The Republican tax plan is in, and an investigation reveals one place stands to lose far more than any other under the new plan.

To recap – the Tax Cuts and Jobs Act will slash the mortgage interest deduction in half from $1 million to $500,000, double the standard deduction and reducing the capital gains exemption, allowing homeowners to deduct profits from a home sale only once every five years, instead of two. Read a full analysis of the new plan here.

The GSEs Fannie Mae and Freddie Mac also say it could trigger yet another bailout for them, so there’s that. But the lower corporate tax rate could also allow them to quickly pay back the draw – read all about that here.

But the mortgage interest deduction debate has been going on for a while. A quick search on HousingWire shows articles debating the mortgage interest rate going back seven years.

Before the Republicans announced their intent to slash the mortgage interest rate deduction, the National Association of Realtors argued that even an increase in the standard deduction could be detrimental to the MID as it would make it irrelevant for all but the wealthiest Americans.

However, in one state, the effects of the cut could be much more far-reaching.

You guessed it – California.

Using the IRS statements of income data from 2015 and filed in 2016 compiled LendingTree, these are the top metro areas where homeowners utilize the mortgage interest deduction, all of which are located in California:

1. San Francisco – with 24% of tax filers claiming mortgage deduction of an average $16,167

2. Samford-Norwalk – with 32% of tax filers claiming mortgage deduction of an average $15,237

3. San Jose – with 28% of tax filers claiming mortgage deduction of an average $14,815

4. Orange County – with 27% of tax filers claiming mortgage deduction of an average $13,938

5. Santa Cruz-Watsonville – with 27% of tax filers claiming mortgage deduction of an average $13,496

6. Oakland – with 30% of tax filers claiming mortgage deduction of an average $13,406

7. Ventura – with 29% of tax filers claiming mortgage deduction of an average $13,257

At this point, another state comes into the picture, taking the eighth spot with Honolulu, Hawaii, with 22% of tax filers claiming an average $13,092 in mortgage deduction. However, the list then continues on with more metros from California.

9. Santa Barba-Santa Maria-Lompoc – with 22% of tax filers claiming mortgage deduction of an average $13,053

10. Los Angeles-Long Beach – with 21% of tax filers claiming mortgage deduction of an average $12,904

11. San Diego – with 26% of tax filers claiming mortgage deduction of an average $12,727

12. Salinas – with 20% of tax filers claiming mortgage deduction of an average $12,279

13. Santa Rosa – with 28% of tax filers claiming mortgage deduction of an average $12,067

14. San Luis Obispo-Atascadero-Paso Robles – with 28% of tax filers claiming mortgage deduction of an average $11,825

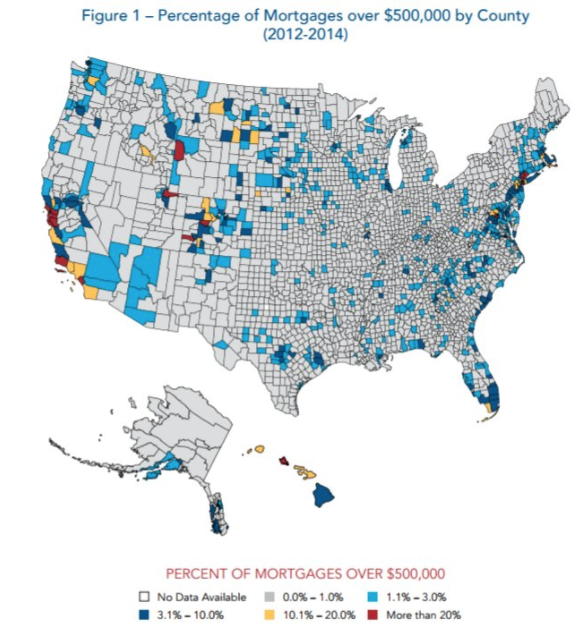

Needless to say, Californians could see a hard hit if the new tax bill passes. Experts point out that only about 5% of U.S. mortgages are more than $500,000, but the map above, produced by the National Low Income Housing Coalition, shows the majority of these homes are either in California or in the Northeast.

So should buyers look to secure their mortgage today, before the tax plan takes effect? Actually, it’s already too late.

In the case of any pre-November 2, 2017, indebtedness, this paragraph shall apply as in effect immediately before the enactment of the Tax Cuts and Jobs Act, the report states.

However, there is an exception for those who are already entered into a contract. Home buyers purchasing their primary residence who were in a binding contract before November 2 and are scheduled to close before January 1, 2018, are exempt from the new rule, as long as the contract closes before April 1, 2018.

And reducing the mortgage interest deduction isn’t the only change the housing market will see due to the new tax plan.

