Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

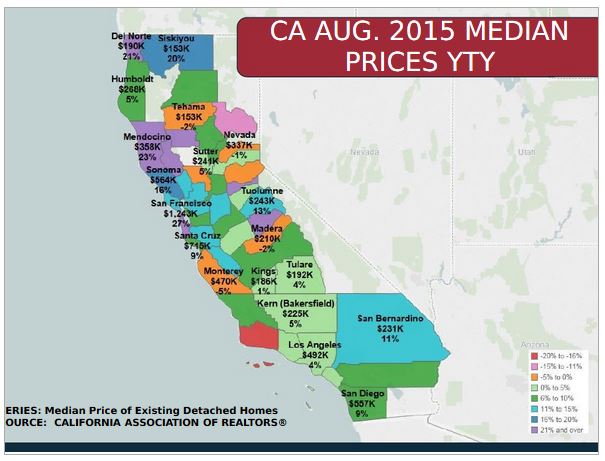

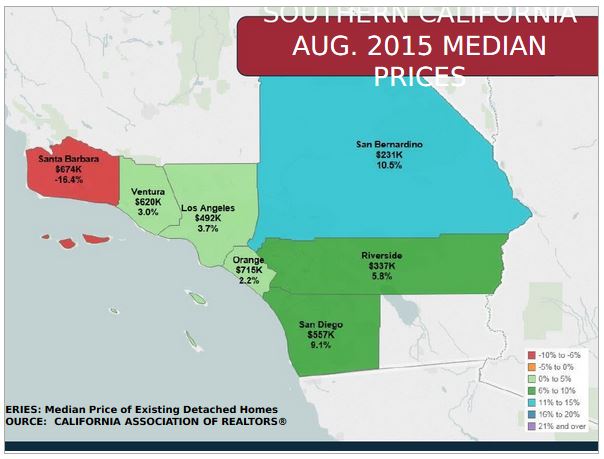

Seems like prime coastal areas have gotten way ahead of county medians.

I’m going to call flat prices for 2016 at the coast, given flattening stock markets and QCOM and biotech troubles.

Rich people want to park their money outside of the stock market. I call continued upside on the coast. The feeling is the stock market has done whatever it will do at least through election year, and global markets may even push it down. A coastal property @3% loan interest (if they don’t pay cash), is attractive. And rental prices are going up up up! I’ve been saying this since I started following Jim in 2007: the rich get richer, no matter what’s happening worldwide. My little kids will never live on the coast when they grow up. The coast will be all 2nd houses and VRBOs by then.

I’m heading to Santa Barbara county!!! Still lots of room to run according to this info.

AND!…I forgot to write what I initially intended…THANK YOU, Jim! This is a data-freak’s dream post. I love the info.

I call continued upside on the coast.

Agreed.

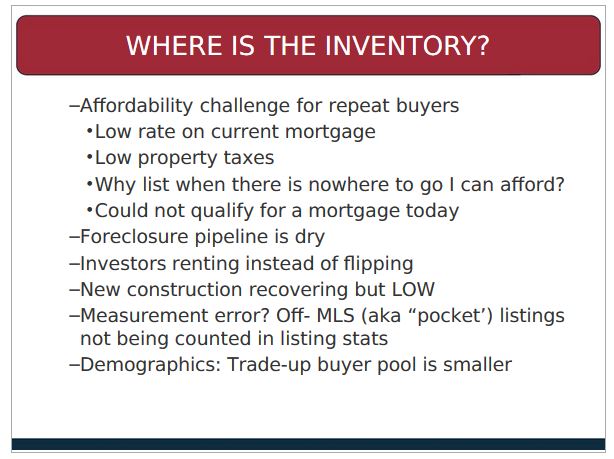

It used to be that as prices rose, more people would sell. But as we’ve seen prices rise 42% since 2009, that hasn’t been the case.

New Listings between Jan 1 and Sept 30:

2011: 4,308

2012: 3,655

2013: 4,091

2014: 3,930

2015: 4,058

The “re-freshing” of listings is still prevalent. They present some statistical noise, but even including those, the inventory count has been virtually the same for three years straight.

Will 2016 be the year that the inventory cuts loose?

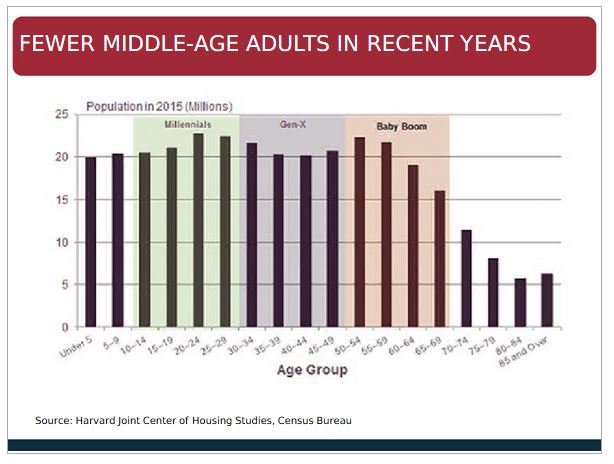

Probably not, and my last graph in the post is why. People are staying longer, and those who have bought in the last few years are more inclined to stay for the duration, due to the difficulty of moving, and how fast prices went up.

This is a data-freak’s dream post. I love the info.

They have a good boomer section too, so I’ll include that later.

It’s frustrating that banks are colluding to keep foreclosures out of the market + keeping interest rates low to cause inflation. This is classic monopolistic behavior or because multiple agents are involved a better definition might be a cartel. It doesn’t matter what you call it because the results are the same. The product (in this case houses) are selling at artificially inflated prices.

I’m 100% behind business but what’s happening in houses in not free trade. Those who hold the assets are benefiting. While those looking to buy have to pay a premium much higher than they would if price manipulation wasn’t occurring.

Just an FYI the next step in the process is for salaries to increase to a level where the ability to buy a house is possible. Salaries always follow inflation it’s just a matter of how long it takes to hit a point of equilibrium. When it takes a long time for wages to increase to inflation levels it’s called Stagflation. People on minimum wage will get screwed, also retirees will get screwed because they can’t get a decent return on investments.

Speaking of VRBOs, there are going to be some heated debates:

http://www.nytimes.com/2015/10/10/your-money/new-worry-for-home-buyers-a-party-house-next-door.html?_r=0

Its not so good for chaps like Jim but a very good reason NEVER to move is……I have owned the Same house for 30 years, monthly mortgage bond payment? 42 US Dollars a month!

You should get with the program – I recommend that everyone should move every 6 to 12 months!

Don’t unpack, I’ll be back!