This guy says a housing bubble is brewing because: A) incomes aren’t going up as fast as homes prices, B) the cost of building materials has risen, and C) oil production should collapse. But if gas prices go up higher, aren’t electric or hybrid cars the answer? For home prices to fall, we would need desperate sellers who need the money so bad they will sell at any price, which sounds more like a boomer liquidation sale – which has been elusive so far, and mitigated by reverse mortgages.

Hat tip to Richard for submitting – here’s the summary:

For these reasons, I see a 3 Stage Collapse of the U.S. Housing Market. The 1st stage of the housing collapse will occur when the broader markets experience a 25-50% sell-off. At this point, the U.S. median home price will fall 40% to $200,000. As U.S. oil production continues to decline, we will enter the second stage as the U.S. median home price drops 60% to $120,000.

The 3rd stage of the U.S. Housing Collapse will occur likely by 2030 (or possibly sooner) as domestic oil production falls 50-75%. As Americans and citizens of the world understand that oil production will continue to decline, the value of stocks, bonds, and real estate will also continue to fall. Which is why I see the U.S. median home price to $40,000 in the 3rd stage of the collapse.

Of course, my timing could be off by a few years, but not decades. Either way, the notion that real estate values will always rise in the future will be DEAD for GOOD as the market is impacted negatively due to falling oil production.

Link to Full Article

People have to live somewhere, and we saw in the last crisis that homeowners don’t sell just because the value declines – unlike with other investments.

Also, I think that the banks learned many lessons from the last crash and they are more likely to want folks to stay in their devalued homes so that they can later recoup their costs. Versus having them “jingle mail” them the keys and walk away from their homes.

Who knows, they could even slash the principal owed and downward adjust the loan to the new valuation?

Sounds impossible, but then the Great Recession was also impossible in many people’s minds.

Either way, best to be prepared and have multiple strategies to cope with whatever the future may bring.

“Either way, best to be prepared and have multiple strategies to cope with whatever the future may bring.”

Speaking of which, when estimating income, how can/do they weight in the stock market holdings, and anyone who bought significant shares of FANG stocks from the beginning of the Obama, thru the Trump administration? Those who did are sitting on significant wads of potential cash. Apple in particular gives healthy dividends to encourage the long riders. Since it’s split a number of times, folks who bought a thousand shares of Apple at 80 when Obama took office now have, I dunno, 6 thousand shares due to splits, on top of increasing dividend payments.

How are those happy campers itemized, when gauging housing market forward potential? A big fat REIT just bought a big fat building I used to live in. Used to be owned by some old cuss. They own, and are acquiring a LOT of rental properties all over the place. What’s the batting power of those mother jonesers, local and international, in the So. Cal market place?

Housing is a global calculus game now. Analytic styles from 2005 ain’t very useful, I’m a reckonin’. I don’t suspect a bubble. Other stuff’s happening, creating a new normal that defies “common sense.” Common sense meaning what your aunt hanna the weekend real estate agent thinks, as well as pop real estate analytics–for now.

Just my caffeine-induced hallucinations, and I could be wrong.

If oil rises significantly, quite possible since Trump killed the Iran deal, that would put a real hurt on the economy.

We’ve got all these other forces at work: high housing costs for existing homes and new builds, stagnant/declining wages for the past 40 years, people 35 & under don’t have the income for housing AND car(s)along with their other debt.

Our traditional domestic oil resources have been in decline since 1970. Fracking, which has delayed our reckoning with oil depletion is costly and a very short term resource. The days of cheap oil are gone which is a large part of the reason we’re in the bind we’re in. And we haven’t talked about climate change which is already kicking in and will get worse in the coming years.

And a good evening Jim to you and your crew.

They will be selling 3-5 dollar gas for the next 50 years IMO.

They keep getting better (cheaper ways) to extract shale rock oil.

A 2008 estimate set the total world resources of oil shale at 689 gigatons—equivalent to yield of 4.8 trillion barrels (760 billion cubic metres) of shale oil, with the largest reserves in the United States, which is thought to have 3.7 trillion barrels.

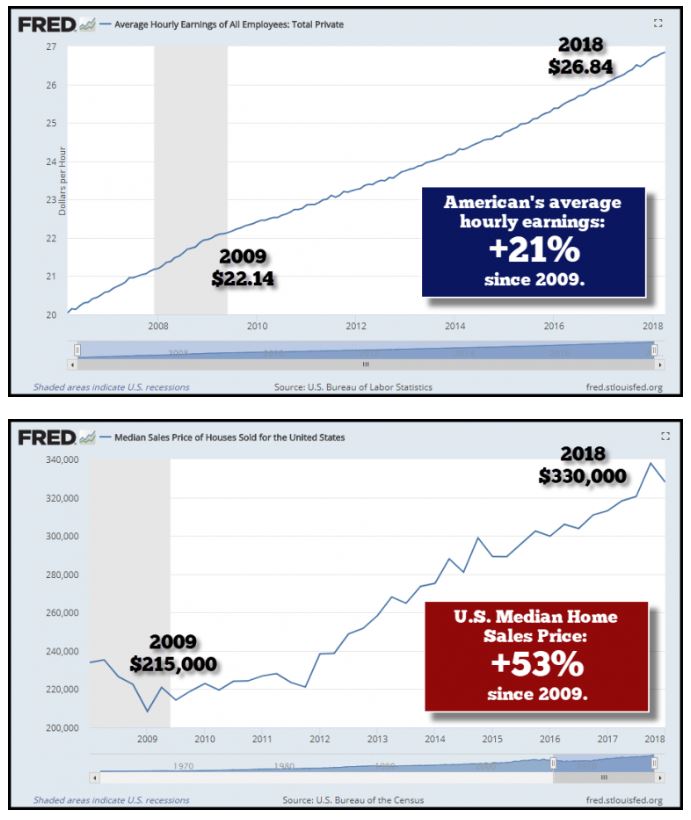

Also they conveniently picked 2009 (near the bottom of the last housing bust)

Jim,

How about a graph on how much ” bricks n sticks” have escalated in price vs incomes and house prices? Have materials increased to match house prices/salarys that much?

The funny part is he probably even believes this.