Janet Yellen has spoken today – but no big shocks:

The possibility of a December hike, around 50 percent before Yellen’s remarks, moved up to 53.5 percent, according to the CME. However, the market continues to doubt anything happening in September, which has just an 18 percent chance.

“Ultimately we think Yellen’s speech really doesn’t give us anything new,” said Chris Gaffney, president of World Markets at EverBank. “They continue to be data dependent and the members still ‘believe’ growth will return in the coming months — but the data continue to prove them wrong so the Fed’s credibility continues to come into question.”

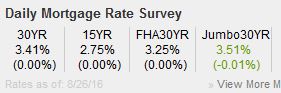

Even if/when the Fed bumps their Fed funds rate, I’m not sure it would change mortgage rates much.

http://www.cnbc.com/2016/08/26/fed-chair-janet-yellen-chance-for-raising-rates-has-strengthened.html

“The Federal Reserve’s forecast of gradual rate hikes is damaging the economy and the central bank’s credibility”, said St. Louis Fed President James Bullard on Friday.

In an interview on CNBC, Bullard stuck to his forecast of one rate hike over the next two-and-a-half years.

Bullard, who is a voting member on the Fed’s policy committee this year, said he was “agnostic” about exactly when the Fed should take that one step but did not seem eager to move at the September meeting.

Bullard said he thought it would be best to raise interest rates after there had been some “good news about the economy.” While there has been two good jobs reports, “year-over-year GDP growth rate is very low,” he noted.

The St. Louis Fed head said he was trying to “break down” the Fed’s “on-the-cusp-of-200-basis- points story” for interest rates over the same forecast horizon.

Asked if he believed the Fed’s forecast was damaging the economy, Bullard replied, yes.

“I think that it is hurting our credibility. By the end of this year, we’ll be two years into the process since [quantitative easing] ended, maybe have moved twice at this point. So I think that is affecting global pricing. You’ve got this policy divergence story that has been in FX markets for a long time here,” he said.

“We want to line that up better with a more realistic assessment of what is going to happen over the forecast horizon,” he said.

Imo, the next big thing is Deutschbank. They’re definitely over-leveraged with toxic derivatives to beat the band, and they’re apparently running out of ideas. When they start to belly up, for those who live and bank in Western Europe, sucks to be you.

I don’t know what that will mean for the US, but I’m betting it will be initially disquieting. Pretending that I guessed right, what should Yellen say? Exactly what she did say, imo. Offer meager hope to the teeming masses, while preparing for the coming global sh*tshow.