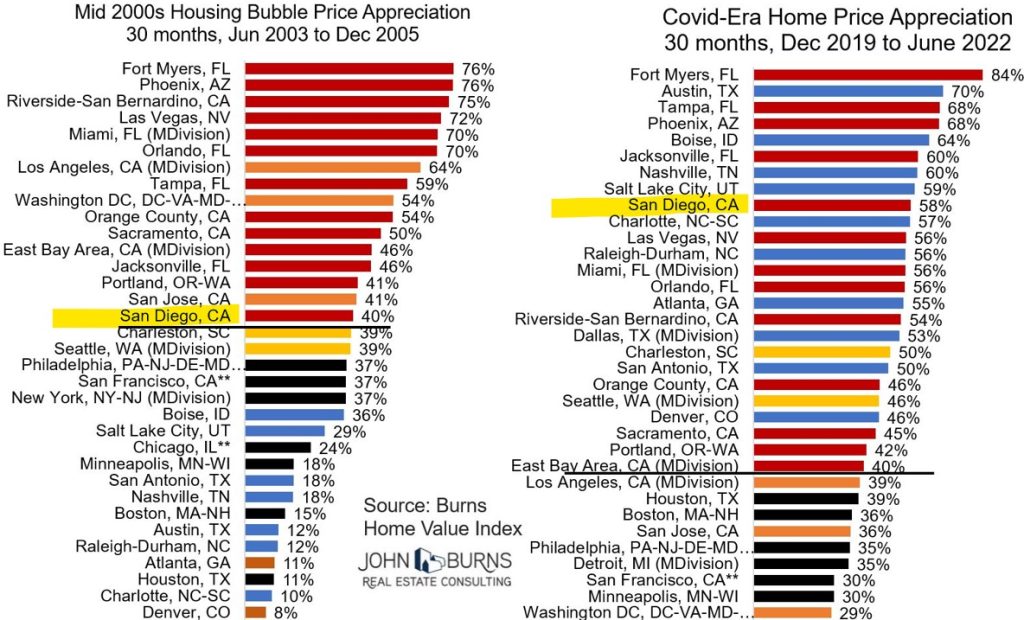

Thanks to JBREC for the chart, and article!

https://www.realestateconsulting.com/speedy-escape-from-housing-market-slump-unlikely/

An excerpt:

In the mid-1990s when 30-year fixed mortgage rates climbed over 9%, ARM usage jumped to 35% of all mortgages. In 1999-2000 as 30-year fixed mortgage rates shot above 8%, ARM usage raged once again to 34% of all mortgages. For comparison, the percentage of homebuyers using ARMs today is just 9%, even as housing affordability resides near its all-time worst and 30-year fixed-rate mortgages have more than doubled in the span of 19 months. As noted by the CEO of KB Home during its Q3-2022 earnings call September 21st: “We have some great and compelling interest rates on adjustable mortgages, where it’s a 10-year fixed. And if I were a buyer, I would take that in a minute. Those [rates] are couple of hundred basis points lower than the 30-year fixed, and nobody is taking it so far.”

Back in the day, ARM usage around here was probably more like 2/3s of the loans, instead of 1/3 of mortgages nationally. Rarely did anyone think they were buying their ‘forever’ home, and moving again within 2-5 years was the plan. I used to just go back to my past clients every two years!

It when I coined my all-time favorite slogan, “Don’t unpack, I’ll be back!”

I predict that over the next 3-6 months, the mortgage industry will be heavily advertising alternative loans like the short-term (5-year and 7-year) fixed rate, or the 2/1 buydowns. These were the products that kept the party going after the new 2-out-of-5-year law was passed in 1997, and serial movers could cash out tax-free every couple of years and buy a better home.

It was later, around 2004-2005, that Countrywide developed their toxic version of the neg-am loan, and then was offering 100% financing to anyone with a 700 credit score that the bubble started popping.

I think we are all convinced that the Fed is going to deliberately cause a recession in the next 1-2 years, and will have to lower rates again – and continue their biggest boondoggle in history. Anyone who buys with an adjustable-rate mortgage can refinance to a lower 30-year fixed rate then.

Wouldn’t it be great if the mortgage industry brought back the convertible loan where you could change your ARM into a fixed rate without having to refinance!

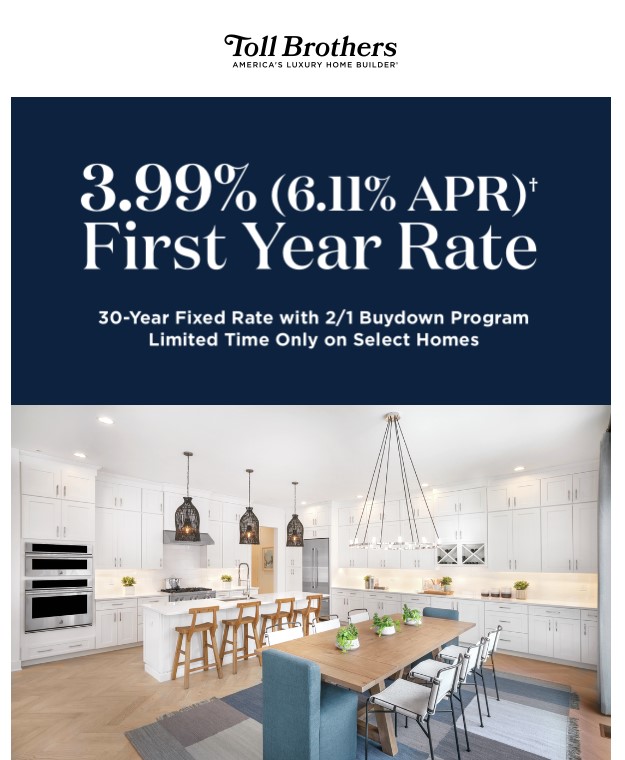

The key to igniting the demand will be a 3-handle, and it’s already in some ads:

Some listing agents are offering a seller credit to buy down the mortgage rate, but it’s vague and uncertain. Will it be enough to make a real difference? Do I have to go through your lender to get it?

I think the mortgage industry needs to advertise the specific rates and terms to gain acceptance in the marketplace. Buyers have only been thinking about getting a 30-year fixed, and will be slow to consider an ARM. But it might be the best hope of a softer landing.

Yes, buyers have to qualify at the fully-indexed rate, not the start rate like back in the old days. But I hope all buyers today are being conservative, and buying well within their means. If so, qualifying at the fully-indexed rate shouldn’t be a problem.

It will limit how much of a solution it ends up being, however.

The credit unions could get in on this. Mission Fed was offering 3.875% for ten years up to a couple of months ago. Bring that back!

The bubble apparently has to go on, into perpetuity. Prices cannot be allowed to fall for the poor schmuck trying to get a roof over his / her head.

Indeed. If there was a big price correction, you know all the rich people would jump in front of the line to gobble up all the deals, and leave the regular folks with the rest.