Many years ago, we purchased a home in Carlsbad, using a realtor that was recommended to us - Jim Klinge. Fast forward to 2025, we recently had the privilege of selling 2 homes in Carlsbad, CA and didn't hesitate to reach out to Jim and Donna Klinge of Klinge Realty Group to guide us through the sales. The transactions were very different, each with its own unique situation, opportunities and challenges. From start to finish, Donna and Jim helped navigate the pre-sale preparation, the listing, showing of the house, buyer negotiations, the final close and all of the paperwork and decisions in between. What stands out with both transactions is the professionalism of Jim and Donna (and their team), wonderful communication (timely, relevant, concise), their deep understanding of market dynamics (setting realistic expectations), their access to top-notch contractors, and last, their ability to guide us across the finish line successfully. We wouldn't hesitate to use Jim and Donna in the future and highly recommend them for anyone looking to buy or sell a property in North San Diego County.

Nearly four months into the year, experts are predicting fewer benchmark rate cuts for 2024. Increasingly, discussion is turning instead to whether or not cuts are coming and even whether there could be another rate increase. But as we move through the spring selling season, more homeowners are interested in selling — sometimes because rates are staying higher for longer.

The share of homeowners intending to sell is trending up

Twenty-two percent of homeowners currently have their home listed for sale or are considering selling their home within the next three years, according to data collected by Zillow in March. Respondents said a large motivator was the decreasing affordability of their current home.

32% stated that they could no longer afford their home, compared to 17% in Q1 2023. 44% reported not wanting to be responsible for repairs and maintenance, compared to 37% last year. Almost six in 10 homeowners intending to sell are more optimistic about financial gains in a home sale this quarter than last. 49% think they’ll get more money now than in the future.

“Homeowners have amassed very advantageous equity in the last five years,” says Orphe Divounguy, Zillow Senior Economist. “That and rising financial wealth and incomes leave them a little less impacted by mortgage rates staying high for longer. The increase in new listings earlier this year was concentrated in relatively affordable regions and markets where many homeowners simply don’t have a mortgage.”

That means more homeowners may be in a position to downsize or more to a more affordable area. “What’s more,” Divounguy says,” homeowners holding mortgages above 5% have shown more readiness to move, as the sustained higher rates don’t necessarily represent a higher pain point.”

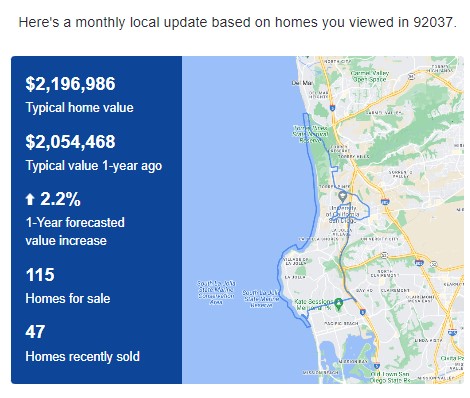

The number of ‘million-dollar cities’ in the U.S. hits a new high

There are currently 550 U.S. cities where the typical home value is $1 million or more, up from 491 a year ago, according to new Zillow data. This also affects mortgage rate lock-in. Homeowners are less likely to sell in more expensive markets — because they’re less likely to have paid off mortgage debt and less likely to find more affordable options nearby.

California boasts the most million-dollar cities, followed by New York and New Jersey. Florida, Texas, and Delaware are the only states that saw a drop in million-dollar cities over the past year.

“Many of these markets still suffer from under-building,” Divounguy says. “In Florida and Texas, new construction is up, and that significant increase in supply has helped to lower home values.”

Inflation has been on the rise since January

The April 10 CPI report showed that inflation rose slightly to 3.5% year over year in March, up from 3.2% in February. This was higher than most economists’ predictions and not what the Federal Reserve wants. It’s also not what buyers — or some sellers — want if they’re still waiting for rates to drop.

> “Many of these markets still suffer from under-building,” Divounguy says. “In Florida and Texas, new construction is up, and that significant increase in supply has helped to lower home values.”

I don’t think “lower” is the correct word. Keep price increases manageable?

I hate the under-building argument. “Hey, nice neighborhood. Let’s change it with a bunch more houses.”

[Formerly Rob_Dawg]

@Giving_Cat

You changed “teams,” huh? Why the name change Rob_Dawg? My cat will be thrilled; my dog not so much. I’ve appreciated your comments for 14+ years. A hat tip to you. I hope you’re well.