I was with a handful of realtors the other day chatting it up about the current market conditions. I said, “they remind me of 2007”, which received blank stares. None of them were in the business then!

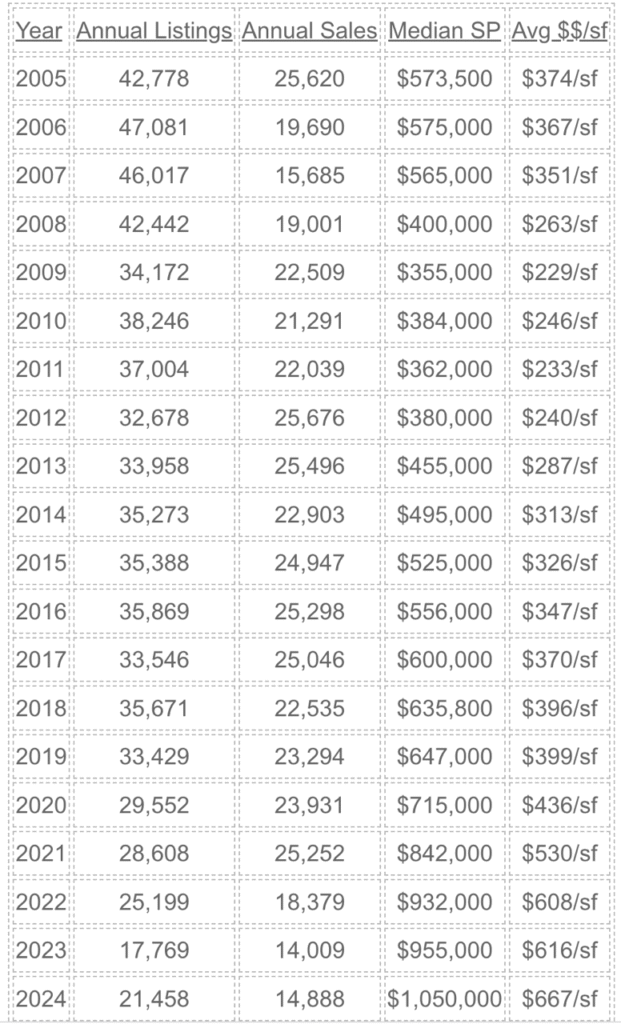

So I went back to check the statistics to verify. Because next month will be the 20th anniversary of this blog, I included the whole history to see where we’ve been:

SD County Detached-Home Annual Stats

There was a bigger drop in the number of sales between 2006 vs 2005, but the percentage of sales divided by listings was a bone-chilling 34% in 2007 – the largest failure rate ever.

Sales are much lower today, thanks to fewer homes for sale.

Halfway through 2025 and the numbers are similar to last year, but the tide appears to be turning. See my previous post!

Back in 2005 there were Bankruptcies and Short Sales. These dont exist in today’s market (like they did back then). If banks let homeowners live for free in houses the market will just continue to stagnate. Ironically rents will continue to go down because accidental landlords will take anything and just pocket the rent while playing chicken with banks on foreclosure.

I hope that 2007 coffee tasted good. 😉

The metric that surprises is decline in $/sf. I suspect we might see a similar retrenchment.

Shadash makes a good point. Banks can control the narrative. This time I suspect they will be aggressively proactive and not let DQs accumulate.

“Not wrong, just early”

RD

It’s okay. I was talking to same advisors the other day that the stock market felt like the tech reck from 2000-03. They had no clue because they were in diapers at the time. Mud under your tires I call it.