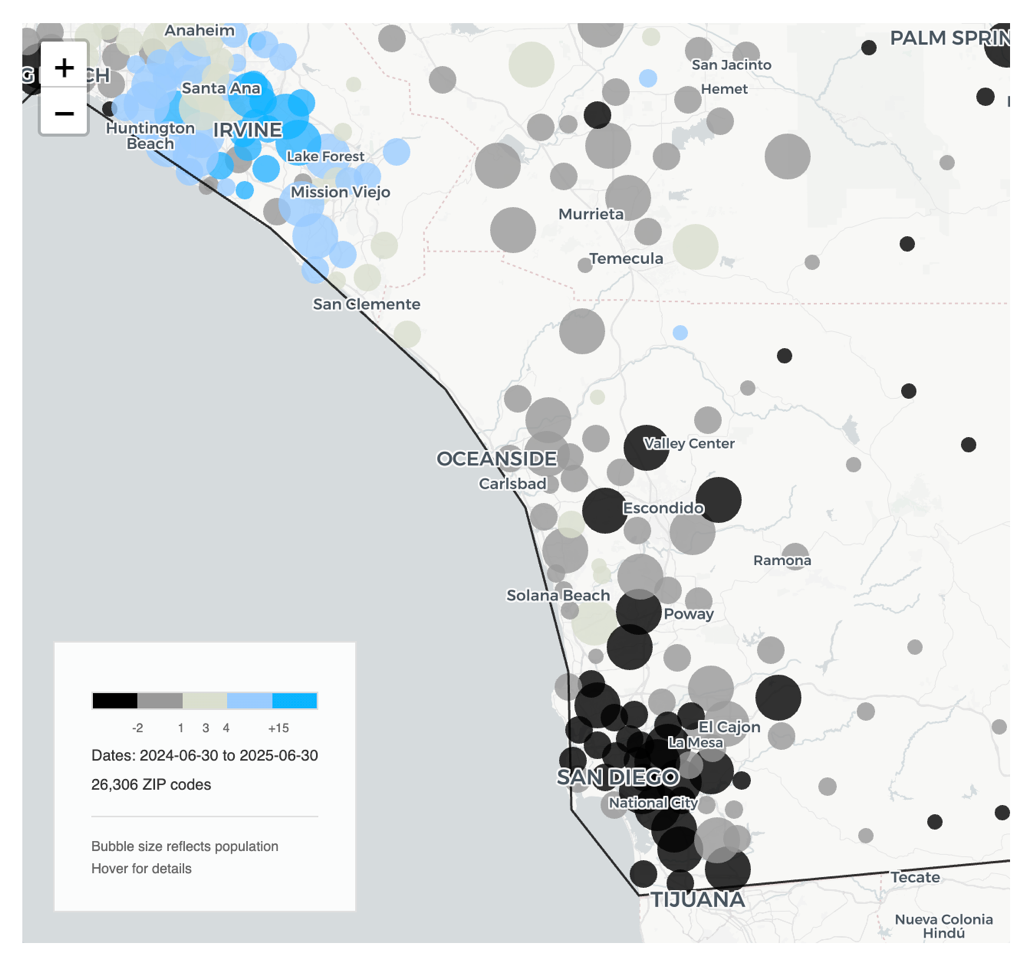

The pricing downturn is expanding throughout the country. While only a few communities felt it in January, now many (36%) of the top metro markets are feeling it:

Jan: 31 of the nation’s 300 largest housing markets (i.e., 10% of markets) had a falling year-over-year reading in the January 2024 to January 2025 window.

Feb: 42 of the nation’s 300 largest housing markets (i.e., 14% of markets) had a falling year-over-year reading in the February 2024 to February 2025 window.

Mar: 60 of the nation’s 300 largest housing markets (i.e., 20% of markets) had a falling year-over-year reading in the March 2024 to March 2025 window.

Apr: 80 of the nation’s 300 largest housing markets (i.e., 27% of markets) had a falling year-over-year reading in the April 2024 to April 2025 window.

May: 96 of the nation’s 300 largest housing markets (i.e., 32% of markets) had a falling year-over-year reading in the May 2024 to May 2025 window.

Jun: 110 of the nation’s 300 largest housing markets (i.e., 36% of markets) had a falling year-over-year reading in the June 2024 to June 2025 window.

