These ivory-tower guys have explored the topic of rising inventory and it’s relationship with declining home prices – and backed up their conclusions with math that every rocket scientist should love!

https://home-economics.us/when-should-we-worry-about-rising-inventory/

Their summary in layman’s terms:

We answer two questions:

- Is there a specific level of inventory that reliably signals price declines?

- What’s the lag between rising supply and falling prices?

Our conclusions, in brief:

We estimate the inventory threshold at 5.0 months. Below that level, inventory has only a weak relationship with year-over-year home price changes. But above it, the relationship becomes more clearly negative, signaling price declines 9 months in the future.

Importantly, this is not a vague association. The fit is unusually strong: our best-performing model—a 9-month lag with a 5.0-month threshold—yields an adjusted R² of 0.75, indicating that it explains a substantial share of the variation in home price growth.

Based on the model coefficients, we calculate that the predicted change in home prices turns negative at 5.81 months of inventory.

In other words, once inventory rises above 5.0 months, prices tend to soften. If inventory climbs above 5.81, the model implies that year-over-year price declines are likely to follow—with a lead time of about 9 months.

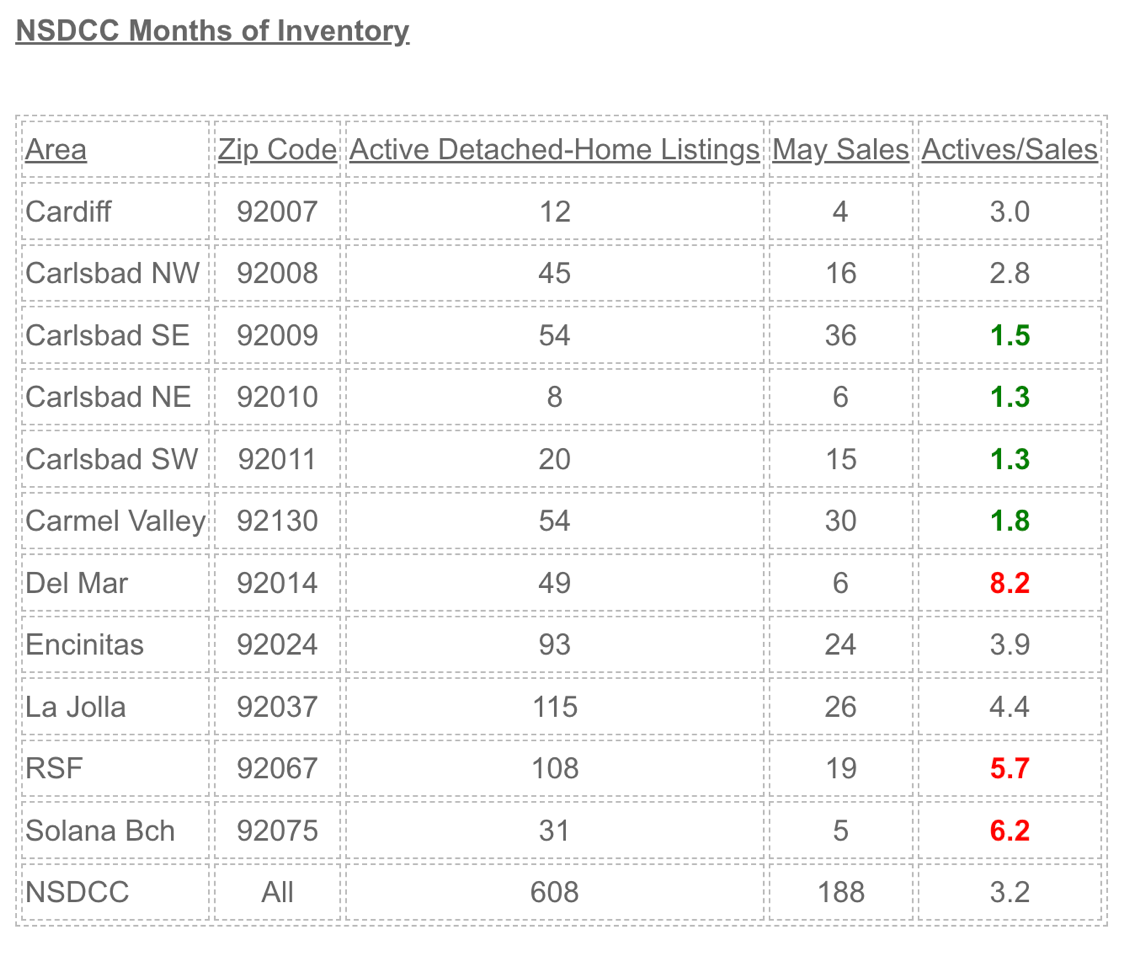

The months of inventory is measured by dividing the current inventory by last month’s sales. For the NSDCC, it means 608/188 = 3.23 months of inventory.

But the NSDCC sales in June are lagging way behind. There have only been 111 closings this month and Monday is the last day. If it gets up to 125-130 sales, then the 608/130 = 4.7 months of inventory!

Let’s break it down to the individual zip codes:

The areas under 2.0 should be fine, at least for now.

But I’ll add that the impatience of sellers who failed to sell this year will be intensifying in 2026. The researchers’ 9-month-window-before-price-declines could be shorter once longtime sellers see a flood of inventory in the new year.

Jim – there are probably as many reasons for selling as there are houses, but are there any common demographics to the current pool of sellers? I read that “boomers are staying put” so is it not them? Their heirs when they’re “staying put” in the hereafter? People leaving because of the cost of living? Perspiring minds want know 😉

I don’t know who is staying put. I’ll never forget the transmission mechanic at Mercedes, who when I asked him how many of these cars have a transmission problem, his answer was “100% of the ones I see”.

Similarly, I’m talking to those who are moving.

7 of 20 sales this year were buyers, and 6 bought their new primary residence and one purchased a second home for now.

Of the 13 sellers, four were unloading a rental, one sold a vacation home, 1 was the family homestead

and seven were boomer-type long-time owners (10+ years). Five of those left the state, and two purchased locally.

When will prices decline? When they do. Also when there are more sellers than buyers. Simple. Ride the wave and eventually it close out and hit the beach.