Although the housing market is often spoken of in aggregate, variations and pricing and market performance can be very localized. For example, according to data from Zillow, the anticipated one-year growth rate for homes prices in the U.S. as a whole is 1.7%, with a median price of $395,220 expected to be reached in 2033. But in fast-growing markets like Columbia, Missouri, that anticipated rate is 6.4% — more than three times the national average.

To determine which are the most attractive cities in which to buy real estate over the coming decade, GOBankingRates looked at homes that are currently priced below the national median of $333,910 with anticipated growth rates in excess of the projected 1.7% national rate. We issued a caveat that of course home prices don’t move in a strictly linear fashion; however, the anticipated one-year growth rate was used primarily to identify housing markets that are moving in the right direction:

https://finance.yahoo.com/news/less-decade-ll-wish-bought-151225967.html

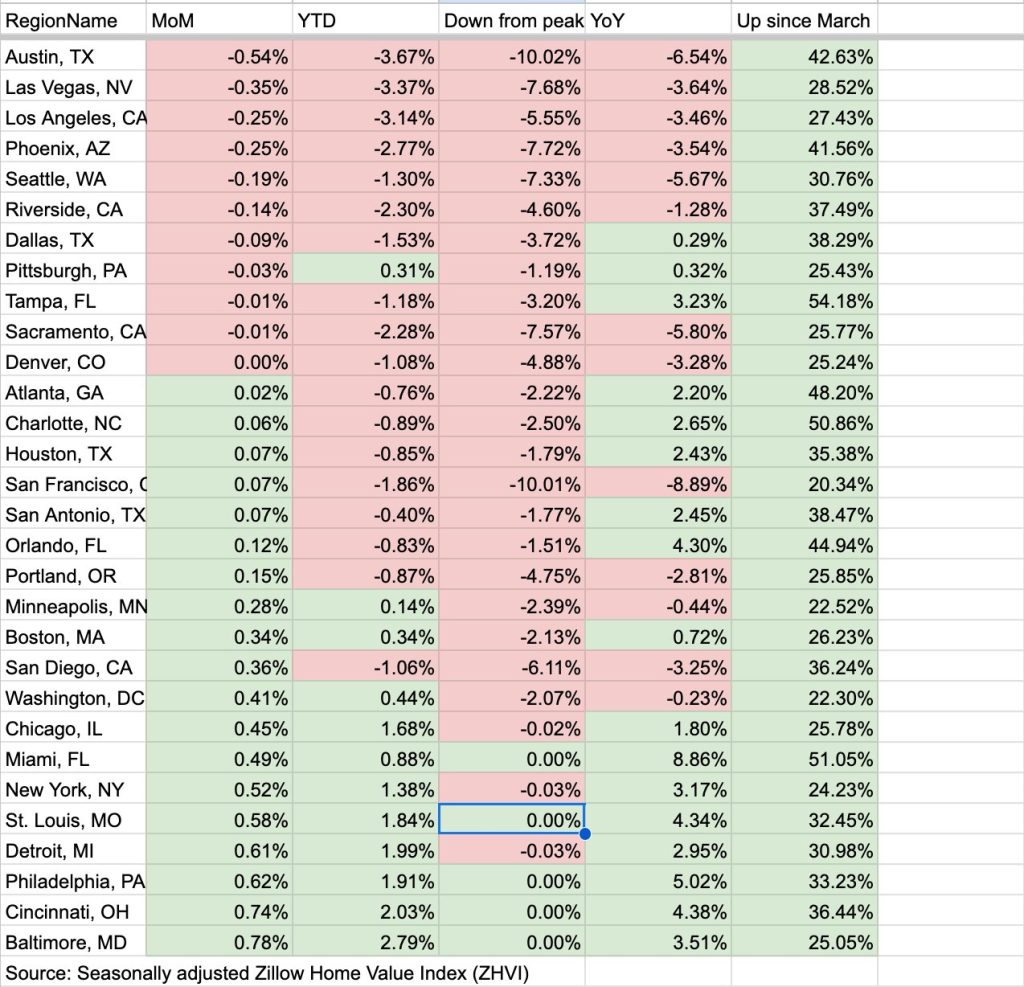

Plus, here’s the HVZI seasonally-adjusted action in metro areas over the last year:

0 Comments