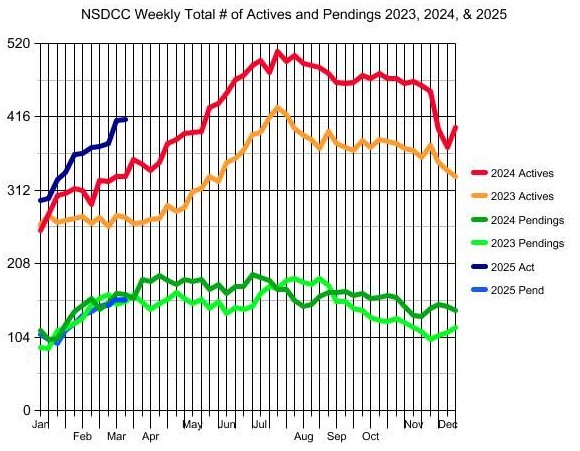

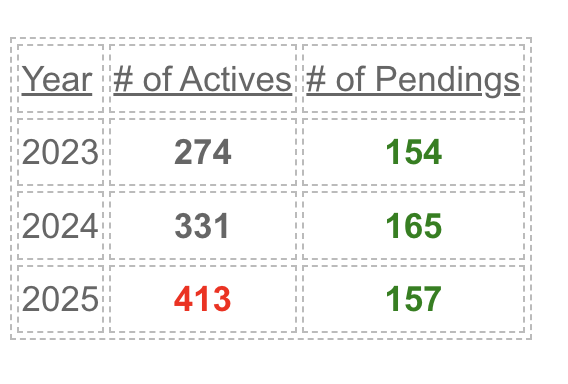

The climb in the number of active listings between La Jolla and Carlsbad took a break and only rose by two. Here’s how the actives and pendings compare to the last two years in mid-March:

NSDCC Actives and Pendings, Mid-March

The 25% YoY increase in the number of actives doesn’t seem to bother the buyers!

All that matters is what will the sellers do who are left out of the party? Will they bang the door down with a big price reduction?

Or pack it up and wait for the market to ‘pick up’?

