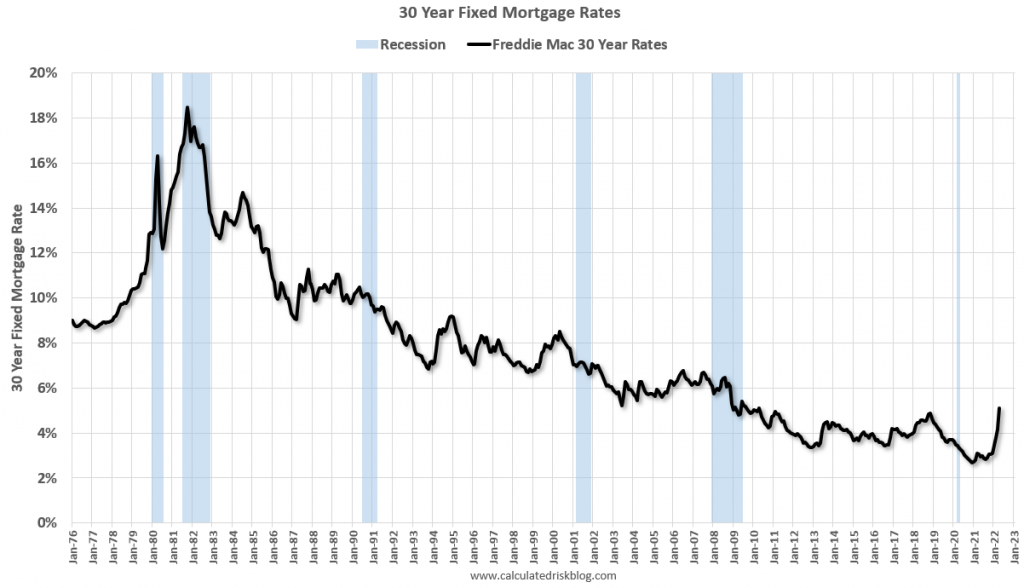

I suggested that mortgage rates should settle into the 4.75% to 5.50% range, and Bill at CR thinks the range will be 5.0% to 5.7%. Today’s rates are in the low 5s, so we have arrived and buyers should not feel the need to hurry up – but it will be bumpy over the next few months. Those with a short runway can opt for 2.375% for ten years.

Currently most forecasts are for the Fed Funds rate to rise to around 3.25%. Goldman Sach’s chief economist Jan Hatzius recently said he thinks the Fed may have to raise rates above 4%, although their baseline forecast is just about 3%.

When the Fed Funds rate peaks in this cycle, the yield curve will likely be fairly flat – meaning the 10-year treasury yield will be at about the same level as the Fed Funds rate. Based on the current estimate for the peak Fed Funds rate (3.25% to 4.0%), the 30-year fixed mortgage will likely peak at between 5.0% and 5.7%. There is some variability in the relationship, so we might see rates as high as the low 6% range. (This all depends on inflation and the Fed Funds rate – but I don’t expect rates to move much higher than the current rate – although 6% is possible).

Of course, rates are still historically low. But rates are up sharply from the recent lows, and my view is the change in rates is what will impact housing (see my post last month: Housing, the Fed, Interest Rates and Inflation; Housing is a key transmission mechanism for the FOMC).

This should help create more inventory as companies flee:

A shortened workweek may become the reality for many employees in California.

Legislation is now working its way through the state legislature that would make the standard workweek 32 hours for companies with more than 500 workers. There would be no cut in pay, and those who work more would be compensated at a rate of no less than 1.5 times the employee’s regular rate of pay.

“It doesn’t make sense that we are still holding onto a work schedule that served the Industrial Revolution,” Democratic Assembly member Cristina Garcia, one of the bill’s sponsors, said in a statement.

While the shift is long overdue, the Covid-19 pandemic and “Great Resignation,” also known as the “Great Reshuffle,” have made it clear the time to make the change is now, she said.

Nearly 48 million Americans walked away from their jobs last year, and the trend is still going strong. Almost 4.4 million workers quit in February alone, according to the U.S. Department of Labor.

“There has been no correlation between working more hours and better productivity,” Garcia said.

However, the California Chamber of Commerce opposes the bill, calling it a “job killer” because it will end up imposing more costs on businesses.

“Labor costs are often one of the highest costs a business faces,” Ashley Hoffman, public policy advocate at the California Chamber Commerce wrote in a letter to Assembly member Evan Low, another Democratic sponsor of the bill.

“Such a large increase in labor costs will reduce businesses’ ability to hire or create new positions and will therefore limit job growth in California.”

Proponents of the four-day workweek say the same work can get done in the shorter timeframe. More companies are now testing it out as a way address employee well-being.

Earlier this month, dozens of companies across the U.S. and Canada began a six-month pilot of a four-day workweek, which is being led by 4 Day Week Global.

The idea is that employees work 80% of the time for 100% of the pay and maintain 100% productivity. It comes down to working more efficiently, including cutting back on unnecessary meetings.

“More and more companies are recognizing that the new frontier for competition is quality of life, and that reduced-hour, productivity-focused working is the vehicle to give them that competitive edge,” said Joe O’Connor, CEO of 4 Day Week Global.

I suspect we will test 6% and find it unacceptable regardless of the competing inflation rate. So 5.5-5.75% sounds right.

Regards the 4day 32hr. No problem. Productivity will cover most. Reduced congestion and less need for commercial space will cover more.

I’m retired now but I’m not missing the meetings about meetings culture. Also the corporate backstabbing and sending emails and cc’ing every frickin’ person in the company.