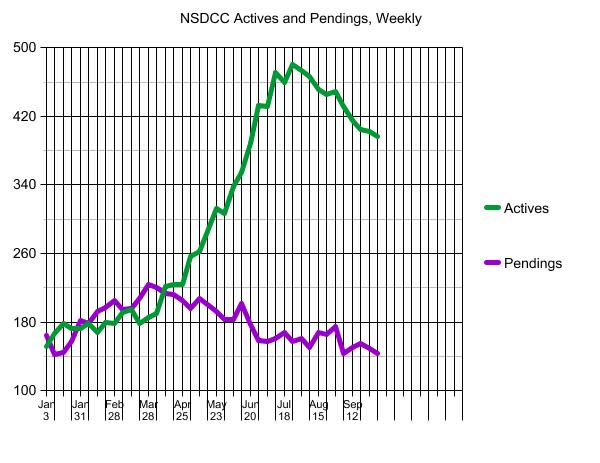

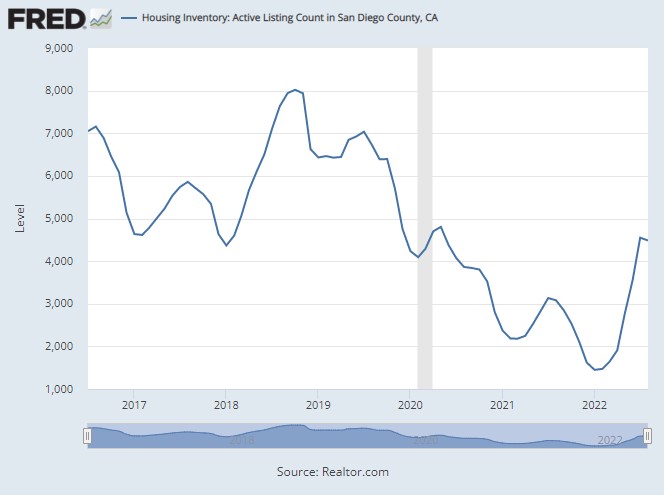

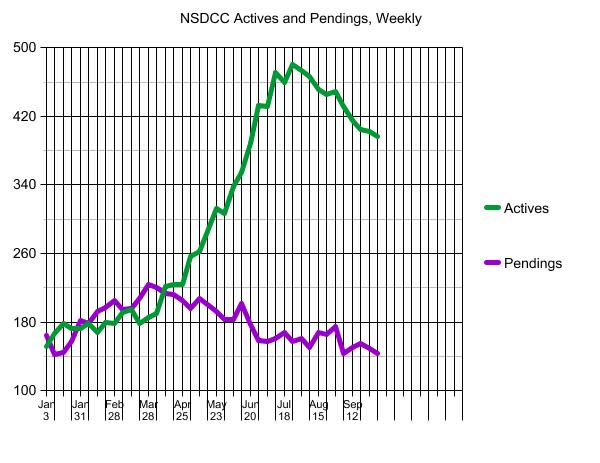

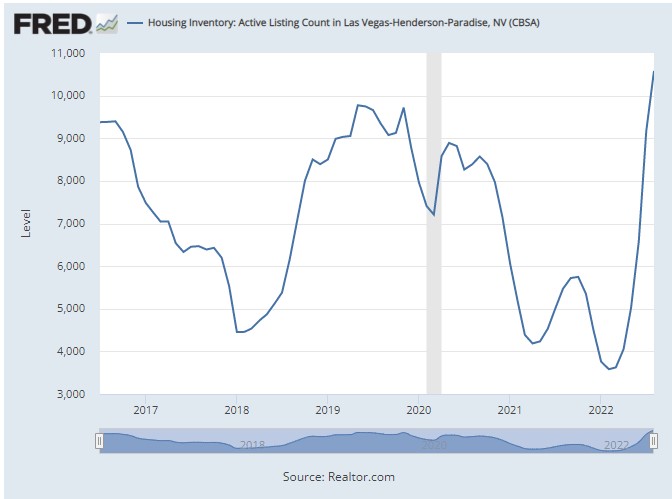

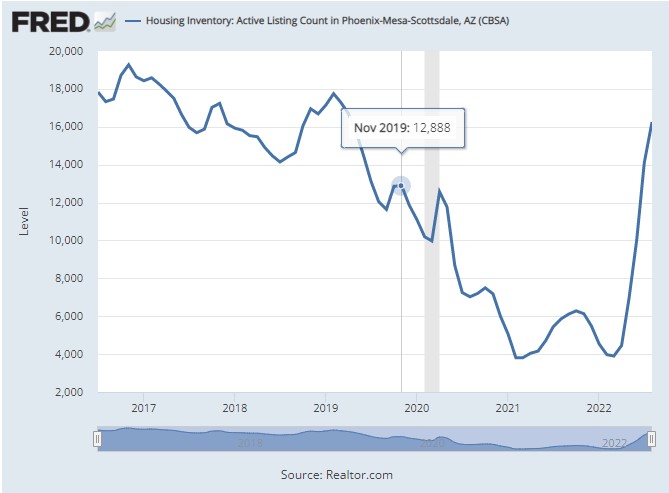

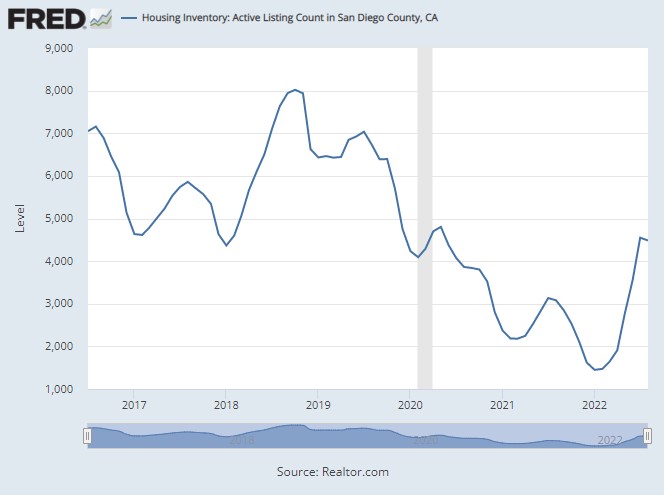

Hat tip to Mark for pointing out how much different our local inventory has performed, compared to other markets around the country. When you hear the doom and gloom from the national talking heads, this is what they are talking about:

