I picked a great day to start the mortgage-rate tracker in the right-hand column! >>>>

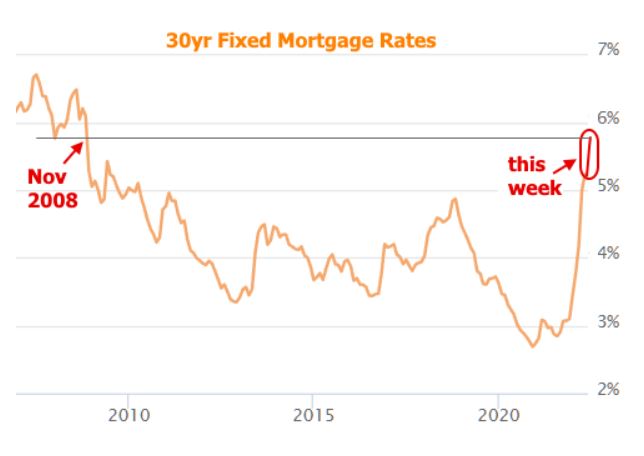

Mortgage rates haven’t been in the 6% range since 2008:

How many agents have operated in a 6% environment? It will be less than half of the active agents today. To check, their license number would have to be around 01850000 or lower (real estate license numbers in California are sequential).

Wondering how to cope? Here are my tips:

- Sellers – Offer to Pay Points. Even if the buyer won’t use your lender, offer to pay 1%-2% of the loan amount to buydown their interest rate. If their lender keeps the money instead of giving a lower rate, well then, heck, at least you tried. But the buyers should appreciate the effort, and two points should reduce the rate by at least 1/4%.

- Sellers – Carry the Financing. If the seller carries all or part of the financing at a reasonable rate, it will help the buyers. Plus, sellers only pay capital-gains taxes on the money you receive, so you’ll get a break there. The big bonus will be if the buyer stops paying – you’ll get your house back too!

- Buyers – Get a Short-Term Mortgage. We call them ARMs, or adjustable-rate mortgages which sounds scary after the neg-am debacle last time. But they offer a fixed-rate for the initial term – just get a seven-year or ten-year loan and refinance once we go into recession and the Feb has to back off again (because they owe $30 trillion themselves, it will probably happen sooner than later).

While the impact on the buyers’ monthly payments is real, it’s the market psychology that will make it worse. Buyers will be expecting lower prices, so instead, consider one of my tips above as an alternative.

What was a 30 Year Mortgage at when you started in the real estate Jim? For me it 11.75% for a 30-year fixed in 1990.

They had just come down to 13%. I dropped everything to get in while I could.

Believe it or not, Jennifer Connelly plays a character from the original Top Gun. Although it was one that was just mentioned in a line of dialogue. That’s right. She plays the Admiral’s daughter that got Maverick into some trouble, according to Stinger:

Stinger: “Son, your ego is writing checks your body can’t cash. You’ve been busted. You lost your qualifications as section leader three times. Put in hack twice by me with a history of high speed passes, over five air control towers, and one admiral’s daughter.”

Goose: “Penny Benjamin?”

According to Joseph Kosinski, the director of Top Gun: Maverick, Connelly plays Penny Benjamin. He told Variety:

“Penny Benjamin, a character we have heard mentioned but never seen before, that was an amazing opportunity to bring Jennifer Connelly’s character into this film.”

In the sequel, Penny is a single mother to a teenager named Amber. She also owns a local bar close to the TOP GUN base.

With apologies to my other lender friends, I feel the need as a public service to mention Mission FCU.

They are offering 3.375% fixed-rate for ten years, fully amortized for 30 years. After the tenth year, it turns into an adjustable-rate.

Loan amounts up to $3,000,000.

For those who know they are going to move within ten years, or know that they will pay off their mortgage within ten years, it’s a no-brainer today.

Dustin Gildersleeve is the loan rep. He closed 33 loans last month, which demonstrates his commitment to excellent service. You can’t close that many unless you have a machine behind you!

Dustin Gildersleeve · Mortgage Loan Originator

Real Estate · NMLS #13509

Phone: 619-379-0196 · Fax: 858-777-3612

dusting@missionfed.com

To apply – http://www.missionfed.com/dustin

You could also refi once the recession hits and rates come down, but I don’t know if they will ever be 3.375% again.

While it’s a nice idea to think you will refi into a 30-year fixed-rate loan some day, if it means you have to take a higher rate, many won’t get around to it.

I know this is a long story. But I hope it’s a lesson for people who think the very low mortgage rates might slip back down to historically-low.

I’ve watched the surge of mortgage rates for awhile, Jim. We built in October, 2018 and when the house was finished, we grabbed a 4.35% 30-year. After talking to you and in conference with my mortgage guy who said he could still get us the 2.85% rate from “yesterday”, we refinanced in May, 2020. He said we were one of only three.

Our mortgage payment is lower than most rents here in Boise (which recently had the fastest appreciation in the nation.).

The mortgage rate hikes are affecting relatives now. They sold their little home years ago–just when area housing prices were rising. With those proceeds, they bought 5 acres into build their dream house 45 minutes away. They wanted to save money for the build , and said they had ample funds for the prospective mortgage payment so they chose to rent. All the while believing they could afford the monthly payment when the house was finally built. They’ve rented for nearly 5 years.

They lined up a builder, spent $7,000 for the plans, and then the pandemic hit. Now they’re with another (national) builder I’ve never heard of. The first plans were for 2,500 sf, now it’s been slashed to 2,000 sf, so they lost the $7k. Although the value of their land has tripled in all these years, they now ponder if when their house is finished, they can afford the mortgage payment.

And now the permit process drags on, and companies here are only guaranteeing lumber prices for one week. The relatives thought they’d start the build in late May but it’s pushed back to early July. Where they once thought they’d finish building in October, it’s now a projected date of sometime in January (think cold weather).

A family of four is living in an old trailer as rates surge. I’m concerned because they have two little kids. Indecision has cost them so much money and time.

Thanks for the story Susie! Timing is of the essence, and many will have their life changed dramatically – in either direction – during the 2021-2023 era.

Hi JTR, do you happen to know of anything in that rate range for San Mateo County up north? TIA!