Someone must have passed a law; if it is November, you must publish something debunking bubbles. The saturation point is near, but the latest contribution, from Freddie Mac’s Chief Economist Sean Becketti, provides a better (and much longer) analysis than most, so we will attempt to summarize his arguments as to why, despite rapidly rising home prices, we aren’t in a bubble. Or as he says, “Not yet.”

The concern, he says, is understandable. Scars remain from the last bubble and there are plenty of warning signs regarding a new one:

- House prices have been on a tear for the last five years, growing about twice as fast as the long-run average and outpacing income growth by a cumulative 42 percent over the last 17 years;

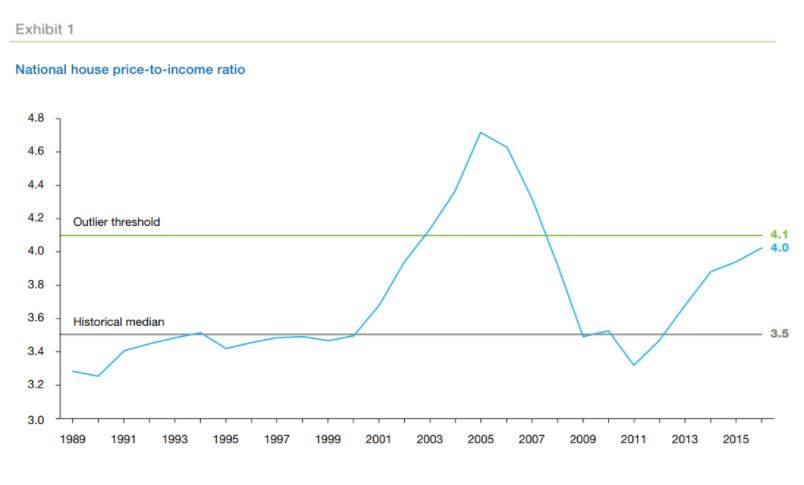

- The number of large metropolitan statistical areas (MSAs) with unusually-high house-price-to-income ratios has grown from five in 2011 to 17 today. At the height of the last bubble there were 27.

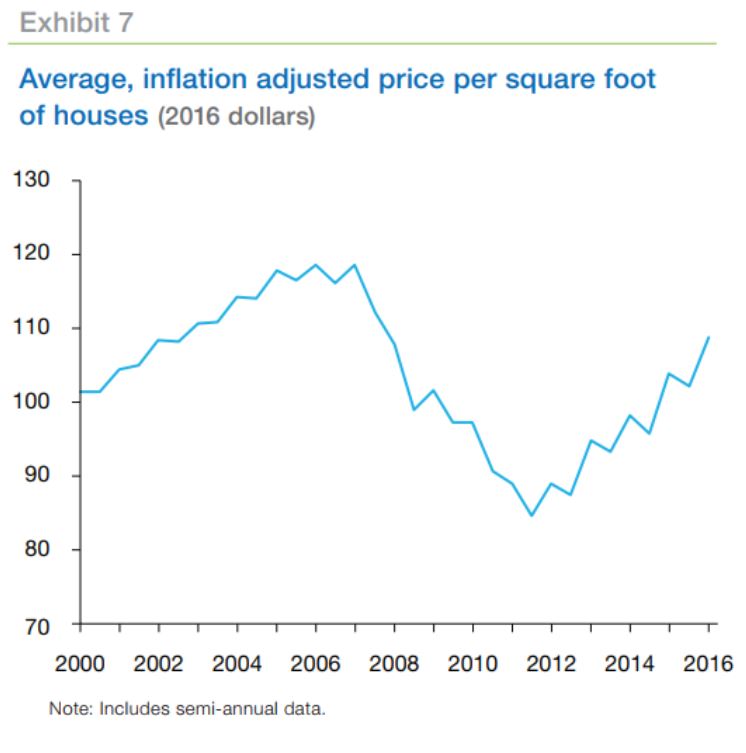

- An increasing share of MSAs with relatively stable construction costs nonetheless have suspiciously high house prices per square foot.