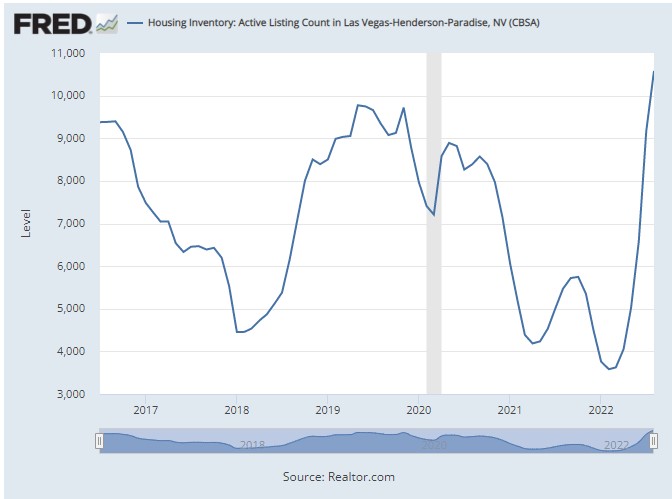

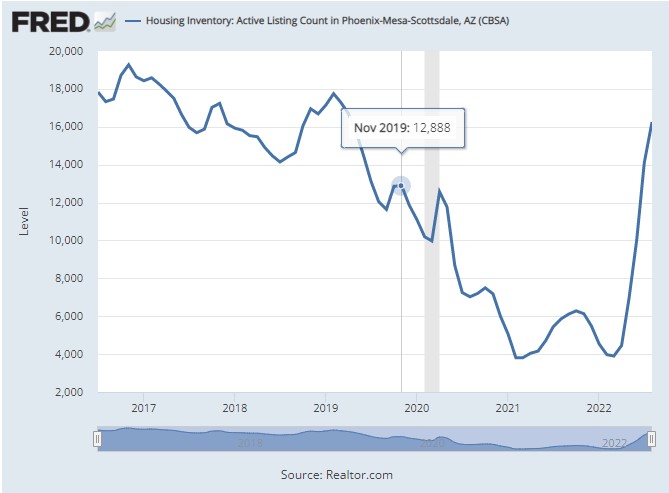

Our inventory topped out in July, and has been declining since – where many other markets are exploding. In September, Las Vegas and Phoenix will probably set all-time highs for their number of homes for sale, where we are around half of our peak inventory numbers.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The $0 – $1,500,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