The $0 – $2,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

43 |

$918/sf |

63 |

27 |

| Jan 13 |

45 |

$936/sf |

53 |

22 |

| Jan 20 |

47 |

$908/sf |

54 |

25 |

| Jan 27 |

48 |

$904/sf |

48 |

32 |

| Feb 3 |

51 |

$914/sf |

47 |

41 |

| Feb 10 |

45 |

$935/sf |

46 |

45 |

| Feb 17 |

45 |

$916/sf |

46 |

46 |

| Feb 24 |

45 |

$958/sf |

48 |

40 |

| Mar 3 |

50 |

$950/sf |

37 |

42 |

| Mar 10 |

55 |

$908/sf |

36 |

45 |

| Mar 17 |

53 |

$891/sf |

35 |

50 |

The $2,000,000 – $3,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

55 |

$1,029/sf |

66 |

36 |

| Jan 13 |

58 |

$990/sf |

63 |

31 |

| Jan 20 |

64 |

$1,018/sf |

57 |

26 |

| Jan 27 |

64 |

$1,025/sf |

53 |

31 |

| Feb 3 |

71 |

$1,009/sf |

50 |

31 |

| Feb 10 |

75 |

$1,005/sf |

46 |

36 |

| Feb 17 |

81 |

$1,015/sf |

44 |

39 |

| Feb 24 |

80 |

$1,012/sf |

38 |

52 |

| Mar 3 |

80 |

$1,034/sf |

33 |

49 |

| Mar 10 |

92 |

$1,029/sf |

37 |

44 |

| Mar 17 |

98 |

$1,015/sf |

39 |

44 |

The $3,000,000 – $4,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

44 |

$1,091/sf |

82 |

19 |

| Jan 13 |

46 |

$1,122/sf |

77 |

19 |

| Jan 20 |

52 |

$1,156/sf |

70 |

16 |

| Jan 27 |

49 |

$1,197/sf |

67 |

20 |

| Feb 3 |

56 |

$1,182/sf |

55 |

21 |

| Feb 10 |

58 |

$1,158/sf |

51 |

25 |

| Feb 17 |

58 |

$1,179/sf |

54 |

24 |

| Feb 24 |

56 |

$1,168/sf |

52 |

24 |

| Mar 3 |

51 |

$1,147/sf |

56 |

31 |

| Mar 10 |

56 |

$1,240/sf |

61 |

34 |

| Mar 17 |

60 |

$1,209/sf |

61 |

36 |

The $4,000,000+ Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

160 |

$1,822/sf |

105 |

27 |

| Jan 13 |

156 |

$1,868/sf |

105 |

31 |

| Jan 20 |

170 |

$1,936/sf |

95 |

29 |

| Jan 27 |

180 |

$1,877/sf |

90 |

31 |

| Feb 3 |

189 |

$1,884/sf |

85 |

31 |

| Feb 10 |

189 |

$1,864/sf |

88 |

29 |

| Feb 17 |

192 |

$1,875/sf |

90 |

32 |

| Feb 24 |

195 |

$1,869/sf |

91 |

34 |

| Mar 3 |

200 |

$1,860/sf |

87 |

34 |

| Mar 10 |

213 |

$1,811/sf |

83 |

36 |

| Mar 17 |

208 |

$1,755/sf |

85 |

30 |

NSDCC Weekly New Listings and New Pendings

| Week |

New Listings |

New Pendings |

Total Actives |

Total Pendings |

| Jan 6 |

27 |

11 |

298 |

108 |

| Jan 13 |

38 |

26 |

301 |

101 |

| Jan 20 |

55 |

16 |

328 |

95 |

| Jan 27 |

60 |

32 |

337 |

113 |

| Feb 3 |

72 |

28 |

363 |

123 |

| Feb 10 |

50 |

34 |

364 |

135 |

| Feb 17 |

50 |

29 |

373 |

140 |

| Feb 24 |

58 |

38 |

374 |

148 |

| Mar 3 |

60 |

31 |

378 |

152 |

| Mar 10 |

60 |

30 |

411 |

156 |

| Mar 17 |

49 |

37 |

413 |

157 |

NSDCC List Price Quartiles

| Week |

1st Quartile |

Median List Price |

3rd Quartile |

| Jan 6 |

$2,685,000 |

$4,472,500 |

$7,995,000 |

| Jan 13 |

$2,499,000 |

$4,250,000 |

$7,750,000 |

| Jan 20 |

$2,695,000 |

$4,300,000 |

$7,767,000 |

| Jan 27 |

$2,795,000 |

$4,498,000 |

$7,995,000 |

| Feb 3 |

$2,695,000 |

$4,350,000 |

$7,499,000 |

| Feb 10 |

$2,799,000 |

$4,299,000 |

$7,695,000 |

| Feb 17 |

$2,695,000 |

$4,200,000 |

$7,750,000 |

| Feb 24 |

$2,699,500 |

$4,250,000 |

$7,645,000 |

| Mar 3 |

$2,550,000 |

$4,375,000 |

$7,497,000 |

| Mar 10 |

$2,500,000 |

$4,200,000 |

$7,250,000 |

| Mar 17 |

$2,500,000 |

$4,000,000 |

$6,995,000 |

What number do you think is the “tipping point” for number of listing’s and officially switching to a buyers market?

My guesstimate is 600+

Yes, that’s probably right – a big number that makes it real obvious. It’s not that obvious now.

I saw a couple of agents bantering about the spring selling season not firing yet, and what to do.

Sellers and agents will just be hoping for something different until June.

Under $3,000,000 looks healthy, with 164 actives and 94 pendings.

Go above $3,000,000 and there are 270 active listings and 65 pendings.

Above $7,000,000 has 98 actives and 10 pendings.