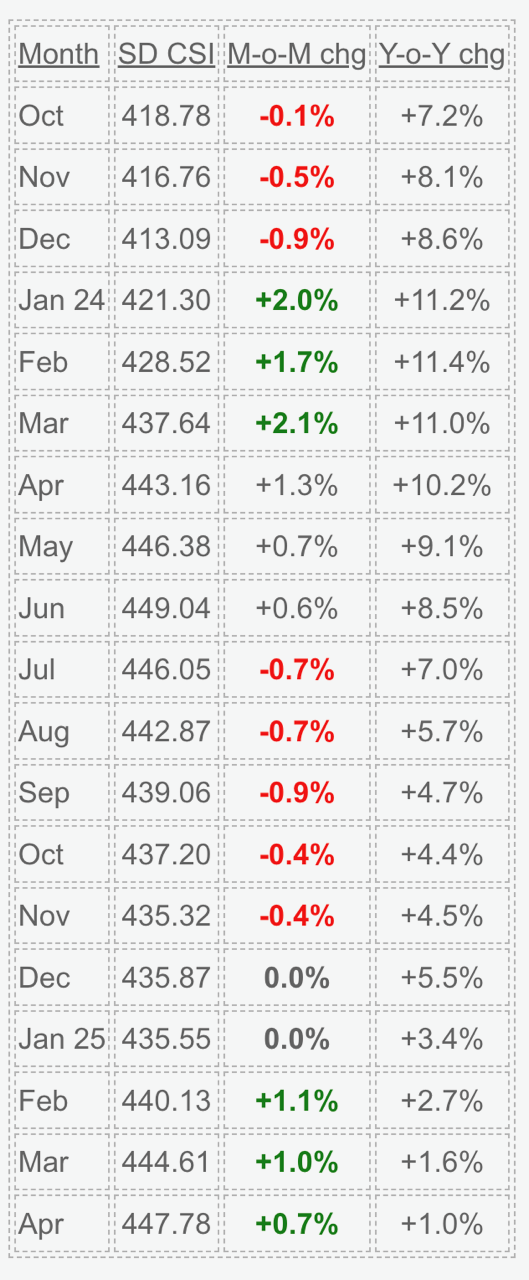

San Diego Case-Shiller Index, April

The first few months of 2025 are logging about half the gains as last year. It means next month will be flat at best, and hopefully the rest of the year is the same as last year?

“The housing market continued its gradual deceleration in April, with annual price gains slowing to their most modest pace in nearly two years,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “What’s particularly striking is how this cycle has reshuffled regional leadership—markets that were pandemic darlings are now lagging, while historically steady performers in the Midwest and Northeast are setting the pace. This rotation signals a maturing market that’s increasingly driven by fundamentals rather than speculative fervor.”

Both the FHFA and Case‑Shiller home price indices were released today. While the data collection time frame is from April, they each suggest a similar shift is underway when adjusting for seasonality. Specifically, if we ignore seasonality, prices rose. If we don’t, they were down 0.4% from March.

Home prices continue to rise YoY, but growth has clearly slowed (and, in April, backtracked a bit). The first negative MoM for seasonally adjusted Case‑Shiller since early‑2023 highlights early signals of market softening.

With mortgage rates holding steady in the upper 6% range and inventory slightly elevated, it would not be a surprise to see a similar trend continue in coming months.