It’s been well-documented that Ben Bernanke and others told mortgage lenders in 2011 to not do anything to disrupt the economy, which was gov-speak for lay off the foreclosures.

Kamala Harris virtually outlawed foreclosures in California with the Homeowners’ Bill of Rights. Lenders now have to offer a loan modification first to anyone in default, and it seems that you have to really not want your house to get foreclosed these days.

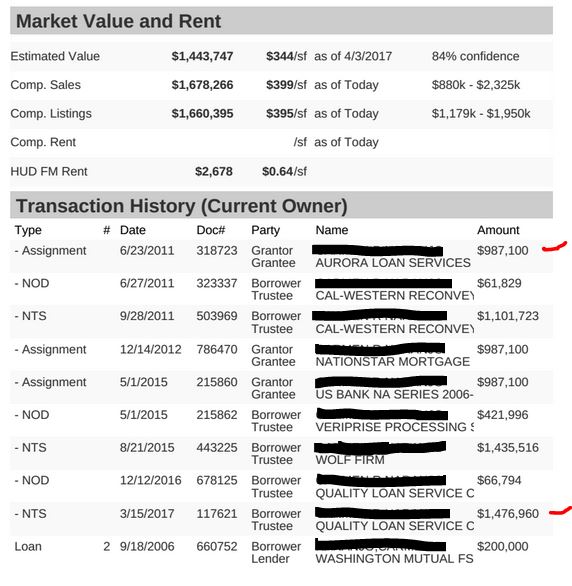

Here’s a borrower who has been in foreclosure since 2011, and by the looks of how the loan balance has risen, the neg-am has been accuring AND they haven’t made a payment. The balance on the first mortgage has gone up $489,860!

I just received notice that the foreclosure process just got CANCELLED too. Either the lender gave him a loan-mod, or they gave up altogether?

The lenders might foreclose if there is enough equity that they won’t lose money. If it’s close, they let it ride, and hope some payments trickle in.

JtR,

since buying in 2013 (thanks to you!!), we have a fair amount of equity – both from payments and increase in market value.

if we get into a pinch and can’t make payments, does the CA home owners bill of rights apply to us? will the banks offer us a loan mod? or, would they foreclose on us to get the equity?

Lender is required by law to offer you a loan modification first, before considering any foreclosure action.

Thanks JtR…..

Then it is safe to assume that we shouldn’t expect to be in the loan mod process very long relative to those with very large loan balances or neg equity.

??

It depends on your cooperation, because they will process a new loan application on you to see how much you can afford. If you don’t call back for weeks or send in an occasional tax return, I doubt they will make a big stink.

Those with neg-am loans will probably get the most latitude.

As soon as Trump’s finished wowing the Ottoman’s, he’s gonna find out about this, and I don’t think he’ll take a shine to it!