9 |

$832/sf |

35 |

36 |

| Jan 10 |

9 |

$766/sf |

28 |

29 |

| Jan 17 |

13 |

$773/sf |

26 |

27 |

| Jan 24 |

9 |

$818/sf |

15 |

29 |

| Jan 31 |

14 |

$752/sf |

14 |

31 |

| Feb 7 |

13 |

$774/sf |

12 |

32 |

| Feb 14 |

11 |

$826/sf |

12 |

35 |

| Feb 21 |

7 |

$889/sf |

17 |

38 |

| Feb 28 |

12 |

$888/sf |

17 |

33 |

| Mar 7 |

9 |

$1,017/sf |

21 |

33 |

| Mar 14 |

14 |

$847/sf |

18 |

31 |

| Mar 21 |

8 |

$912/sf |

26 |

36 |

| Mar 28 |

10 |

$914/sf |

25 |

28 |

| Apr 4 |

10 |

$782/sf |

33 |

34 |

| Apr 11 |

19 |

$733/sf |

21 |

36 |

| Apr 18 |

16 |

$795/sf |

28 |

34 |

| Apr 25 |

18 |

$891/sf |

27 |

30 |

| May 2 |

22 |

$822/sf |

23 |

31 |

| May 9 |

24 |

$887/sf |

17 |

46 |

| May 16 |

25 |

$783/sf |

22 |

25 |

| May 23 |

29 |

$782/sf |

23 |

29 |

| May 30 |

30 |

$782/sf |

24 |

28 |

| Jun 6 |

34 |

$763/sf |

25 |

28 |

| Jun 13 |

33 |

$802/sf |

29 |

29 |

| Jun 20 |

48 |

$774/sf |

28 |

22 |

| Jun 27 |

43 |

$755/sf |

32 |

22 |

| Jul 4 |

49 |

$757/sf |

33 |

23 |

| Jul 11 |

56 |

$757/sf |

35 |

22 |

| Jul 18 |

51 |

$741/sf |

38 |

24 |

| Jul 25 |

53 |

$755/sf |

38 |

22 |

| Aug 1 |

46 |

$736/sf |

36 |

29 |

| Aug 8 |

43 |

$746/sf |

41 |

32 |

| Aug 15 |

37 |

$775/sf |

37 |

34 |

| Aug 22 |

36 |

$766/sf |

41 |

33 |

| Aug 29 |

34 |

$750/sf |

40 |

39 |

| Sep 5 |

28 |

$717/sf |

50 |

31 |

| Sep 12 |

31 |

$736/sf |

52 |

29 |

| Sep 19 |

32 |

$753/sf |

36 |

27 |

| Sep 26 |

31 |

$726/sf |

39 |

28 |

| Oct 3 |

34 |

$733/sf |

34 |

22 |

The $1,500,000 – $2,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

8 |

$842/sf |

52 |

36 |

| Jan 10 |

13 |

$751/sf |

28 |

29 |

| Jan 17 |

16 |

$736/sf |

33 |

27 |

| Jan 24 |

16 |

$801/sf |

17 |

27 |

| Jan 31 |

15 |

$696/sf |

14 |

34 |

| Feb 7 |

15 |

$765/sf |

17 |

34 |

| Feb 14 |

10 |

$726/sf |

19 |

38 |

| Feb 21 |

19 |

$715/sf |

15 |

39 |

| Feb 28 |

9 |

$660/sf |

12 |

46 |

| Mar 7 |

16 |

$789/sf |

15 |

46 |

| Mar 14 |

17 |

$837/sf |

8 |

44 |

| Mar 21 |

18 |

$867/sf |

11 |

43 |

| Mar 28 |

14 |

$838/sf |

15 |

48 |

| Apr 4 |

18 |

$762/sf |

25 |

42 |

| Apr 11 |

23 |

$774/sf |

15 |

39 |

| Apr 18 |

22 |

$792/sf |

17 |

41 |

| Apr 25 |

18 |

$810/sf |

20 |

41 |

| May 2 |

27 |

$809/sf |

17 |

37 |

| May 9 |

33 |

$837/sf |

17 |

46 |

| May 16 |

39 |

$793/sf |

19 |

44 |

| May 23 |

43 |

$793/sf |

22 |

44 |

| May 30 |

36 |

$843/sf |

23 |

36 |

| Jun 6 |

43 |

$817/sf |

23 |

41 |

| Jun 13 |

49 |

$845/sf |

24 |

42 |

| Jun 20 |

57 |

$817/sf |

24 |

41 |

| Jun 27 |

75 |

$807/sf |

24 |

35 |

| Jul 4 |

70 |

$827/sf |

27 |

33 |

| Jul 11 |

71 |

$812/sf |

30 |

38 |

| Jul 18 |

