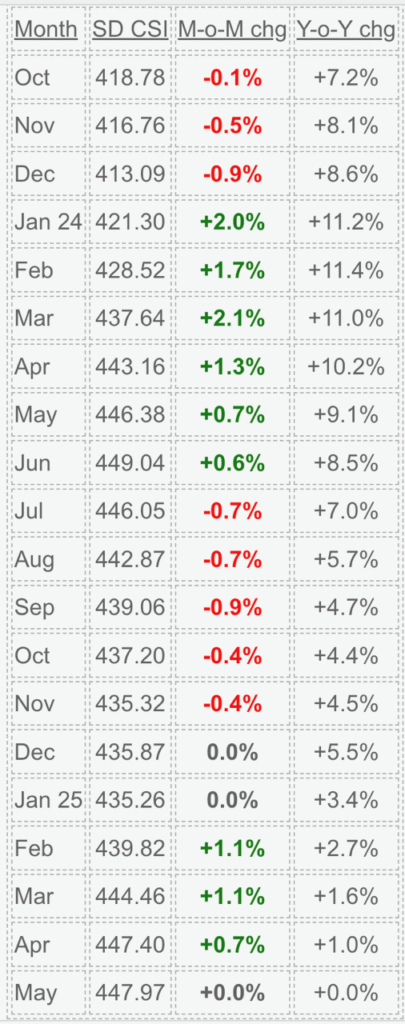

San Diego Case-Shiller Index, Non-Seasonally-Adjusted

The buyer enthusiasm in 2025 was about half of what it was in 2024.

The May reading is the first double-aught month, with both MoM and YoY logging in zeros, and it sure looks like it will be the peak of the year. Last June was the peak of all-time, and it could hold up if we don’t get a bump next month.

In the last half of 2024, the index lost 3.1%, and we’re probably heading for a similar drop this year – at best. It should set up the same first-quarter mini-frenzy in 2026 that we experienced at the beginning of 2024 and 2025.

“May’s data continued the year’s slow unwind of price momentum, with annual gains narrowing for a fourth consecutive month,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “National home prices were just 2.3% higher than a year ago, the smallest increase since July 2023, and nearly all of that gain occurred in the most recent six months. The spring market lifted prices modestly, but not enough to suggest sustained acceleration.”

Still 9.1% higher than 2023. And you still haven’t unpacked all those boxes from when you moved in. Year over year has its uses but doesn’t mean much to most people.