From MND:

http://www.mortgagenewsdaily.com/10312014_aging_housing.asp

An excerpt:

A survey of attitudes toward housing released on Thursday by The Demand Institute indicates that the Baby Boom generation still has no intention of aging gracefully. In fact, when it comes to housing it appears few intend to yield at all to their advancing years.

The Institute, a nonprofit run by the Conference Board and the Nielson ratings people, surveyed 4,000 households last year in which residents qualified as members of that huge post-war generation born between 1944 and 1963 about their future housing plans.

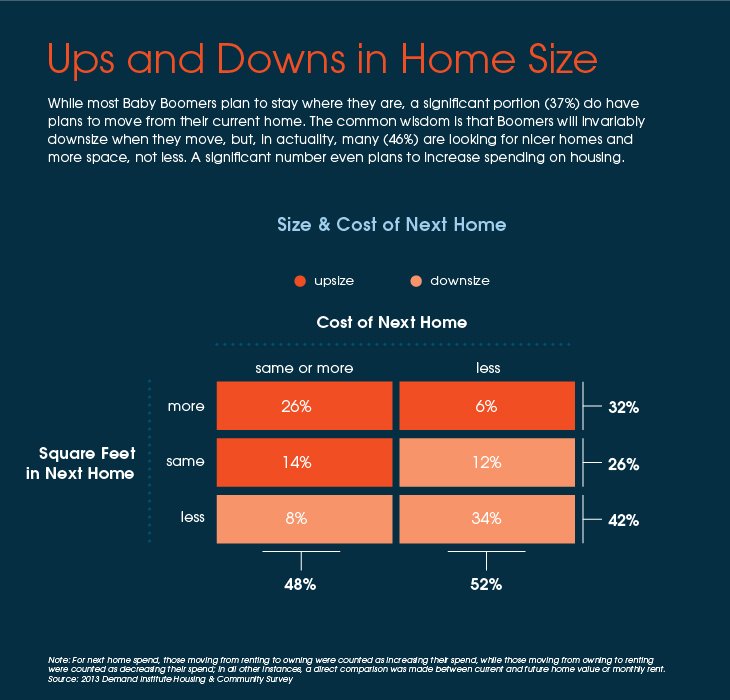

The survey found that as a group Baby Boomers had a median net worth of $200,000 in 2007 and were on their way to accumulate nearly $370,000 by 2013. Instead the recession sent many off the rails and at the time of the survey that median net worth was down to a median of $143,000. Although many Boomers have delayed or modified their plans due to the recession they have, the Institute says, not abandoned them entirely. Over the next five years it is expected they will spend $1.9 trillion on new home purchases and $500 billion on rent.

Read full story here:

http://www.mortgagenewsdaily.com/10312014_aging_housing.asp

Thanks daytrip!

http://www.nytimes.com/interactive/2014/11/03/health/bracing-for-the-falls-of-an-aging-nation.html?module=Search&mabReward=relbias%3Ar

A net worth of $370K doesn’t give one a lot of choice in one’s life decisions. I think what’s missing in these surveys is how much boomers expect to inherit from relatives. I think a lot of boomers have that in the back of their minds, but it’s not being reflected in these surveys.

I know one gal who never saved a nickel, didn’t go to college, lived by the seat of her pants, but since her grandparents were worth millions, her economic strategy turned out to be quite rational. They passed on, and she lives on a large ranch–she always loved horses–fully paid for. I have a friend, who had a rich uncle. That translated in a new home, and full financial security for my friend when uncle passed away. Before that he was struggling financially. Without his uncle, his retirement years would likely have been relatively tragic. Instead, it’s clear blue skies for him.

I’d like to see more surveys that reflect real net worth, as well as “expected” net worth. Maybe call it the “dark pension pool.”

daytrip,

The lottery ticket relatives are becoming few and further between with all the reverse mortgages.

Also and this could just be my observation only but it seems to only take 2-3 generations of kids that don’t work to blow through big fortunes/trusts.

In the end hard work and trudging though the day to day usually ends up being for the best. (unless you get hit by a bus on your way to work 1 day before retiring. In that case it would really suck.)

I always figured prepare for the worst. That u will actually have to save a few bucks to retire. If a few bucks fall in your lap look at it as a windfall.

Looking around I don’t really see any money landing in my lap. Never has, never will.

I think 75% of people expect to live on freebies for retirement.

“Looking around I don’t really see any money landing in my lap. Never has, never will.”

I strongly suspect that in the neighborhoods serviced by this blogsite, the opposite is frequently true.