Currently, homeowners are allowed to deduct the profits from the sale of their home from their taxes if it is their primary residence. They must have lived in the house two out of the past five years, and can deduct the gains once every two years.

The GOP’s new plan changes the requirements to say the seller must have lived in the home for five of the past eight years, and may only collect on the benefit once every five years.

But this deduction will fall off completely for higher income earners. From the plan:

If the average modified adjusted gross income of the taxpayer for the taxable year and the two preceding taxable years exceeds $250,000 (twice such amount in the case of a joint return), the amount which would (but for this sub-section) be excluded from gross income under subsection (a) for such taxable year shall be reduced (but not below zero) by the amount of such excess.

Unlike the mortgage interest deduction change, this shift would take effect at the beginning of 2018.

Will interest on rental homes with mortgages about $500k still be fully tax deductible?

do the interest limits apply to refinance existing loan?

If you have 1 million loan now and can deduct the interest, what happens if you refi next year? Capped at $500k?

Sounds like changes that will squeeze inventory more and keep people hunkered down. No one single thing will drive a decision, but little cuts add up. You can deduct the interest on the existing $1m loan today, but if they move, can only deduct interest on the first 500k…

Only 1 cap gain-free sale every 5 years. Getting the free gain frees people to sell and pocket the cash and move up or down. Waiting longer to ripen will slow velocity.

I know several people that have accumulated rental houses over the years with the idea that they would move from one to the other every few years as they got older to cash out to fund retirement. Scrap that plan. They’ll just keep them as rentals now I would guess.

keep people hunkered down.

They don’t think about that stuff – those politicians should read this blog!! 😆

We could see a surge of tax-free sales before the end of 2017 of those high-income sellers:

But this deduction will fall off completely for higher income earners. From the plan:

If the average modified adjusted gross income of the taxpayer for the taxable year and the two preceding taxable years exceeds $250,000 (twice such amount in the case of a joint return), the amount which would (but for this sub-section) be excluded from gross income under subsection (a) for such taxable year shall be reduced (but not below zero) by the amount of such excess.

Unlike the mortgage interest deduction change, this shift would take effect at the beginning of 2018.

So what your are saying is that the 5000 houses for sale in the Ranch are now very motivated sellers?

So what your are saying is that the 5000 houses for sale in the Ranch are now very motivated sellers?

LOL – but will they figure it out in time? They need to do something TODAY!

The actual benefit to them isn’t that much though. If they get $500,000 tax-free, what does that save them? $150,000 or so in fed and state capital-gains tax? They will need to drop their price by double that just to get an offer!

Jim – I was planning on selling my place in Q1-2018. This new tax plan would directly effect me as I’ve been the home for 3.5 years and was planning on using the equity to purchase my next home. If I try to sell now, prior to Jan 1st, would they go by the recording date or date that you entered into contract for the new tax assessments? Any info is appreciated!

If you had a client looking to buy witn all cash, would you tell them to hold off for awhile now? Seems like prices must fall as a result of all of this?

For North County coastal what is the cost to build ppsf? About $250 (without land)?

Trying to figure out a “floor” where prices could fall to. Is it fair to think $300/sf in a good part of NCC would be that floor?

what trump wants does not always means he get it, this is the initial offer on the table, look for changes on the final product.

However, if you want the 250/500 exclusion DO IT IN 2017 without income limiations..now that is gonna get changed no quesiton, the interest exclusion is gonna get changed, the real issue with that is whether its mid-2018 or 1-1-2018 is a more likely date is open to deal on that. The 10K property tax exclusion might also get grandfathered or raised.

Look for the following after effects…Lower inventory coupled with a slight reduction in demand, the housing crisis is gonna get much much worse with builders not building or withdrawing from upscale projects as their stocks value decrease.

Less people upgrading,now maybe in 3 years if a change, look for some kinds of revisons restoring some of what was taken away.

simple math here: house value 1,525,000 which is a nice coast house: loss of interest deduction at 4% is $40,000 ( Ist 525 deductable)…loss of property tax deduction at 1.25 rate is 10,732 ( property tax at 20,732-10,000 allowable), add mello fees, insurance fees….nobody is gonna move….and lose over 50K per year.

Rancho Santa Fe- those folks are the best of the best in terms of keeping money, saving on taxs, they will put those homes in corporate shelters, LLC’s etc…they are way ahead of us. In my opinion best over all place to live in SD county quality of life….just follow their lead.

A cynic would look at the tax proposal in its entirety and might conclude that every aspect was biased to negatively impact California.

Posted from a dozen miles west of the cesspool that is our State capital.

For North County coastal what is the cost to build ppsf? About $250 (without land)? Trying to figure out a “floor” where prices could fall to. Is it fair to think $300/sf in a good part of NCC would be that floor?

