I asked a few local real estate professionals what they thought about the current market conditions, and where the market might be going.

The two big title companies, First American and Fidelity (which insures 13-15 other title companies) said that the year-over-year numbers are steady/flat and they expect a slight increase over the rest of the year.

Alonzo said that the inventory is 28% above long-term norms. Price cuts are 18% above long-term norms, indicating increased pressure on sellers to reduce prices. Interest rates are hovering around 6.7% putting downward pressure on buyer demand. Don’t anticipate interest rates to drop till 2026. In short homes prices will slightly drop this second half of the year, with more buyer selection.

Anna, who runs the local transaction-coordinating company, said 2023, 2024, and 2025 have all felt very similar to her (me too). Her volume is steady.

Local realtor Tanya said she hopes the rest of 2025 is less uncertain than the first chaotic half! Her main thoughts are that there’s always a market, hot or soft, there’s always buyers and sellers. This year does feel different though – with the political chaos and slack consumer confidence and non-budging rates – so a less-motivated buyer pool could be a very hard pill to swallow for some sellers after years of being in the drivers seat.

Laker Joe said he’s experiencing longer market times, but if it’s single family, priced right and in great shape in a good location, then you could have multiple offers. If not, it’s gonna take a bit. Definitely more of a traditional market. And with the number of cancellations; listing agents definitely want to work with other reputable agents that will get across the finish line with their Buyers.

I thought the last two comments were very pertinent.

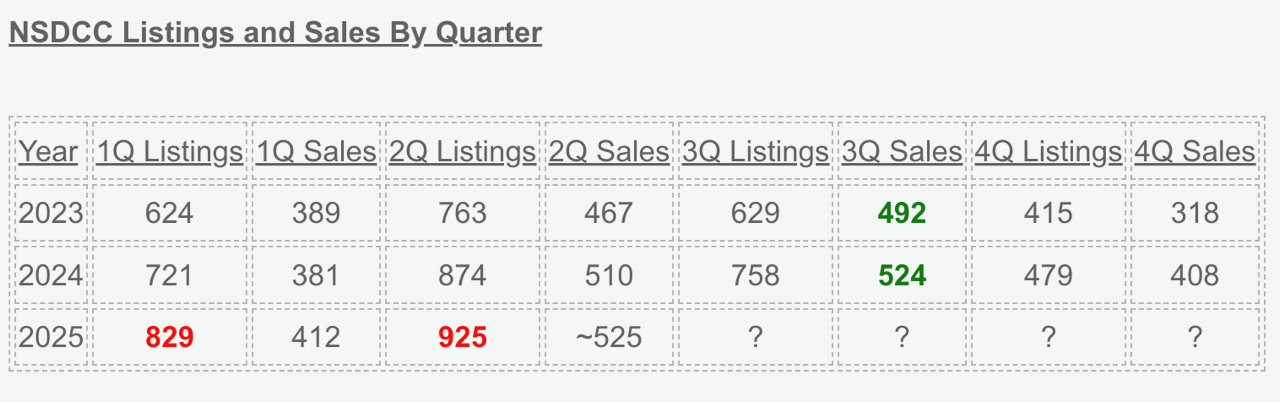

Even though sales have been holding up nicely, I think it’s going to get tougher, Specifically, the third quarter of 2025 is likely to be very different than usual.

I think we are due for a 25% plunge in 3Q sales.

Here’s why:

- Too many listings.

- Too many picked-over listings.

- Rates aren’t changing enough.

- The best 2025 buyers have bought a house by now.

- The remaining buyers want a deal.

Sellers are slow to adjust on price. Because the remaining inventory is down to the picked-over and somewhat-inferior homes (judging by them being unsold), their prices need more correction than before. They need a strong correction – like 10% in July, which just about every seller will resist.

It’s why I think there will only be around 400 sales in 3Q25.

Today, there are 162 pendings, so 400 sales over the next 3 months is possible. Any plunge in sales will be a reflection of how much sellers resist lowering their price, how willing buyers are to making lowball offers, and the agents’ ability to create deals that eventually close escrow.

You can probably understand why I have my doubts!

It won’t change the likelihood that January and February will be red hot again, and even the 4Q25 sales will be decent as the new reality gets collaborated into play. With a 25% plunge in 3Q sales, the annual count will only be -4% under the total sales in 2024.

But the 3Q is where the price discovery will be occurring.

Because sales are the precursor, they need to dip before the pricing gets fully affected. But pricing is already softer, so it will be in the 3Q that the final impact/correction on values takes place to get pricing where it needs to be for the 2026 January-February Selling Season.

Marketing isn’t just changing.

It’s transforming at warp speed.

Here are a few jaw-dropping numbers that show how tech and shifting buyer behavior are completely rewriting the real estate playbook:

📱 68% of homebuyers now start their search on a mobile app, not a desktop website

🎥 1 in 4 real estate video views now happen on YouTube Shorts (yes, those 60-second vertical clips)

📦 40% of Gen Z say they’d buy a home sight unseen if the price and terms were right

🧠 $8 billion poured into real estate tech startups in Q1 2025 alone, a record-breaking surge

🖼️ 76% of consumers say virtual tours are more important than traditional open houses

What does that mean for you?

✅ Film mobile-first, vertical video walkthroughs of every listing.

✅ Add a 3D tour or Matterport link to every MLS post and marketing email.

✅ Rebuild your drip email campaigns to be mobile-optimized (and maybe retire those text-heavy messages).

✅ Embrace AI-enhanced content, because the competition already is.

The landscape is shifting. Fast.

Two letters: QR