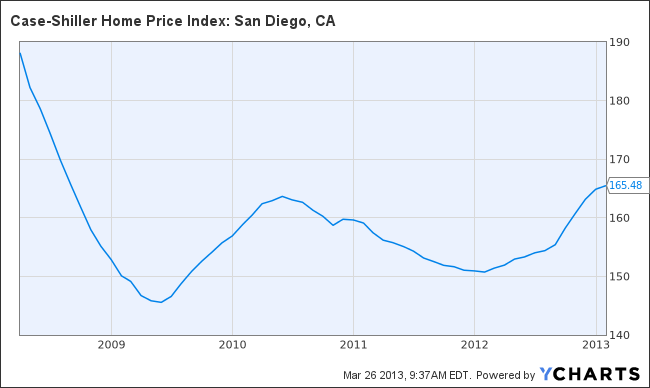

San Diego’s latest seasonally-adjusted Case-Shiller Index increased for the 12th month in a row:

Jan. 2012: 150.74

Dec. 2012: 164.87

Jan. 2013: 165.48

Year-over-year: +9.8%

Month-over-month: +0.4%

Yesterday an appraiser confirmed that he is adjusting comps for appreciation, and mortgage underwriters are going for it. He said that adding 0.5% to 1.0% per month is acceptable.

A twelve-month winning streak, and banks allowing appreciation in appraisals – what’s next, no-doc loans?

P.S. The previous month-over-month difference was +1.0%.

Case-Shiller Home Price Index: San Diego, CA data by YCharts

NASA Federal Credit Union and Navy Federal Credit Union are offering members mortgages that do not require a down payment or mortgage insurance.

This type of loan contributed to the burst of the housing market in 2008, but both banks said they believe their underwriting standards and member relationships will protect everyone from loan losses, Credit Union Times reported.

Bill White, vice president of residential lending at NASA Federal Credit Union, said the bank focuses on members’ ability to repay the loan instead of what might happen to the value of the underlying asset.

White added, “It really is all about our members. They understand how the credit union seeks to help them and they want to help the credit union too.”

I love free equity!!!! Investors who took risk deserve bigtime reward.

Interesting that Navy Federal and NASA Federal are lowering the down payments standards. Maybe demand for mortgage loans at those credit unions is on the decline and their trying to entice some potential borrowers. You would think they wouldn’t do anything if they had sufficient loan demand. That was the same thing that happened at the top of the bubble. The ninja loans and stated income loans were in response to weakening demand for loans yet a increased investor demand for MBS. You could certainly see loan demand impacted at a place like Navy Federal with the sequester going into effect.

the spike in the index from 2009 to 2011 is presumably from the first time buyers tax credit. The index then fell once that credit was removed.

I wonder if the index were to drop again if mortgage rates increased?

@ JSG

If they rise 2% points I will practically guarantee it will.