74 |

$793/sf |

32 |

35 |

| Jul 25 |

83 |

$787/sf |

34 |

29 |

| Aug 1 |

81 |

$780/sf |

35 |

31 |

| Aug 8 |

76 |

$796/sf |

40 |

30 |

| Aug 15 |

80 |

$789/sf |

42 |

38 |

| Aug 22 |

78 |

$801/sf |

46 |

38 |

| Aug 29 |

81 |

$811/sf |

51 |

40 |

| Sep 5 |

82 |

$795/sf |

50 |

31 |

| Sep 12 |

78 |

$796/sf |

53 |

29 |

| Sep 19 |

73 |

$818/sf |

47 |

34 |

| Sep 26 |

75 |

$795/sf |

45 |

33 |

| Oct 3 |

75 |

$826/sf |

42 |

31 |

The $2,000,000 – $3,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

18 |

$1,080/sf |

127 |

43 |

| Jan 10 |

23 |

$1,038/sf |

85 |

37 |

| Jan 17 |

26 |

$1,044/sf |

80 |

41 |

| Jan 24 |

28 |

$1,015/sf |

37 |

42 |

| Jan 31 |

22 |

$949/sf |

38 |

47 |

| Feb 7 |

26 |

$919/sf |

29 |

42 |

| Feb 14 |

22 |

$997/sf |

37 |

49 |

| Feb 21 |

21 |

$966/sf |

33 |

54 |

| Feb 28 |

26 |

$905/sf |

32 |

57 |

| Mar 7 |

29 |

$922/sf |

28 |

57 |

| Mar 14 |

20 |

$852/sf |

26 |

58 |

| Mar 21 |

17 |

$928/sf |

26 |

60 |

| Mar 28 |

34 |

$927/sf |

12 |

65 |

| Apr 4 |

32 |

$927/sf |

20 |

69 |

| Apr 11 |

44 |

$910/sf |

17 |

62 |

| Apr 18 |

48 |

$997/sf |

19 |

66 |

| Apr 25 |

42 |

$1,092/sf |

18 |

73 |

| May 2 |

54 |

$995/sf |

19 |

70 |

| May 9 |

61 |

$910/sf |

20 |

73 |

| May 16 |

64 |

$977/sf |

22 |

69 |

| May 23 |

82 |

$953/sf |

25 |

59 |

| May 30 |

78 |

$951/sf |

27 |

56 |

| Jun 6 |

94 |

$963/sf |

27 |

58 |

| Jun 13 |

98 |

$961/sf |

28 |

70 |

| Jun 20 |

91 |

$935/sf |

32 |

59 |

| Jun 27 |

111 |

$894/sf |

30 |

60 |

| Jul 4 |

112 |

$910/sf |

33 |

60 |

| Jul 11 |

122 |

$912/sf |

34 |

56 |

| Jul 18 |

103 |

$893/sf |

39 |

68 |

| Jul 25 |

108 |

$883/sf |

40 |

63 |

| Aug 1 |

110 |

$887/sf |

41 |

58 |

| Aug 8 |

124 |

$941/sf |

39 |

50 |

| Aug 15 |

114 |

$945/sf |

45 |

51 |

| Aug 22 |

123 |

$948/sf |

42 |

46 |

| Aug 29 |

125 |

$938/sf |

46 |

45 |

| Sep 5 |

116 |

$948/sf |

48 |

38 |

| Sep 12 |

110 |

$908/sf |

49 |

43 |

| Sep 19 |

108 |

$928/sf |

50 |

46 |

| Sep 26 |

106 |

$926/sf |

51 |

45 |

| Oct 3 |

103 |

$941/sf |

50 |

46 |

The $3,000,000 – $4,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

19 |

$1,230/sf |

90 |

26 |

| Jan 10 |

22 |

$1,210/sf |

76 |

25 |

| Jan 17 |

19 |

$1,207/sf |

86 |

23 |

| Jan 24 |

17 |

$1,129/sf |

92 |

24 |

| Jan 31 |

21 |

$1,172/sf |

70 |

22 |

| Feb 7 |

19 |

$1,169/sf |

67 |

25 |

| Feb 14 |

19 |

$1,234/sf |

65 |

28 |

| Feb 21 |

21 |

$1,279/sf |

69 |

28 |

| Feb 28 |

22 |

$1,214/sf |

64 |

25 |

| Mar 7 |

27 |

$1,295/sf |

60 |

24 |

| Mar 14 |

27 |

$1,201/sf |

65 |

27 |

| Mar 21 |

23 |

$1,282/sf |

69 |

31 |

| Mar 28 |

25 |

$1,253/sf |

67 |

30 |

| Apr 4 |

30 |