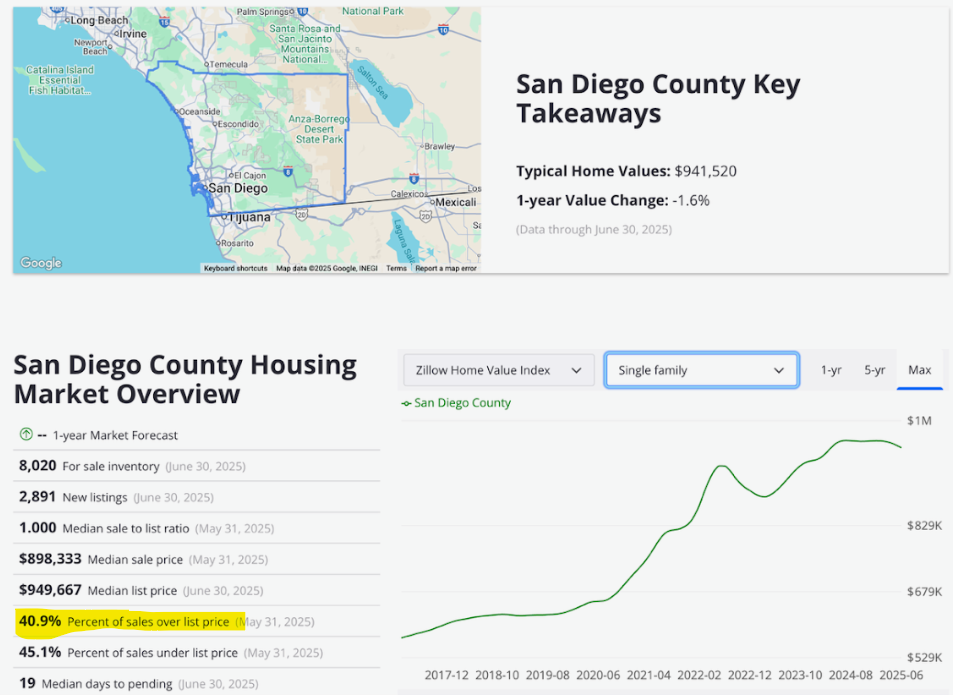

Year-over-year home value declines, using the Zillow Home Value Index, are evident in major metros such as Austin (-5.8%); Tampa (-5.7%); Miami (-3.8%); Dallas (-3.7%); Orlando (-3.7%); Phoenix (-3.5%); San Francisco (-3.4%); San Antonio (-3.3%); Jacksonville, Florida (-3.2%); Atlanta (-2.9%); Denver (-2.7%); San Diego (-2.4%); Raleigh (-2.1%); Sacramento (-1.8%); Houston (-1.8%); Riverside (-1.5%); New Orleans (-1.2%); Charlotte (-1.0%); Memphis (-1.0%); San Jose (-0.9%); Portland, Ore. (-0.4%); Seattle (-0.1%); Los Angeles (-0.4%); and Birmingham (-0.1%).

Goldman Sachs made this prediction: “Against the backdrop of an easing housing market, we expect national home prices to rise just 0.2% December-over-December this year and 0.8% next year.”

Thankfully, the buoyant first quarter of the year had a +3% in pricing for the La Jolla-to-Carlsbad market that will help offset the negativity we’ll have for the rest of the year.

Is there anything promising about the market? Yes!

- There were 3% more NSDCC detached-home sales in the first half of 2025 (vs. 2024), which makes you think the market is doing fairly well if sales are higher!

But consider this stat – and this is Zillow reporting it, not me:

There were 40.9% of the sales that closed over their list price? WOW! Wouldn’t you think that in a regular market, about 10% or maybe 20% of the homes would sell above list?

This isn’t a normal market….or maybe it is?

We’ve received two offers on our Linda Lane listing, and it’s over list already.

How do you explain it?

Most of the enthusiasm is in the entry-level of each market where it’s more competitive. Once you get higher in price, there’s more inventory and buyers get more picky.

For example, the homes priced at $2,500,000+ in Olde Carlsbad better have something special about them because you can get a nice tract house in La Costa or something decent in Encinitas for that money.

There doesn’t appear to be enough buyers to pick up every home for sale, so that’s where the market will be made for the rest of the year.

Will sellers sharpen their pencil on price, or just let it ride? The vast majority won’t do much, if anything about their price. About 40% of them have been on the market for more than 60 days, so they are way off the buyers’ radar.

Another contributing factor is the demise of the buyer-agent.

I’ve had five agents tell me that they are writing an offer on Linda Lane. NONE of them showed their buyers the home initially – they all came to the open houses, which is fine because I like having some influence on them.

The traditional showing of a home by the buyers’ agent who properly advises their clients on the not-so-obvious features is where the deal is made. Without it, buyers are left to figure it out on their own, and it’s just too easy for them to stay on the fence unless they see something really special.

As a result, my job at open houses has evolved into being the de facto buyer-agent. I’m the one who sells them on the value, and then they go find their agent to write it up!

I don’t mind – in fact, I love it.

Do you see other agents really selling their product at open houses? Me neither. It’s why the market sluggishness will be around for a while, and maybe forever.

0 Comments