During the frenzy, pricing didn’t matter much – buyers were overbidding everything. Now that the environment has settled down just a bit, the list price chosen by sellers makes a difference.

Here are some of my notes on pricing.

Make the pricing easy to digest. The value-range pricing is the worst when it comes to confusing the buyers on how much to offer, but it’s not the only bad idea. A list price that is just above a major number (like $2,025,000) doesn’t give the buyers much room to offer less. It’s fine if you want to telegraph to people that you want $2 million, but make it easy for them to get there.

Lately I’ve had great luck with the 50s. In this example, a list price of $2,050,000 would make it easy for a buyer to offer $2,000,000 and think they are at least getting a $50,000 break.

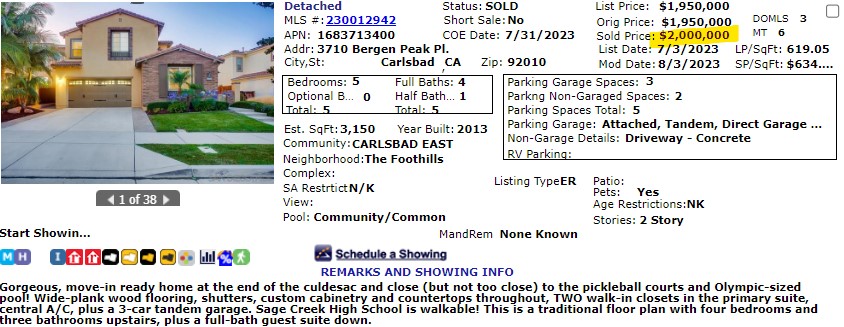

Read the room. We initially discussed a list price of $1,850,000 for our listing on Bergen Glen. I was coming off a streak of bidding wars that produed overbids of $100,000 and $150,000….but those were in south Carlsbad and Encinitas. Was the NE Carlsbad market that hot?

It was already July by the time we hit the open market, and it felt like the cooldown was underway. A smaller home had just closed escrow on the same street for $1,617,000 on June 1st, and I wasn’t confident we’d have a wild bidding war that would push up the price by hundreds of thousands. It might only go up a little, or maybe not at all.

Which price would be the best strategy to wind up at $2,000,000?

We decided to increase the list price to $1,950,000 and hoped we’d get just enough action to boost the final price to $2,000,000. We got two offers, and one was willing to rise up to the $2 million for a quick close and occupancy before school started.

You may have seen the the comment section yesterday that my Bergen Peak seller took his extra winnings on a long trip to Europe!

Productive counter-offering. Not every house gets multiple offers and a bidding war. More buyers are offering LESS than the list price! How the listing agent handles the counter-offers usually makes or breaks the deal. I have two rules of thumb for sellers:

- The final price usually ends up around the midpoint of the initial offer price and the seller’s first counter.

- Come down in price substantially in the first round, then not so much in the second round.

The lower the buyer offers, the more the seller should come down in the first round. A buyer who is in love with the home is unlikely to offer way under price, so I’m not talking about those folks

It is trying to make a deal with the less-motivated buyers who offer less – we know they aren’t that crazy about the place, and you better tempt them with an attracive price to see if that will get them to buy.

By coming down by a decent chunk in the first round, it gives the less-motivated buyer some hope that the seller might give it away. If they are just bluffing and really are motivated, they will probably just sign it, but if they are less-motivated, they will likely counter-offer higher than they would have.

You can beat a counter-offer session into the ground, and kill a deal by wearing out the other party. When the buyer motivations are suspect, you want to get this over with and sellers should consider signing the buyer’s first counter-offer. But if the gap is still too large, the next seller counter-offer price of a smaller increment (say 2% instead of the 4% in the first round) would send a message to the buyer that it’s time to sign the seller counter and buy the house – and if they counter again, the deal is probably going to die.

You want to find a way to create a win-win. Agents who insist on burying the other side will find that buyers aren’t taking it any more, and a crafty handling of the process makes the difference.

0 Comments