It’s a new year and many, including Zillow economists, are optimistic. After a year in which almost half of agents reported selling one home or less, optimism is a valuable tool. To that end, there are a few major macroeconomic tailwinds that might fuel the early months of 2024:

- The job market remains strong.

- Despite a couple of blips in January, inflation continues to trend toward the 2% target rate.

- The Fed has signaled that benchmark rates were likely at or near their peak while hinting at rate cuts.

Benchmark rate cuts can mean mortgage rate softening. Mortgage rate softening means more sellers loosen their grip on rate lock. Taken together, these trends drive a healthier housing market.

That’s the glass-half-full picture. Now let’s take a deeper look at a few trends.

More homeowners want to sell

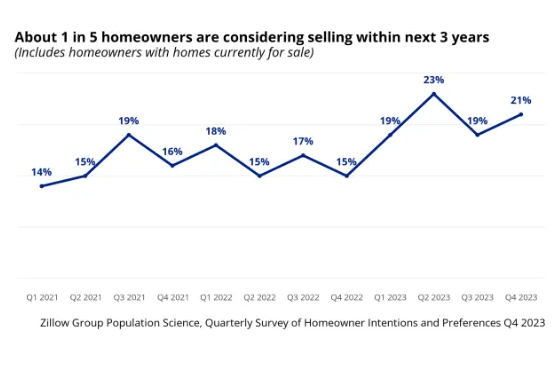

Twenty-one percent of homeowners are considering selling within the next three years, according to Zillow research from December. That’s up 15% year over year.

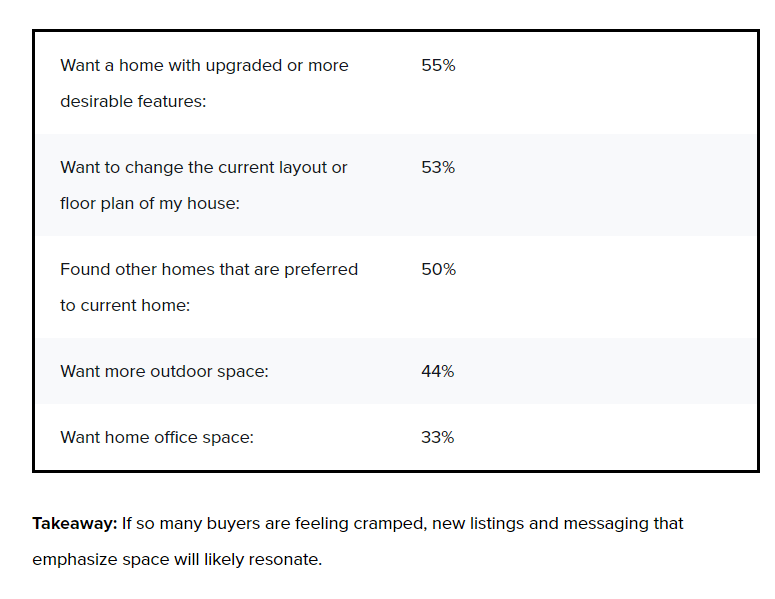

Here are some of the most common reasons why:

Tech jobs, long-distance movers are spreading out from traditional hubs

A Zillow analysis of United Van Lines data shows that long-distance movers are heading to metro areas that are less expensive and have less competition from other home buyers.

“Housing affordability is reshaping migration trends. Buyers are moving where homes are more affordable and where there’s less competition,” says Zillow Senior Economist Orphe Divounguy. “Affordability remains the biggest challenge for most homebuyers today. Helping them navigate it by pointing them to a loan officer first is key. It’s even more crucial if they’re new to the area.”

Out are states like New Jersey, New York, North Dakota, Illinois, Michigan, and California. Top destinations include Charlotte (Zillow’s hottest market prediction for 2023), Providence, Indianapolis, Orlando, and Raleigh.

Additionally, a recent Brookings report found that tech jobs are spreading out. Traditionally concentrated in hubs like San Francisco, Seattle, and New York, tech employment is branching out to new “rising star” metros. Since 2020, cities like Dallas, Austin, Denver, Miami, Nashville and Salt Lake City are pulling larger shares of tech work.

The study found that this phenomenon was already underway, but that the pandemic, remote work, and high mortgage rates likely accelerated it.

Takeaway: Cities and states gaining workers are almost all more affordable than the traditional tech hubs. Out-of-town leads in these rising star metros may have healthy incomes and be looking to view upper-tier buys.

While rent growth slows in many markets, concessions are up

Rent growth is slowing in many major metros and rents are even falling in a few. Nationally, rents are still up 3.3% from a year ago, but they dipped (0.2% from the previous month). Forty-five of the 50 largest metro areas have seen annual increases.

- Annual rent increases are highest in Cincinnati (7.1%), Providence (7.1%), Hartford (7.1%), Buffalo (6.3%), and Louisville (6.1%).

- Rents fell month over month in 32 of the 50 largest metro areas. The largest drops are in Jacksonville (-0.8%), San Diego (-0.7%), New York (-0.6%), Denver (-0.6%), and Austin (-0.6%).

Rental concessions, like free months of rent or free parking, have surged unexpectedly. In December, 32.7% of rentals on Zillow offered at least one concession. That’s up just 0.7 percentage points from November but 10.1 percentage points from last year. This rise is especially prevalent in cities like Oklahoma City and Memphis, which each saw a 4 percentage point increase from November to December.

Takeaway: Leads may be weighing another lease before a purchase. But equity starts when you buy. Those who plan to live in their new home for long enough can start building that equity now, and most experts agree that significant rate drops won’t happen anytime soon.

https://www.zillow.com/agent-resources/blog/january-market-report-tailwinds/

The link in the first paragraph goes to a harsh article dated January, 2024. This nugget in particular:

Nearly one-half (49%) of these agents had none or only one sale in the previous year while nearly three-quarters (70%) had five sales or fewer. Almost all of these agents hold another steadier job or are retired. For most agents, the residential real estate industry is truly a part-time business.

The section about tech workers moving to more reasonable housing cost areas is true.

However, it’s not because they want to. The Tech market has slowed dramatically, and offshoring jobs is common. Global workforce competition for jobs has allowed companies to lower the amount they pay.

I’ve seen $50 an hour contract work (ie no benefits) for Developers with 10+ years experience. In Santa Clara + Onsite! Obviously nobody is going to jump on this type of role willingly. But the fact that it exists shows that businesses think someone will.

More first time home buyers are needed. That’s going to take more than high employment and lower interest rates. Unfortunately I suspect “the government” is going to “help.”

A tax deal proposed by Washington, D.C., lawmakers could lead to the creation of more than 200,000 new homes for low-income families by boosting the low-income housing tax credit that incentivizes developers to build new affordable-housing units, part of the broader Tax Relief for American Families and Workers Act of 2024, introduced by Sen. Ron Wyden, an Oregon Democrat and the Senate Finance Committee chairman, and Rep. Jason Smith, a Missouri Republican and the House Ways and Means Committee chairman.