While these purchases will only be a sliver of the five million homes sold every year, they could add up over decades and help to keep the supply of homes for sale somewhat limited.

New funding: Seattle startup Arrived Homes raised $10 million in equity and $27 million in debt financing to help scale its tech-infused real estate model that lets people invest in single-family rental homes for as little as $100. The company’s backers include the venture capital arms of Jeff Bezos (Bezos Expeditions) and Marc Benioff (Time Ventures); former Zillow Group CEO Spencer Rascoff; Uber CEO Dara Khosrowshahi, and other longtime tech execs.

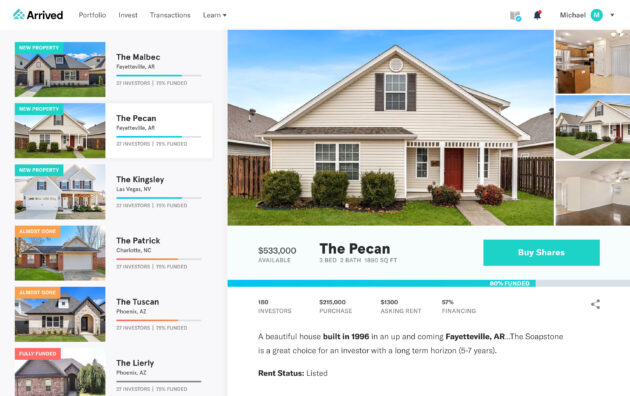

The model: Arrived is a crowdfunding platform that allows anyone to purchase shares of rental properties and earn a passive income while the company handles everything from property acquisition to necessary improvements and management of daily operations.

The idea is to open up access to real estate investing beyond wealthy individuals and institutional investors, and use technology to help identify and manage rental properties. It’s a model used by companies such as Pacaso, another new startup which raised $75 million in March and splits ownership of vacation homes into different pieces as part of an LLC, much like Arrived.

Arrived is not legally permitted to share projected returns but does provide historical data and an investment calculator, as well as case studies. Investors can invest up to $20,000 per house and are paid quarterly. Rental tenants also receive shares in the property. If Arrived sells a home, the proceeds are distributed to investors.

The business: The company makes money in a few different ways, including a commission paid by the original seller when Arrived first buys a home; by sourcing the property and preparing it for investment; and through management fees for its portfolio of homes, such as a 1% management fee on the money people invest.

The traction: Arrived has secured more than 30 properties across Arkansas, North Carolina, and South Carolina; 12 of those are full funded or reserved, with about $3 million in property value funded over the past three months. The company declined to provide revenue metrics or number of users. Arrived is focused on residential homes in the middle of the market that can provide strong cashflow and dividends to users, but is also planning to launch in places such as Austin and Seattle that have strong appreciation potential.

Read full article here:

Not even remotely possible for ongoing interest, fees, insurance, etc. to be covered by appreciation minus back end taxes. This is old fashioned timeshares minus the 2 weeks per year.

Nota Bene. New forms of partial ownership “timeshares” are not the same.

More evidence the top is in…The last fools are piling on!

The more they financialize home ownership, the more it puts the American Dream out of reach of the working class.

I don’t know how you stop it, but this will not end well.

So this is like a high-cost, high-fee REIT with less diversity?

What could go wrong?

> A high-cost, high-fee REIT with less diversity…

and most importantly; no liquidity.

Excellent observations from all here at the Bubbleinfo brain trust.

Seems like a good leap from buying all the properties to then renting out portions to others.

It’s like they (black rock etc al) get double rent

Meanwhile the guy you worth with that night a home 10 years ago is a partial owner of the place you, as a new person to the area, rent

This will only perpetuate the wealth/income disparity/gap

The exotic financing of this era – getting celebrities to put their name on a new twist. Kardashian Mortgage is next!

Months after former Freddie Mac CEO David Brickman declared that he would lead a new company to shake up the multifamily sector, the lending platform has finally arrived.

The company, called NewPoint Real Estate Capital, is backed by mortgage brokerage Meridian Capital Group, investment manager Baring and private equity firm Stone Point Capital. The Commercial Observer first reported the news.

In January, Brickman ended a two-decade run at Freddie Mac, where he transformed its multifamily arm from something that resembled a sleepy company into a sophisticated finance operation, rising to CEO in 2019. His new company will seek to provide Fannie Mae, Freddie Mac and U.S. Department of Housing and Urban Development loans.

NewPoint Real Estate is gearing up to launch a new securitization vehicle with the goal of providing higher leverage debt to multifamily projects.

“I think there’s an opportunity to rethink securitization for multifamily,” Brickman told the Commercial Observer.

The product will provide a larger first mortgage to developers, which could decrease their need for additional financing, such as preferred equity or mezzanine debt, which generally bear higher interest rates.

“Given the asset class and given its safety, we want to be able to figure out how to get to a little bit higher leverage,” Brickman said.

Barings, an investment management firm owned by Massachusetts Mutual Life Insurance Company, was looking for a way to boost its Freddie business. The company holds one of a select few licenses that allow lenders to originate loans for Freddie Mac.

Any time you hear the words, “mezzanine debt”, look out!