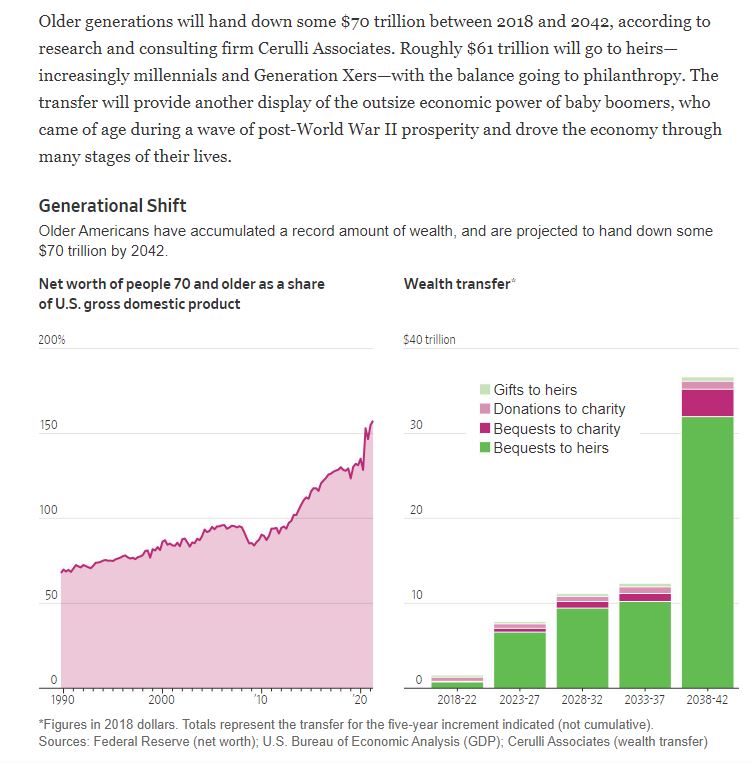

Are you wondering if our local housing market could maintain current pricing – or even go higher? It’s possible, and if it happens, a major reason will be baby boomers pitching in to help their kids buy a home.

Compare the 2018-2022 era to what’s expected to happen over the next 20 years (chart above).

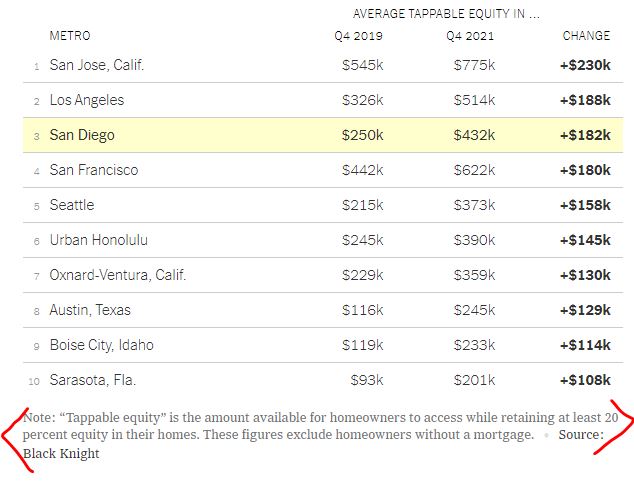

And then there’s this:

It’s hard to determine exactly how many buyers are receiving help from their parents, in part because few are willing to discuss how they’re paying for a new home. But financial advisors say they’ve seen a wave of ultra-wealthy parents seeking advice on buying homes for their kids because of the increased gift and estate tax exemption.

The Tax Cuts and Jobs Act doubled the amount that Americans can pass on to heirs tax-free, to about $12 million for individuals and $24 million for couples in 2022. It will sunset at the end of 2025, when the exemption is scheduled to be cut in half.

It’s not just for the ultra-wealthy either. Every homeowner has picked up enough additional home equity lately that they might find a way to tap into it to help out their kids:

Unfortunately, the generational wealth transfer will do nothing to add to the supply of homes for sale – it will only create more demand of affluent buyers playing with money that’s been given to them.

The Fed will be forced to keep trying to control inflation, and Rob Dawg thinks mortgage rates will get as high as 7.25% (and they could go higher). It will cause an uncomfortable frenzy-transition period because the longer it takes, the more money will be inherited. Yikes!

How long will people wait-and-see?

Get Good Help!

Even as the US real estate market shows signs of cooling, inflation and higher interest rates are making it difficult for young house hunters to buy properties — at least on their own.

Parents are increasingly helping their adult children purchase homes, whether that means co-signing a mortgage, giving money for a down payment or buying the property outright, according to real estate agents across the country.

In New York, Coldwell Banker Warburg’s Becki Danchik says she has never seen so many parents buying homes for or with their kids in her 15 years as a broker. Since January, she’s worked with four parent-child combo clients, three of whom are paying all cash.

“It has a lot to do with rental prices being so high,” she said. “They feel like it’s a waste to be throwing away money on rent when they can capitalize on the sales market right now.”

