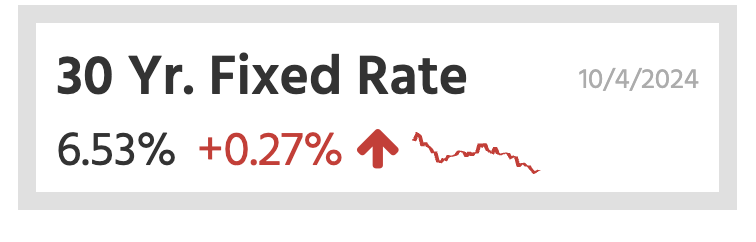

The Fed did their half-point drop on September 18th, and since then the 10-year yield been rising.

Mortgage rates may or may not come down – in spite of what the Fed does.

Buyers who are waiting until next year because they think rates will be lower could be disappointed.

Don’t listen to the prognosticators – stay in the hunt for the right house at the right price!

This rate was 6.15% on September 18th.

Today’s much-anticipated jobs report ended up coming out much stronger than expected. A stronger result was all but guaranteed to cause carnage (relative) in the mortgage market and that’s definitely what we’re seeing. A caveat is that rates are still much lower than they were several months ago, but the average lender is now back in line with mid August levels. Additionally, this is one of the largest single day jumps we’ve seen with the average 30yr fixed rate moving from 6.26% to 6.53%.

A move of more than 0.25% in a single day is tremendously uncommon, but it can happen due to the underlying structure of the mortgage bond market.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-10042024

The Fed has a dual mandate. Inflation and employment. Both are fuzzy concepts.

The Fed does not control interest rates. The Fed usually effectively influences interest rates. Usually. The exceptions are when their actions defy fundamentals. This is one of those times.

My first mortgage was 10%. We will survive.

Mine was 11.75% in 1990. A 10 year fixed to adjustable.

Mine was 9.99% for three months, and then neg-am adjustable.

But the home’s price was only $92,500!