$1,199/sf |

61 |

27 |

| Apr 11 |

32 |

$1,174/sf |

62 |

31 |

| Apr 18 |

33 |

$1,216/sf |

68 |

31 |

| Apr 25 |

33 |

$1,219/sf |

63 |

33 |

| May 2 |

37 |

$1,164/sf |

50 |

36 |

| May 9 |

33 |

$1,132/sf |

57 |

32 |

| May 16 |

40 |

$1,119/sf |

53 |

32 |

| May 23 |

40 |

$1,135/sf |

57 |

27 |

| May 30 |

40 |

$1,178/sf |

61 |

28 |

| Jun 6 |

43 |

$1,224/sf |

56 |

28 |

| Jun 13 |

48 |

$1,184/sf |

52 |

28 |

| Jun 20 |

52 |

$1,117/sf |

53 |

26 |

| Jun 27 |

60 |

$1,120/sf |

51 |

19 |

| Jul 4 |

55 |

$1,127/sf |

58 |

23 |

| Jul 11 |

68 |

$1,140/sf |

47 |

26 |

| Jul 18 |

66 |

$1,206/sf |

52 |

25 |

| Jul 25 |

65 |

$1,200/sf |

54 |

26 |

| Aug 1 |

59 |

$1,191/sf |

60 |

26 |

| Aug 8 |

58 |

$1,209/sf |

63 |

22 |

| Aug 15 |

59 |

$1,166/sf |

62 |

21 |

| Aug 22 |

57 |

$1,163/sf |

60 |

28 |

| Aug 29 |

53 |

$1,168/sf |

64 |

31 |

| Sep 5 |

48 |

$1,157/sf |

67 |

25 |

| Sep 12 |

50 |

$1,215/sf |

67 |

27 |

| Sep 19 |

46 |

$1,196/sf |

74 |

26 |

| Sep 26 |

42 |

$1,200/sf |

82 |

20 |

| Oct 3 |

42 |

$1,216/sf |

78 |

20 |

The $4,000,000+ Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

100 |

$1,884/sf |

128 |

30 |

| Jan 10 |

105 |

$1,864/sf |

113 |

29 |

| Jan 17 |

109 |

$1,763/sf |

110 |

34 |

| Jan 24 |

105 |

$2,130/sf |

114 |

42 |

| Jan 31 |

102 |

$2,114/sf |

118 |

53 |

| Feb 7 |

109 |

$2,000/sf |

108 |

50 |

| Feb 14 |

108 |

$2,005/sf |

109 |

47 |

| Feb 21 |

113 |

$2,008/sf |

103 |

43 |

| Feb 28 |

111 |

$1,991/sf |

101 |

47 |

| Mar 7 |

115 |

$1,904/sf |

91 |

39 |

| Mar 14 |

121 |

$1,893/sf |

95 |

43 |

| Mar 21 |

116 |

$1,905/sf |

97 |

44 |

| Mar 28 |

104 |

$1,966/sf |

97 |

59 |

| Apr 4 |

103 |

$1,929/sf |

97 |

56 |

| Apr 11 |

106 |

$1,906/sf |

97 |

55 |

| Apr 18 |

108 |

$1,874/sf |

100 |

51 |

| Apr 25 |

116 |

$1,829/sf |

97 |

38 |

| May 2 |

117 |

$1,781/sf |

95 |

32 |

| May 9 |

116 |

$1,831/sf |

96 |

36 |

| May 16 |

124 |

$1,854/sf |

91 |

39 |

| May 23 |

125 |

$1,855/sf |

92 |

36 |

| May 30 |

129 |

$1,706/sf |

93 |

39 |

| Jun 6 |

131 |

$1,740/sf |

89 |

33 |

| Jun 13 |

132 |

$1,793/sf |

86 |

38 |

| Jun 20 |

148 |

$1,772/sf |

84 |

35 |

| Jun 27 |

153 |

$1,779/sf |

87 |

29 |

| Jul 4 |

155 |

$1,777/sf |

82 |

25 |

| Jul 11 |

164 |

$1,759/sf |

85 |

26 |

| Jul 18 |

170 |

$1,740/sf |

86 |

26 |

| Jul 25 |

178 |

$1,701/sf |

84 |

27 |

| Aug 1 |

180 |

$1,696/sf |

85 |

28 |

| Aug 8 |

173 |

$1,715/sf |

91 |

24 |

| Aug 15 |

168 |

$1,746/sf |

89 |

32 |

| Aug 22 |

160 |

$1,718/sf |

92 |

29 |

| Aug 29 |

165 |

$1,732/sf |

93 |

28 |

| Sep 5 |

162 |

$1,745/sf |

95 |

26 |

| Sep 12 |

152 |

$1,715/sf |

96 |

29 |

| Sep 19 |

