Hat tip to our seller who noticed a new paragraph in the counter-offers this year that went undetected by everyone I know – and we go to the Forms Update every year to hear about changes!

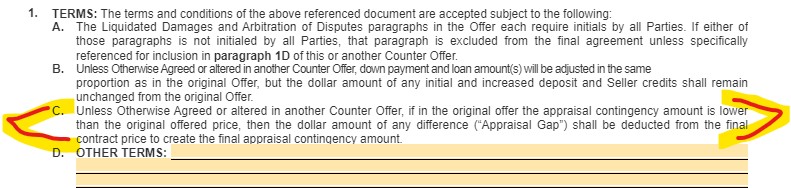

Paragraph 1C in the counter-offer identifies the Appraisal Gap:

When we first read this, it sounded like the purchase price would automatically be lowered to the appraised value without negotiation.

But Gov at the C.A.R. legal office submitted this response:

It means that if, for example, the buyer made an offer of $500,000, contingent on the property appraising at $475,000, and the Seller countered at $520,000 and the buyer accepts the counter, the buyer’s appraisal contingency is automatically adjusted to be $495,000. In other words the $25,000 “appraisal gap” is carried over in the counter. (I admit the language is a little confusing).

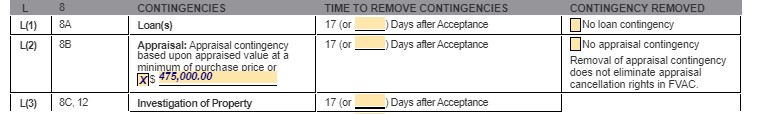

Here is the part of the contract that he references:

I’ve never seen anyone put a lower value in Paragraph L(2), but we just started using this version.

The touchy part was that the counter-offer comes later – after the contract verbiage above – which would mean that it would supersede it. It looked like the buyer could waive the appraisal contingency, but then the counter would make it valid again.

Glad that Gov was able to clear that up!

I think this is important to both listing and buyer agents! It might appear to be a small fraction of the agreed contract price, but that’s real money that could be 10-50k+ out of pocket to either principal party depending on how it unfolds. I thought this post would get a handful of comments because of the real impact it has for those who must finance their purchase and the likely required appraisal.

Thanks JtR for this post.

You’re welcome Cheese!

Even though Gov provided an explanation, I don’t think it is very clear (thus the snarky ending to the post).

I haven’t seen any agent input a lower price in Paragraph L(2), but think of the ramifications.

At first glance, the listing agent might breathe a sigh of relief that the appraisal can come in low and still have a deal. It is an appraisal-waiver-lite.

But the appraisers get a copy of the contract. When they see that they don’t have to push it to the full purchase price and because they are nervous already, won’t it be more likely that their appraisal report will come in a little short?

Then once it comes in lower, aren’t the buyers going to insist that the purchase price is lowered too? You better believe it, and then when the agents involved read this paragraph, won’t they conclude that the price has to be lowered? Because that’s the way it reads…kind of. Gov explains that it merely adjusts the contingency, but the unintended consequence is that it causes a stir.

The verbiage is actually causing a problem that wasn’t there previously.