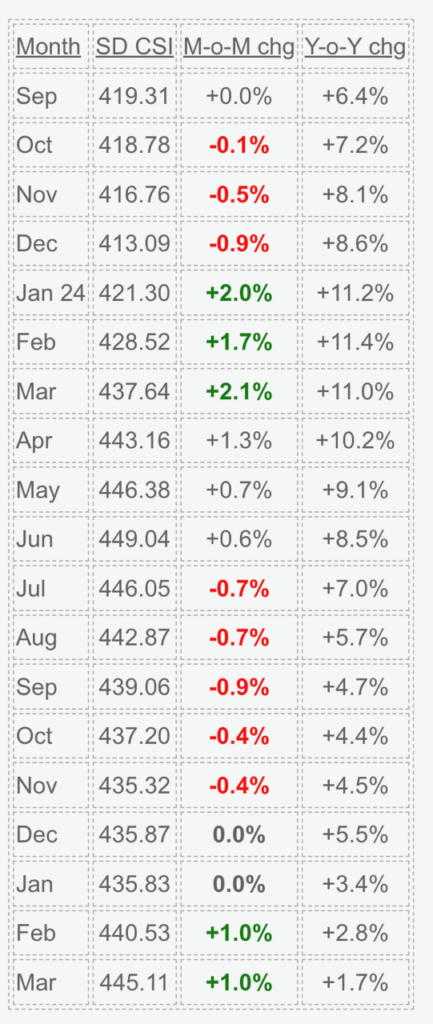

San Diego Case-Shiller Index, March

The back-to-back 1% gains will probably be as good as it gets in 2025, and we could wind up with a negative percentage overall for the year.

The change has been 1% or less (+/-) for the last eleven readings.

Welcome to Flat City.

Percentage change between January and December:

2019: +4.7%

2020: +12.4%

2021: +24.0%

2022: -1.0%

2023: +9.0%

2024: +3.2%

~~~~~~~~~~~~~~~~~~~~~~~~

“Home price growth continued to decelerate on an annual basis in March, even as the market experienced its strongest monthly gains so far in 2025,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “This divergence between slowing year-over-year appreciation and renewed spring momentum highlighted how the housing market shifted from mere resilience to a broader seasonal recovery. Limited supply and steady demand drove prices higher across most metropolitan areas, despite affordability challenges remaining firmly in place.”

The Truth of Today’s Market

Buyers are Selective. Cautious. Distrustful.

Sellers are Nostalgic. Unrealistic. Stubborn.

Interest rates are high—but not everything is about rates.

There’s more demand than supply—but no urgency.

Deals aren’t just difficult. They’re draining.

And no one is throwing you a bone.

There’s no wind in your sails.

Everyone thinks they are an expert because of the internet.

That, more than anything, is clogging the process. Information is but one part of true expertise. Assuming that information is correct is but one hurdle.

Those are just the new aspects. All the old bullet points still persist.

JtR; a suggestion. Ask potential buyers what they think it would take to reproduce any particular homestead at modern prices. Not just land and structure but regulation and construction standards. Then you can tell them what to expect from the planning desk as to fees.