Thanks Tom – I remember when we used to compare resales to what a new-build will cost. But now the thought of buying a lot and building a custom home is so remote due to the lack of land available.

But $300/sf is the the number I use for construction cost per square foot for a quality custom new-build.

Seems like prices must fall as a result of all of this?

Very little risk of prices falling. When faced with writing a check to the IRS, homeowners will resort to doing anything else but. It usually happens when their tax liability hits six figures, there is something about that much money that ticks off older people.

But the affluent take it in stride. I know one guy who paid a million in taxes to make a deal. The net benefit was worth it.

Because the death tax is the desired way to go, any negative tweaking of the current tax law will cause fewer sales. The only hope for lower prices is a massive boomer liquidation, which is more likely to happen in smaller doses.

Our reader Another Investor checks in regularly with the opinion that boomers are so solid that any thoughts of a liquidation environment is remote at best.

Let’s face it, the boomers have all the cards, and they will play them carefully and only when needed.

Can you rent your $1.5M house to yourself through LLC and then get the full interest deduction?

Franklin, it’s not $50k lost per year, it would be $50k deduction loss, so more like a 25% of that actual expense, or $12k. For someone making 300k a year, that’s a loss of around 4% buying power. Painful, but not a massive change. I think the effect is more psychological, the thought of avoiding taxes is an incentive to take a larger mortgage. (“it’s a tax write-off!”) Most people don’t really do the math.

If I try to sell now, prior to Jan 1st, would they go by the recording date or date that you entered into contract for the new tax assessments? Any info is appreciated!

I don’t think anyone knows for sure at this point, but it will probably be the recording date.

If you’re around here, let’s get on it!

If you had a client looking to buy with all cash, would you tell them to hold off for awhile now? Seems like prices must fall as a result of all of this?

You’ve heard it here before, but we are due for the Big Stagnation – and probably overdue. Sellers are going to try to get more than the last guy did….until they are convinced otherwise.

It will be a function of how quick they will dismiss the usual mantras, like “It takes time”, “I’m in no hurry”, “I don’t need to sell”, and the all-powerful, “I’m not going to give it away!”.

We’re going to be down to the people who need to sell just to live/breathe, so the tighter inventory of salable homes will help to balance it out.

But cash or financed buyers who are diligent in their search for the needle in a haystack can land a good deal by working with a good agent and having some luck.

For ‘prices to come down’ in general would require every seller to take less. There aren’t enough that NEED to sell to cause an overall downturn in prices, but technically it is possible if we run out of buyers.

Let’s say that the sales volume dropped by 50% or more because of Stagnant City – caused by most sellers not being willing to lower their price enough to sell.

For prices to follow, the demand would have to drop too. Otherwise, we will still have too many buyers chasing even fewer houses that are priced to sell.

We should also note that the measuring of prices has always been vague and unreliable too. The media will go bonkers with any drop in the median sales price, but you and I know better.

I think this is the time to buy, while unknown is there, if they put say a June 30 deadline on interest deduction, look for the banks to raise rates to make money and sellers to raise prices, The fact is a fair market priced house at 4% historically is a bargain and with the locking in of that money for 15/30 years you win. If it stays say to 1-1-18, it just an increased cost like the new added tax on purchases. The more the costs, the more it is difficult to build affordable housing,especially with removal of tax credit…..

I still like north county costal no matter what they do to the tax code, and the bottom end….the old rule buy the best neighborhood and lower price range has never been more true.

Given that California would be hit the hardest, why haven’t representatives of CA been as vocal as those of NY & NJ in opposing this? If they join forces, there will be enough votes to kill it.

Boomers will flee like rats when the lights turn on once this bubble deflated even a little. I laugh at the constant argument “it’s different this time”

We’ve seen boom and busy over and over again since the beginning of time. It’s not different “this time”

“We’ve seen boom and busy over and over again since the beginning of time. It’s not different “this time””

No, but it’s qualifiably different from last time, and I think that’s the point. Nobody is denying real estate market cycles.

Hopefully I am missing something , but shouldn’t the loss of the state tax deduction be a significant concern for californian’s throughout the state including even more so buyers in more expensive areas such as north county coastal? Loss of state tax deduction would decrease a person’s after tax income which effects not just people’s ability to buy a house but their ability to save for retirement, kids’ college educations, healthcare etc.

Considering that a fair number of home buyers now in 2017 throughout urban areas of the state including nsdcc are high income and likely pay tens of thousands of dollars a year on state taxes, wouldn’t the loss of that decision put a big damper on their ability to make monthly payments for a mortgage?

I feel like people have been talking a lot about the mortgage interest deduction (MID) because it is more relevant in most other states, but i am not hearing as much about and the loss of the state tax deduction which numbers wise seems like it will hit their income a fair bit for someone who is looking to buy in urban California (sd, oc, la, Bay Area etc).

