In recent years, property tax rates have been on the rise across the U.S., driven by increasing home values and changing local government needs. The year 2024 has seen significant changes in property taxes, with states implementing various measures to either alleviate or increase the tax burden on homeowners.

Nationally, the average property tax bill for single-family homes has increased by 4.1 percent in 2023, driven largely by rising home values.

From 2019 to 2023, the median property tax bill for single-family homes in the U.S. increased by around 24 percent. This trend has particularly affected new homeowners, many of whom are surprised by higher-than-expected property tax bills.

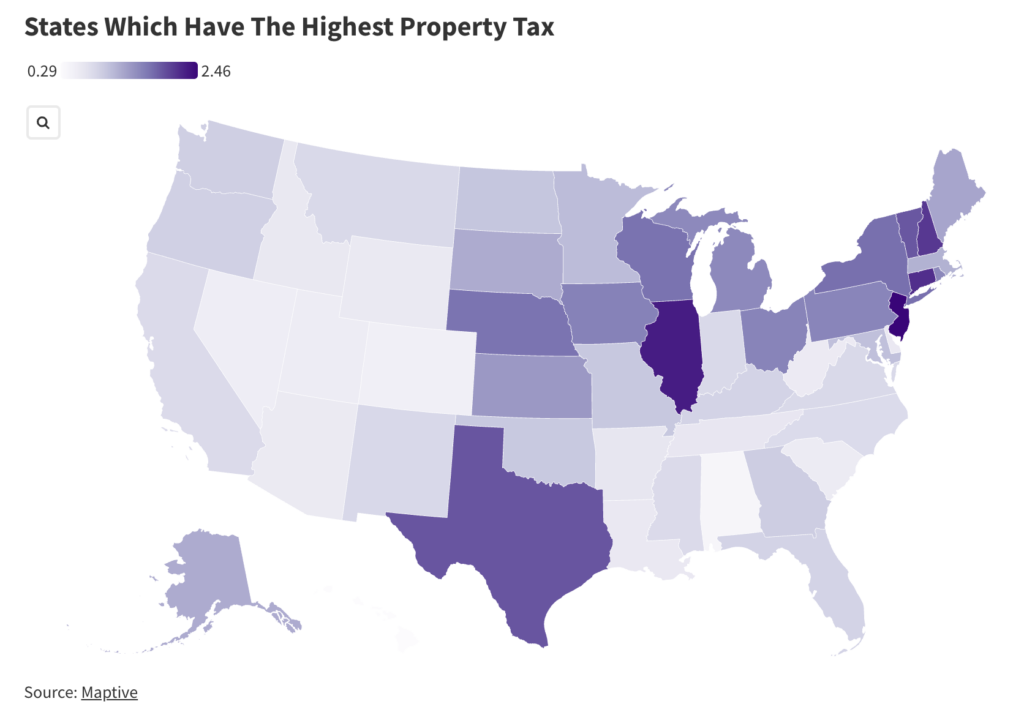

Here are the states with the lowest property-tax rates:

- Hawaii: Hawaii boasts the lowest property tax rate in the country at 0.29 percent. Homeowners here pay an average of $1,915 annually on a median-priced home.

- Alabama: With a property tax rate of 0.43 percent, Alabama residents pay approximately $742 in annual property taxes on a median-priced home.

- Colorado: Colorado has a property tax rate of 0.52 percent, resulting in an average annual tax of $2,125 on a median-priced home.

- Nevada: In Nevada, the effective property tax rate is 0.55 percent, with homeowners paying about $1,793 annually on a median-priced home.

- Utah: Utah rounds out the list with a property tax rate of 0.57 percent, leading to an average annual tax of $1,972 on a typical home.

https://www.newsweek.com/map-states-paying-highest-property-tax-1941692

It is important to contrast Illinois and New Hampshire. NH has very high property taxes but far lower (incl. none) other taxes. IL however is like California with usurious taxes on everything that moves or not.