The National Association of Realtors has re-thought their negativity barrage on the tax reform, and is back in cheerleader mode:

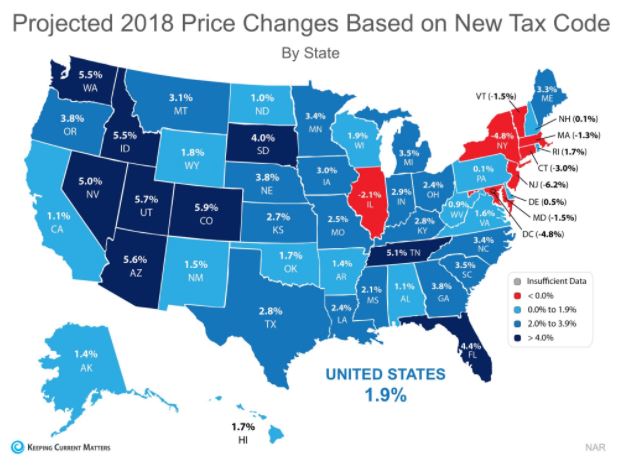

While the new tax law is already in effect, here we estimate how home prices will trend in 2018 for each state. The new tax law reduces the limit on deductible mortgage debt and limits the deductibility of the real estate tax up to $10,000. These two provisions are expected to have an impact on the housing market. Moreover, a higher standard deduction may lessen the incentive to purchase a home, as fewer consumers will utilize mortgage interest and property tax deductions.

Aside from the tax reform impact, it is of utmost importance to understand that the current state of the housing market will also influence home prices. Prices are shaped by supply and demand, like any other economic asset. A shortage of supply pushes up prices, while excess supply causes prices to fall. In the past five years, housing inventory has fallen across the country and as a result, home prices continue to rise.

Link to Article~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

They have broken down their data for each state too.

Here is what they say about California:

In spite of California prices going up 7.9% in the third quarter of 2017, they project a 1.1% increase for 2018 – which is quite a drop-off.

How is their math? Let’s check:

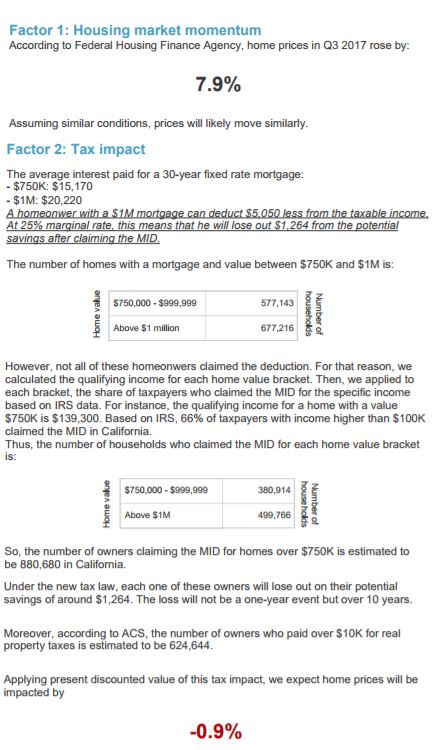

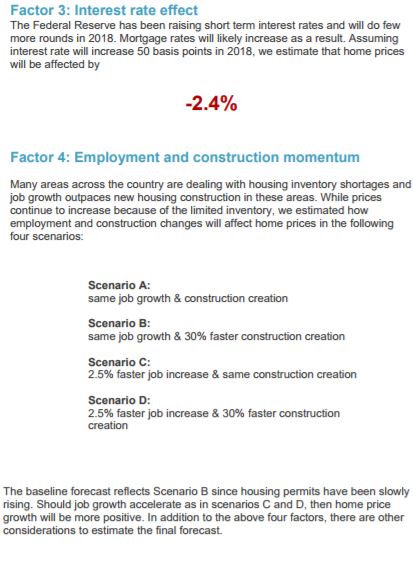

Factor 2 – Tax impact

The average interest paid for a 30-year fixed-rate mortgage:

$750K: $15,170

$1M: $20,220

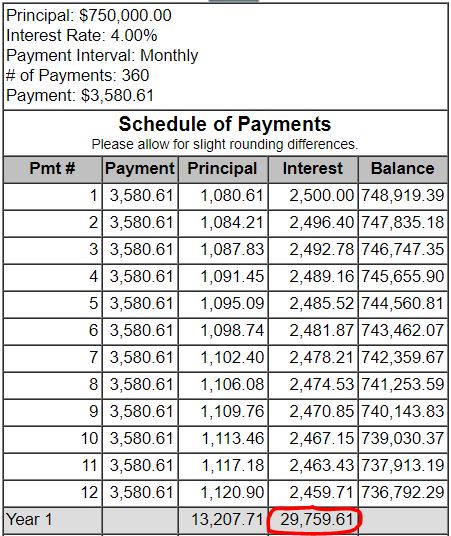

What? Just a quick look at those numbers and you can sense a mistake. Interest on a $750,000 loan has to be more than $1,200 per month. Thanks to Google, there are several mortgage amortization calculators online, and within 30 seconds I found this:

Even the full interest paid over the life of the loan divided by 30 is more than $15,170 (it’s $17,967 per yr). Then they calculate the impact on existing homeowners, BUT THERE IS NO M.I.D. CHANGE FOR THEM. The new limit of $750,000 is for new home buyers, not existing.