This isn’t a tax blog really, but what you point out is correct. There are a lot of tweaks they are doing with this proposal and they are still horse trading on specifics. It is proposed that the standard deduction goes for singles to $12,000 from $6,350 for married couples filing jointly to $24,000 from $12,700. So if you itemize less than $12/24k, you’ll be ahead I think. If more, look at the individual entries on your Schedule A. Under this proposal, cap the property tax at $10k (that’ll sting a lot of people), eliminate the state income tax deduction. Existing loans grandfather, but if you want to see what would happen under new rules if you bought, eliminate the MID for any interest on the loan over 500k. I think they are tweaking some other deductions too.

By the way, they were going to scrap property tax deduction completely, but had to give in and give the 10k deduction because all the “we don’t do income tax” states get their money through higher property taxes (I’m looking at you Texas).

Oh, based on my last post, there is another thing that will entrench owners / discourage sellers and squeeze inventory. If you bought a 800k or less house at some point, your property taxes will be fully deductible. If your house is now worth more and you trade across or up in value, you new property taxes above 10k won’t be deductible. Won’t be the deciding factor, but every dollar goes into the decision tree.

While the National Association of Home Builders (NAHB) was fast out of the box yesterday, slamming the newly released Republican tax reform proposal, the National Association of Realtors® (NAR) issued a statement merely acknowledging release of the bill and saying it needed time for a review. It didn’t take long.

Before the close of business yesterday it released a statement from its President William E. Brown calling the proposed bill “a tax increase on middle-class homeowners” one that “threatens home values and takes money straight from the pockets of homeowners.”

Brown continued, “Realtors® believe in the promise of lower tax rates, but this bill is nowhere near as good a deal as the one middle-class homeowners get under current law. Tax hikes and falling home prices are a one-two punch that homeowners simply can’t afford.”

He referenced the Census Bureau’s recent data on the country’s homeownership rate which shows it still hovering around a 50-year low after a more than decade-long slide and said that buying a home is the single largest investment many middle-class families will ever make. It is also an important path to household wealth; the average net worth of a homeowner is 45 times that of a renter. “By eliminating or nullifying the incentive for homeownership, however, Realtors® are concerned that homeownership’s wealth-building potential could be pushed out of reach.”

Brown pointed to an NAR analysis of the House Republican blueprint for reform made earlier this year. It found that plan, which proposed nullifying the mortgage interest deduction (MID) for all but the top 5 percent of tax filers as well as eliminating the deductibility of state and local taxes including property taxes, would cause a 10 percent drop in home values and raise taxes on middle-class homeowners by an average of $815.

Like that blueprint, the proposed legislation doubles the standard deduction, while repealing all itemized deductions, except for charitable contributions and the MID. However, it caps the latter at $500,000 for newly purchased homes. The bill also eliminates state income tax deductions altogether, while installing a new cap on property taxes and puts new restrictions on the capital gains exemption homeowners utilize today when they sell their home. “The exemption is vital to allowing homeowners to use their equity to pay for retirement and other long-term needs,” Brown said.

He concluded by stating that “The nation’s 1.3 million Realtors® cannot support a bill that takes homeownership off the table for millions of middle-class families. We know this legislation is just the beginning of a much longer discussion. Our members will continue to make their voices heard as we push towards tax reform that responsibly lowers rate while protecting the dream of homeownership.”

The Mortgage Bankers Association (MBA) also expressed concern about those portions of the tax proposal that affect housing. MBA President and CEO David H. Stevens said his group is concerned about the MID, deductibility of local real estate taxes and the capital gains exception and added they had problems with certain provisions on the production of affordable housing.

On the positive side, MBA was pleased the bill retained the deductibility of business interest for real estate, section 1031 like-kind exchanges for real property, and the low-income housing tax credit.

Stevens’ statement concluded, “We recognize this is the opening bid in the discussion on tax reform and we look forward to continuing to work with policymakers to find the right balance that both reduces the tax burden on American families and spurs economic growth, without posing unnecessary risk to the housing and real estate markets.”

http://www.mortgagenewsdaily.com/11032017_tax_reform.asp

A comment left at the MND – people are never going to move:

Has anyone else noticed the proposed tax deduction is ONLY on purchase loans so there would be no more refinances. It would never make sense to refi your mortgage and give up your tax deduction.

Mark Zandi, chief economist at Moody’s Analytics, said the tax changes could initially cut prices by 10 percent in expensive markets and 3 percent to 5 percent across the U.S. An S&P index of homebuilders tumbled as much as 2.7 percent on Thursday, the biggest loss since November 2016.

https://www.bloomberg.com/news/articles/2017-11-03/cohn-says-new-mortgage-deduction-limit-won-t-hurt-housing-market