155 |

$1,727/sf |

97 |

28 |

| Sep 26 |

157 |

$1,728/sf |

97 |

27 |

| Oct 3 |

150 |

$1,701/sf |

96 |

27 |

NSDCC Weekly New Listings and New Pendings

| Week |

New Listings |

New Pendings |

Total Actives |

Total Pendings |

| Jan 3, 2022 |

17 |

14 |

152 |

164 |

| Jan 10 |

39 |

18 |

167 |

142 |

| Jan 17 |

34 |

29 |

179 |

145 |

| Jan 24 |

41 |

40 |

173 |

157 |

| Jan 31 |

43 |

40 |

173 |

182 |

| Feb 7 |

43 |

38 |

179 |

179 |

| Feb 14 |

44 |

49 |

168 |

193 |

| Feb 21 |

51 |

38 |

180 |

197 |

| Feb 28 |

39 |

39 |

179 |

205 |

| Mar 7 |

54 |

37 |

191 |

195 |

| Mar 14 |

48 |

51 |

195 |

196 |

| Mar 21 |

39 |

46 |

178 |

207 |

| Mar 28 |

53 |

50 |

185 |

224 |

| Apr 4 |

46 |

40 |

190 |

220 |

| Apr 11 |

61 |

39 |

221 |

213 |

| Apr 18 |

41 |

46 |

224 |

212 |

| Apr 25 |

50 |

43 |

224 |

205 |

| May 2 |

76 |

37 |

256 |

196 |

| May 9 |

59 |

46 |

262 |

207 |

| May 16 |

78 |

48 |

286 |

200 |

| May 23 |

61 |

42 |

312 |

192 |

| May 30 |

54 |

44 |

307 |

183 |

| Jun 6 |

70 |

31 |

338 |

183 |

| Jun 13 |

60 |

41 |

354 |

202 |

| Jun 20 |

71 |

25 |

388 |

177 |

| Jun 27 |

73 |

26 |

433 |

159 |

| Jul 4 |

55 |

39 |

432 |

158 |

| Jul 11 |

55 |

24 |

471 |

161 |

| Jul 18 |

49 |

35 |

459 |

168 |

| Jul 25 |

60 |

20 |

480 |

158 |

| Aug 1 |

55 |

35 |

473 |

161 |

| Aug 8 |

40 |

32 |

466 |

151 |

| Aug 15 |

51 |

32 |

451 |

168 |

| Aug 22 |

43 |

29 |

445 |

166 |

| Aug 29 |

43 |

27 |

449 |

175 |

| Sep 5 |

31 |

22 |

432 |

144 |

| Sep 12 |

38 |

22 |

415 |

151 |

| Sep 19 |

45 |

26 |

405 |

155 |

| Sep 26 |

45 |

27 |

402 |

149 |

| Oct 3 |

46 |

19 |

396 |

143 |

Let’s also note the differences in the August median sales prices:

Las Vegas: $400,000

Phoenix: $430,000

Austin: $577,500

Denver: $550,000

San Diego: $850,000

Logically, the higher-priced market should be having more trouble? Not here.

The ten U.S. metros with the highest rates of homebuyers backing out (San Diego not mentioned):

Jacksonville, FL (26.1%)

Las Vegas (23%)

Atlanta (22.6%)

Orlando, FL (21.9%)

Fort Lauderdale, FL (21.7%)

Phoenix (21.6%)

Tampa, FL (21.5%)

Fort Worth, TX (21.5%)

San Antonio, TX (21.1%)

Houston, TX (20.6%)

I’ve always thought 23% cancellation rate was industry average. So maybe it lowered during covid and is now back to normal?

You would know better than me, but yes during covid is was close to zero!

“Logically, the higher-priced market should be having more trouble? Not here.”

No, not necessarily. I’d say the most overpriced, or most unaffordable, maybe. But affordability and overpriced are really hard to measure. It’s also very very early in this down cycle. In the last crash, SD took it hard, so who knows?