Families with means have long helped relatives find their footing as new homeowners, particularly in expensive metropolitan areas, agents say. But that assistance is crucial now more than ever, with sky-high home prices and mortgage rates above 5%. Plus, real estate is increasingly being viewed as a hedge against inflation and a better option than paying rent.

Ellen Sykes, a broker at Coldwell Banker Warburg, just worked with a client whose father purchased her a $3 million apartment on New York’s Upper East Side. The money will come out of her future inheritance, and she’ll pay the maintenance and renovation costs on the property.

“It’s a form of estate planning and being able to take care of your children while you’re still living,” Sykes said.

When Sheila and Sebastien Centner’s eldest son got into the University of Miami, the Toronto-based couple purchased a vacation home there. Then, after their younger son got into the school, they paid about $195,000 for the caretaker’s cottage behind the house and spent another $100,000 renovating it into a one-bedroom, one-bathroom apartment.

Sebastien said that one or both of the boys — ages 21 and 24 — will likely live there soon, and later on, one of them could sell it and use that money as a down payment for their next place.

“The greatest appreciation of wealth has always been in people’s homes,” Sebastien said. “We wanted to help them out with that. Getting that foot in the door is important.”

College students make up a sizable portion of the clients Ian Slater, a broker at Compass, has helped find apartments at 208 Delancey on the Lower East Side, a short walk from most of NYU’s campus. Studios start at about $690,000 with monthly fees of $900, and one-bedrooms are about $999,000 with fees between $1,100 and $1,500.

“You see interest from people saying, ‘That could be a down payment. I may just as well have an apartment that appreciates,’” Slater said.

Others, like Mijeong Park, are purchasing apartments for their kids to live in after graduation. Although she currently lives in South Korea, her son recently finished the MBA program at Columbia University and decided to stay in New York City full-time. She helped him buy a one-bedroom, one-bathroom unit at “Bloom on Forty Fifth”, a new condo building in Hell’s Kitchen, for about $1 million.

“I work with a lot of foreign investors, and they tend to buy properties for their kids,” said Mina Bevan, an agent at Douglas Elliman who assisted the family. “They don’t want them to waste their money on rentals.”

Stories from Utah:

https://www.deseret.com/2022/6/10/23064453/housing-market-american-dream-out-of-reach-generational-wealth-gap-millennials-baby-boomers

You also can’t talk about generational wealth without also acknowledging there are deep racial divides. White households have a “homeownership rate that is 30 percentage points higher than that of Black households,” the Times reported.

“The vast majority of that boomer wealth is white boomer wealth,” Kimbrough said. “The ability to pass that onto their children and to help their children buy a house is something many more white parents are able to do for their kids because of all the systemic inequality and the way we set up housing markets in the ’60s, ’70s and ’80s that barred a lot of people from entry at that time.”

For those who look at these charts and simply think all of this wealth will eventually shift to younger generations once their baby boomer or Gen X parents die, Kimbrough notes it takes a long time for that wealth to eventually transfer — especially as life expectancy expands in today’s modern age.

“Yes, it is true that some of this — and perhaps much of this wealth — will pass eventually, but it’s not true that it’s going to happen when they’re still young enough to take advantage of that to buy a home when they’re having kids,” Kimbrough said.

“And when you’re expecting that generational wealth to transfer on, again, you’re perpetuating the inequalities of who had the wealth to begin with and whose kids will then end up with the wealth.”

From an article dated yesterday:

In 2022, housing volatility isn’t attributed to lax lending standards but instead an imbalance of housing inventory and demand that has driven affordability to new lows.

“I don’t think home prices will fall anytime soon,” Holden Lewis, a home-and-mortgage analyst at NerdWallet, told Insider. “Demand still exceeds the supply of available homes for sale, the economy is creating jobs, and lending standards are strict. Those factors work to keep home prices from declining.”

While buyer demand has somewhat cooled due to mortgage-rate hikes spurred on by the Federal Reserve’s attempts to cool inflation, home prices are still climbing in neighborhoods across the country.

“Normally, higher mortgage rates cause home prices to cool,” Nadia Evangelou, the senior economist and director of forecasting at the National Association of Realtors, told Insider. “But, I don’t expect home prices to drop in 2022. We will see slower home-price appreciation, but not a price drop.”

Pass the popcorn please, this is going to be good…..

Baby Boomers are the most selfish generation of all time. They inherited lots of money from the greatest generation who were savers. The Boomers are spenders and are living longer. Fewer pensions folks. That Tesla lease payment does not go away. Roll that lease Boomer. Time will tell.

Several observations from the front lines. Generation skipping is a thing. A good thing. If a lot of this transfer goes to paying down debt, another very good thing. I’ve been written out of the will so many times if my mom leaves me anything it will be a surprise.

You quote “The ability to pass that onto their children and to help their children buy a house is something many more white parents are able to do for their kids because of all the systemic inequality…”

No, it is much more complex than that. “Red Lines” were fading fast in the late 60s and I doubt any made it another 15 years. Wealth and race are not clear cut when you look at all the other factors that are more important to wealth outcomes.

Don’t mistake an extended period of older Americans exercising wealth preservation strategies for some kind of scheme.