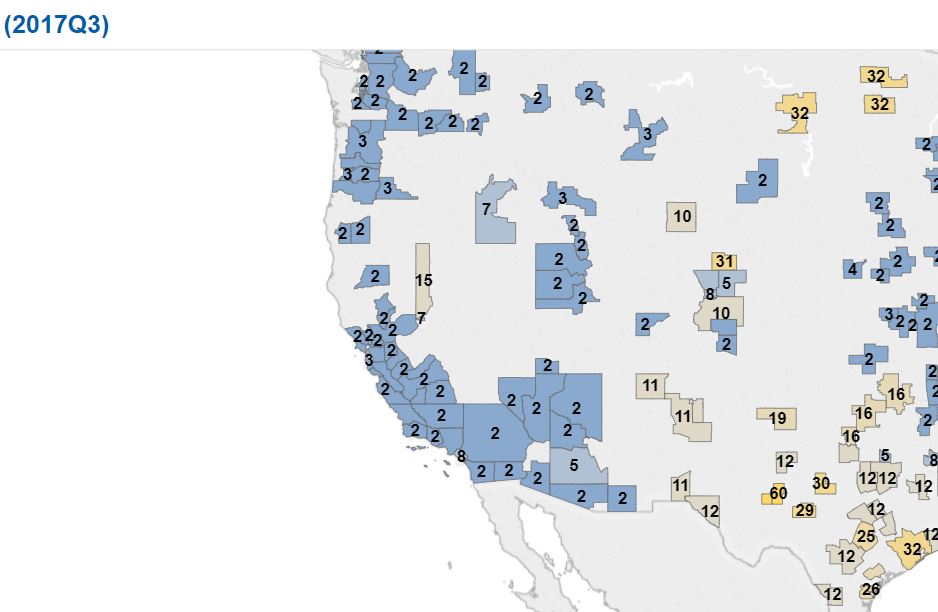

An article based on research from a mortgage insurance company, who has a stake in the game (unlike economists). The image above shows virtually no risk of prices falling in Southern California over the next two years.

H/T daytrip:

Housing bubble coming? According to one mortgage insurance company’s latest reports, there’s only a slim chance Southern California home prices will fall in the next two years.

Arch MI gauged the economic foundations of home values in 100 major metropolitan areas to determine local housing markets with “minimal” risk. Locally, Arch MI found solid performance among regional businesses and limited development of new homes as factors that should keep home prices firm.

Orange County was the riskiest market in the region — if having a 4 percent risk of a price decline in the coming two years is what you consider dicey. That compares with the county’s 28-year historical average of 25 percent chance of falling home values.

Arch MI noted Orange County’s home prices were up 12 percent in the two years ended in 2017 — only the 52nd highest among the 100 large metros studied. Per-capita homebuilding of 18 single-family homes per 10,000 residents — ranked No. 63 out of 100. Business output rose 5.2 percent last year, the 40th fastest growth nationally.

Los Angeles County had 2 percent risk of decline as 2018 started vs. a 1980-2018 average of 27 percent, according to Arch MI.

That score came as L.A. home prices surged 15.9 percent in two years — No. 32 biggest gain; per-capita homebuilding of 6 houses per 10,000 population was fourth slowest nationally; and business output rose 4.9 percent last year, No. 51 fastest.

In Riverside and San Bernardino counties, Arch MI found risk of home-price declines at 2 percent vs. a 28-year historical average of 25 percent.

Inland Empire home prices are up 15.6 percent in two years — No. 33 highest — as per-capita homebuilding of 26 per 10,000 — ranked No. 52 — while business output rose 5.5 percent last year, 29th fastest.

Arch MI doesn’t find much risk out of the region either: The nationwide risk of decline was 5 percent even after home prices rose 12.6 percent in two years. Yes, that was up from 2 percent a year ago.

“Housing markets in most cities are exceptionally strong due to a shortage of homes for sale,” Arch MI wrote. “Construction has lagged the growth in households and employment for nearly a decade. Even recent interest rate increases and higher taxes on some upper-income earners didn’t slow the market, as many had feared.”

Riskiest big markets, by Arch MI’s math? Texas and Florida!

No. 1 diciest was Houston (22 percent chance of price declines within two years) followed by San Antonio (20.3 percent); Tampa-St. Petersburg (19.2 percent); Cape Coral-Fort Myers (17.8 percent); Austin (17 percent); Fort Lauderdale (16.9 percent); and Miami (16.4 percent).

“Housing markets aren’t likely to cool until the economy slows, either from substantially higher interest rates or an unexpected economic shock,” Arch MI wrote. “Short of a war or stock market crash, housing markets could continue to surprise on the upside over the next few years.”

Link to Article

They didn’t see it last time so why would they this time?

One reason why FL and TX are riskier than what seems to be bubbly California is that the former two markets have relatively free markets for land use. Californa is about the most restrictive and regulations have ensured that housing supply has lagged demand for more than 30 years. It’s tough to have longterm price stability or reductions when you have an institutional bias against supply. That doesn’t mean prices can’t decline, but it shows why CA is one of the rare markets over the past 100 years where housing costs outpace inflation decade after decade. One thing that could change that is radical land use reform, but if one can’t even get something like SB827 passed, it’s hard to see how supply will improve for the forseeable future. It may end up only changing due to demographic shifts.

@lgs

You have a very valid point, particularly if you include NIMBYs