit better but you cannot live in an index fund. Then again you don’t pay utilities or taxes or repairs. I called the bubble last time so I’m comfortable calling a pause here. Changes in tax law probably have something to do with the current inflection. If Prop 13 gets gutted in 2020 all bets are off. And make no mistake the split role proposition will upend the entire sector not just the commercial properties targeted.

Just a pause or slight break. This not a bubble this time.