The N.A.R. is publishing articles nationwide, and nobody checks these? If they can’t get their facts right, how reliable is anything they say?

Like my high school baseball coach used to say,

“Don’t believe anything you hear, and only half of what you see!”

Steve Jenner and his wife were planning to buy a home near the house they’re renting in Dana Point, where properties typically sell in the $1.2 million to $1.5 million range.

But in December, just as Congress was voting to pass a new tax law limiting real estate-related deductions, the Jenners backed out and renewed their lease instead. They may not be able to afford to buy a home under the new tax law, Jenner said.

“The deduction on your taxes won’t be there anymore,” said Jenner, 50, a sales executive for a biotech firm. “That increases my cost to own because I’m not getting that benefit.”

Throughout Southern California, potential homebuyers and their real estate agents are trying to assess how tax cuts President Donald Trump signed into law Dec. 20 will impact housing.

Some are pulling out of the market, local agents say. Others are in a holding pattern and some home shoppers said they plan to buy out of state where the tax consequences won’t be as great.

There also are forecasts showing California house price increases won’t be as big as they would have been before the tax changes.

But interviews with economists, mortgage brokers, accountants and agents show there are just as many who think this is no big deal. The brouhaha will die out, they say, once the industry adjusts to the new reality.

“Every time these new laws are passed, there’s panic. Then it ends up being nothing,” said Blake Roberts, CEO at Pier to Pier Brokers in Hermosa Beach. “Death, divorce and desire keep happening, and people still have a need to buy real estate.”

After weeks of dueling proposals and constant revisions, the final tax bill ended up with three key provisions affecting homebuyers: A lower cap on mortgage interest deductions, reduced state and local tax write-offs and an increased standard deduction.

Borrowers buying homes after Dec. 14, 2017, can only deduct interest paid on up to $750,000 of home mortgage debt, vs. $1 million for homes purchased earlier.

Buyers getting a mortgage of $1 million or more will pay about $3,000 to $4,000 a year more in federal taxes, depending on their individual tax rate.

About one out of every seven buyers in Orange and Los Angeles counties will be affected, according to CoreLogic: 15.5 percent in Orange County and 14 percent in Los Angeles County.

In the Inland Empire, only about 1 percent of buyers borrowed more than $750,000 to buy their homes in the past year.

But the tax hit is compounded by a new $10,000 cap on deductions for state and local taxes, including property taxes.

Almost one in 10 homeowners in Orange and Los Angeles counties have property tax bills above $10,000, according to Irvine-based Attom Data Solutions. Just over 2 percent in the Inland Empires pay more than $10,000 in property taxes.

The third provision — the doubling of the standard deduction — will significantly reduce the number of households who take advantage of the mortgage interest and property tax deductions by itemizing on their tax returns, some economists said.

“There will be people who say, ‘We don’t have to buy. We’ll continue to rent,’ ” said Oscar Wei, senior economist for the California Association of Realtors. “It will definitely disincentivize people from buying a home.”

Price gains will be smaller under the new tax law, according to forecasts by both Moody’s Analytics and the National Association of Realtors.

Los Angeles County home prices, for example, will be almost 5 percent lower by the summer of 2019 than they would have been if there were no tax legislation, Moody’s determined. In Orange County and the Inland Empire, prices will be nearly 4 percent lower by mid-2019.

NAR predicted California price gains will be reduced almost 1 percent under the new tax plan.

“House prices suffer under the tax plan,” wrote Moody’s Chief Economist Mark Zandi.

Price gains will be softened even further if mortgage rates increase, as predicted. Home prices could even drop in high-cost California housing markets, said NAR Chief Economist Lawrence Yun.

“I would not be surprised to see a 5 percent price decline in some of the higher-priced areas, such as Orange County or San Francisco,” Yun said in a phone interview.

The new tax law could hit the luxury home market hardest because of lost property tax write-offs, said luxury home broker Phil Immel of Dana Point.

Buyers paying $5 million or more will lose at least $50,000 a year in property tax write-offs under the new law. Orange and Los Angeles counties had nearly 950 such sales in the year ending in November, according to CoreLogic.

And those in the rarified market of $20 million-plus home sales — and there currently are about 100 such homes on the market in Orange and Los Angeles counties, according to Redfin — will lose at least $200,000 or more in property tax write-offs annually.

“I’ve got some sellers with $25 million listings who are kind of nervous it’s going to soften their price,” Immel said. “It’s going to affect the uber-luxury market, … even though these people have hundreds of millions of dollars — or a billion — and typically own two or three of these homes. It’s going to make them hesitate.”

https://www.ocregister.com/2018/01/12/to-buy-or-not-to-buy-new-tax-law-creates-uncertainty-for-some-homebuyers/