Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

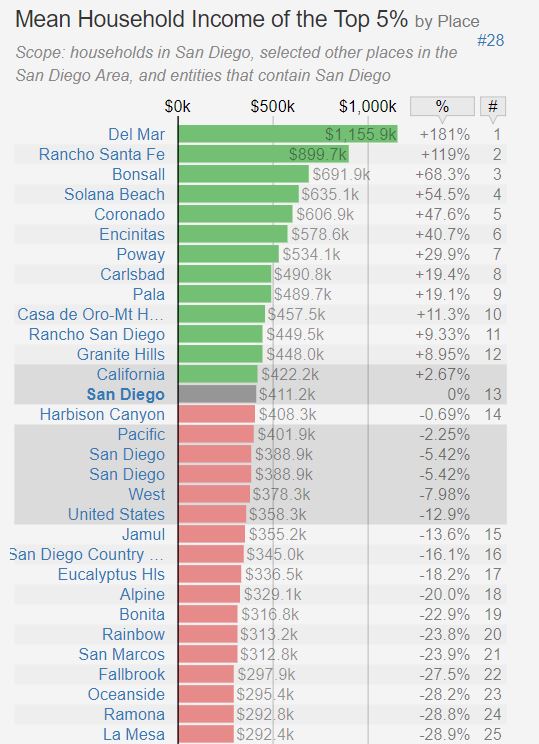

There’s a little sleight of hand going on here. People don’t start out affording a Del Mar beach home. If you have a nice place in La Jolla to sell then the “leap” isn’t that large. They don’t call it the property ladder for nothing.

People don’t start out affording a Del Mar beach home.

But it is getting harder and harder for existing homeowners to make sense of moving again, especially if you are already in a high-end area. Even down-sizers are struggling with finding something cheaper nearby that make it worth it.

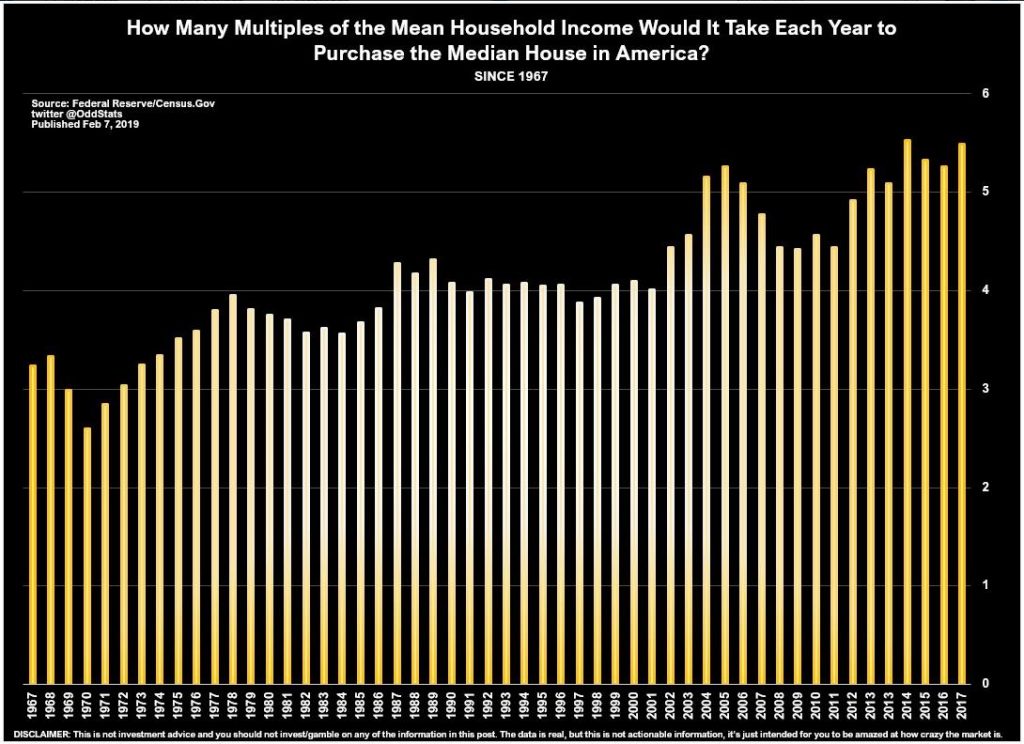

Which means we’re left with a buyer pool of first-timers and those coming from far away. Both either need to make a big income (see chart) or bring a truckload of money with them.

I’ll see if I can add some data research to that.

Please don’t compare the median with the mean. A billionaire or two in Del Mar is probably highly skewing that number.

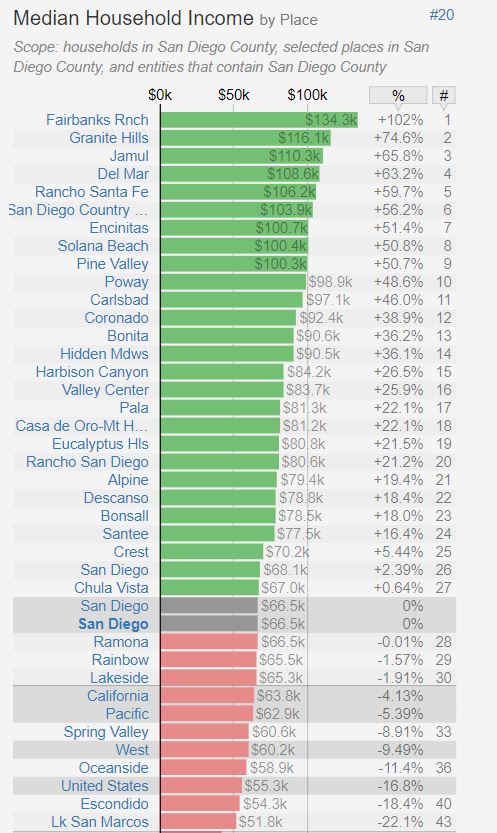

I’ll add the median income. Just trying to use the same metric as the original graph.

It doesn’t mean much (pardon the pun!) except to note that the trend is getting more unaffordable each year.

You have to compare mean to mean or median to median. The median would be a better stat to use. Just my opinion

I didn’t make the first graph, I stole it! 😆

I feel better and better about renting and waiting. The political and economic climate lead me to believe prices breaking down rather than wages jumping up.

Prepare for a lonnggg wait….

> I didn’t make the first graph, I stole it!

As much as we love you, you are still at heart a Realtor®.

😉

Yes, prepare for a long wait. While rents keep going up!

I don’t believe prices will be coming down significantly anytime soon. The Fed won’t allow it. It will be stagnation as people hunker down and stay where they are now.

Because of Housing Bubble 1.0, the rules of this game have been changed. The Fed manipulated and reflated the bubble and is attempting to keep it inflated for as long as they can print digital money.

Hmm, what comes after trillion? Quadrillion!

As much as we love you, you are still at heart a Realtor®.

Through and through!

And thanks for the registered trademark. Did you know the proper spelling of realtor is REALTOR?

Design standards for REALTOR® marks must be followed:

The preferred form of the term is REALTOR®—in all caps, and using the registered trademark symbol. If using the symbol isn’t possible, then the next best form is in all caps: REALTOR.

https://www.nar.realtor/logos-and-trademark-rules/top-5-things-you-need-to-know-about-the-realtor-trademarks