Sellers have not been moving as often, with a typical seller owning his/her home for 11.5 years before selling, the highest level in at least the last 38 years. The trend was especially obvious for older generations, as baby boomers typically owned their property for 15 years before selling, while the Silent Generation held on to their properties for 30 years before selling.

~~~~~~~~~~~~~~~~~~

In Houston, an agent uploaded photos of her listing that included models wearing underwear. The Association deleted them.

We allow photos and descriptions of properties that are highly exaggerated or distorted, but now we’re drawing the line at underwear models?

~~~~~~~~~~~~~~~~~~

There have been a number of banks and mortgage companies announcing drastic layoffs or going out of business altogether. But most have been refi shops, and now that rates are in the mid-to-high-4s, there’s nobody left for them to refinance.

~~~~~~~~~~~~~~~~~~

73% of today’s realtors have never worked in a 5% mortgage-rate environment. Let’s keep those rates low!

~~~~~~~~~~~~~~~~~~

Want to know one of the largest growth markets on the planet? The world’s 65-plus population. Already at a historical high of over 600 million people, it’s projected to hit 1 billion by 2030, and 1.6 billion by 2050!

AND…..this expansion will take place primarily in wealthy countries. In the U.S. alone, the spending of Americans ages 50 and up in 2015 accounted for nearly $8 trillion worth of economic activity. (Barron’s)

~~~~~~~~~~~~~~~~~~

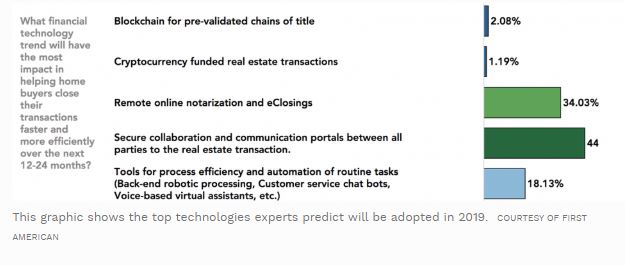

Let’s hope that ‘secure collaboration and communication portals’ is 100%!

~~~~~~~~~~~~~~~~~~

Note: Following both the ’70s and ’80s prices booms, price increases slowed significant and mostly moved sideways for some years in nominal terms. Maybe that will happen again. Bill McBride

Someone (me). Somewhere (here). Sometime (a dozen years ago). Mentioned the shift to aging in place. Back then the average mortgage note closed out in a bit less than eight years. People moving (and yes, more refinancing). Back then I urged buyers to look at their purchase as possibly their last home. I took my own advice. Which often parallels JtRs advice.

The 70s and 80s had vicious asset rending inflation to make those “recoveries” look better than the reality. This Great Recession had much lower inflation and lower growth and thus took much longer to recover.

Yeah, stay away from blockchain. New study found that it’s extremely overrated and the purveyors of blockchain technology are not delivering on their promises:

https://www.theregister.co.uk/AMP/2018/11/30/blockchain_study_finds_0_per_cent_success_rate/