It is difficult to spot a bubble before it bursts, but Becketti says there are three defining characteristics. First, they are fueled by self-fulfilling predictions, i.e. prices rise simply because people expect them to. Nobel Laureate Robert Shiller called them “a kind of social epidemic” where price increases generate enthusiasm among investors, who then bid prices higher. The feedback continues until prices get too high, and the bubble bursts.

That is the second defining feature of bubbles, they do indeed burst. Not just correct, a normal part of the ups and downs of asset prices, but crash, reflecting a sudden realization that prices have become unsupportable.

The third defining feature is the central role easy credit plays in their growth. When lenders begin to believe that price increases can go on forever, they grow less concerned about whether borrowers can repay the loan. Bubbles collapse when lenders finally get worried and restrict riskier types of credit. Paradoxically, Becketti says, in the last decade lenders restricted credit, thus pricking the housing bubble and triggering the burst they were trying to avoid.

Hunting for bubbles is problematic. Since prices might make a soft landing, it is tempting to monitor conditions a bit longer rather than act. Identifying a bubble can spook people and trigger a crash that didn’t need to happen. Becketti admits that Freddie Mac is “stuck.” A potentially-destructive house price bubble “is one of the key risks we have to manage as best we can.”

The company has talked before about its two-part approach to identifying bubbles, first by comparing the current median house price to the median income (PTI) ratio to a historical norm of 3.5. They have found a national PTI above 4.1 is unusual enough to merit further analysis. It broke through that outlier in 2004, started to collapse in 2006, hitting bottom at 3.3 in 2011. It is currently approaching, but is still under the 4.1 threshold. Because bubbles can be local or regional, Freddie Mac also tracks the PTI ratios for the 50 largest metro areas and as noted earlier, 17 are currently a cause for concern.

The inventory shortage is strong evidence against a price bubble and the slow rate of increase in construction suggests any eventual price adjustment will be gradual rather than a collapse.

A second piece of evidence is a bubbles’ reliance on easy credit. Freddie Mac looks for signs of credit deterioration. Increasing delinquencies and defaults tend to appear very late in a bubble’s life, so it isn’t surprising that the company’s book of business “has exhibited stellar credit performance to date.”

A much earlier sign is an increase in leverage; declining home equity. But the reverse is currently the case. While house prices have risen rapidly since 2001, outstanding mortgage debt has barely budged. “Homeowners, at least in aggregate, are not funding a spending spree with the equity in their homes.”

So far, no sign of an imminent bubble, however there are those fast-rising home prices. Becketti says maybe they are looking in the wrong places for evidence. The national PTI ratio provided plenty of early warning about the last bubble, enough to have taken corrective action before It burst. But one possible warning sign isn’t enough, confirming evidence is needed.

Read the full report here:

http://www.mortgagenewsdaily.com/11102017_housing_bubbles.asp

credit is easy again? I thought the narrative all along has been that credit is too tough…??

too confusing

I do not think we are anywhere near a bubble, at least here in SD, Demand and Supple especially along the coast is very strong. Price adjustments yes..ups and downs normal, but if any of this new tax laws pass with regard to eliminating housing tax deductions, look for less supply…..and increased population growth, especially since the trend is to go back to the city and not go to suburbs. With population growth, some of the suburbs are the city now.

I agree with the article on a lot of points, credit in my opinion is much better vetted today, than prior to the crash, but just look at the price of new construction…here in CA..increased gas taxs, sales taxs, permit fees, new gov fee on sale of homes etc….the cost of housing all these people is not gonna down.

From the article: “Because bubbles can be local or regional, Freddie Mac also tracks the PTI ratios for the 50 largest metro areas and as noted earlier, 17 are currently a cause for concern.”

So, is San Diego one of these 17? What is its current ratio, and what is its “normal” ratio?

Price per square foot is high because communities and builders are pushing density. Dense costs more.

The one thing that hasn’t been mentioned in the report is “the monthly nut.” The Great Recession did a great job clearing out the house/mortgage combos that were too expensive. TMN has been rising since but low interest rates still has it below bubble peaks.

Charts look/feel about right to me.

San Diego is not one of the 17. In California only L.A. is. If you google the article on fredie’s Website they breakdown all 17.