This is how close we are to a market resurgence. If sellers would pay down 4% to 6% of the loan amount to lower the buyer’s mortgage rate by another 1% to 1.5% and get it into the 4s, we’d be looking good for springtime.

From JB:

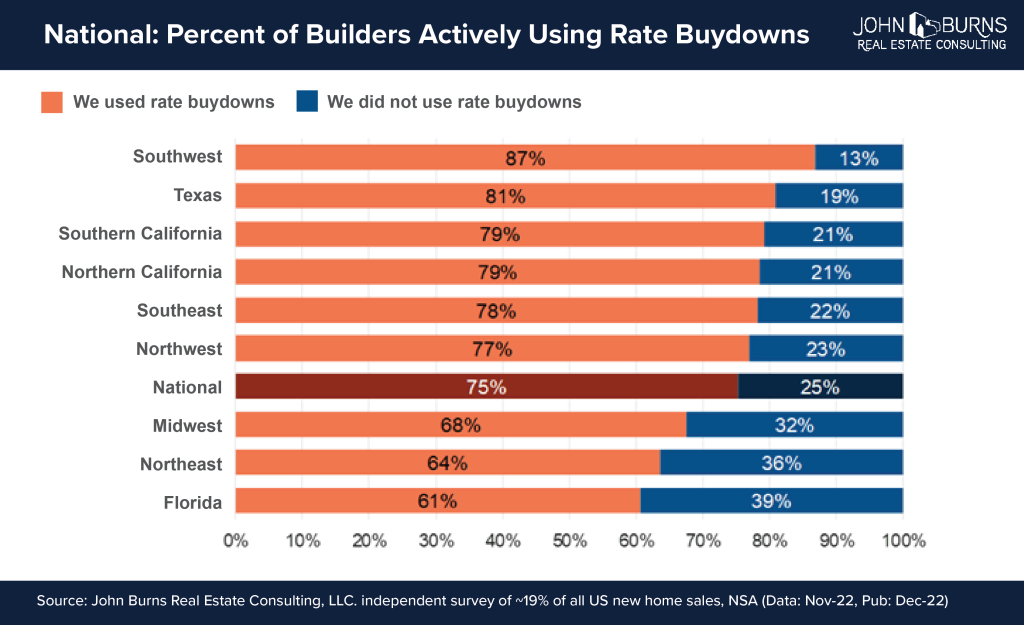

In early December, 75% of nationally surveyed home builders confirmed they are buying down buyers’ mortgage rates to make payments more affordable.

Our survey indicates 32% of builders are buying down the full 30-year term and another 30% of builders are temporarily reducing the rate for the first two years of the mortgage. The remaining 13% of builders identified other less common buydowns. Builders pay these costs up front, effectively reducing monthly payments by prepaying for some of the buyers’ interest on the loan. Few resale sellers are offering these savings to prospective buyers.

Two popular strategies involve builders lowering the mortgage rate for the buyer:

30-year rate buydown: Builders are contributing 5%–6% of the home purchase price up front to lower the 30-year mortgage rate by 1%–2% typically. For example, builders may reduce the rate from 6.5% to 5.0% using last week’s Freddie Mac mortgage rate.

2-1 temporary rate buydown: Builders are contributing 2% of the home purchase price up front, which lowers the first-year mortgage rate by 2%, and the second-year mortgage rate by 1%. Using last week’s 6.5% rate, a buyer’s rate would be 4.5% in year one, 5.5% in year two, and 6.5% thereafter. Borrowers still have to qualify at the 6.5% rate to benefit from a reduced payment in the first few years, giving them some breathing room to perhaps spend money on furniture or other needed items.

Because buyers have to qualify at the highest rate that will occur during the 30-year term, builders using the 2-1 temporary buydown tell us some buyers still cannot qualify. By shifting to a 30-year rate buydown, builders can lower the rate and monthly payment used to qualify struggling buyers.

Read the full article with more calculations here:

https://www.realestateconsulting.com/the-light-rate-buydowns-help-buyers-purchase-new-homes/

Arent builders just upping the overall price 2-3% then using the extra cost to buy down the buyers mortgage? Meaning builder margin stays the same they’re just using some of the “profits” to make the buyers monthly less cost.

Kind of nice but this trick would only work so much. The fact that 75% of builders are doing this implies that house prices are too high.

Yes, but it is a great gimmick for payment shoppers – they get what they want. A new house with an acceptable payment!

On the resale homes, I’ll suggest that doing effective home improvements would be a better choice for sellers. But because many don’t want the hassle, the buydown is a good alternative.

P.S. Improvements aren’t a hassle for the homeowner when they list with us – we do it all.