The Mortgage Bankers Association (MBA) released its latest mortgage application numbers this morning and the modest movement belies the drama unfolding in the world of mortgage rates. As usual, the MBA does a good job of capturing average rate movement week to week and they correctly identified last week’s big spike to the highest levels since the first half of 2019.

Despite the surge, mortgage applications didn’t respond in a major way. Refi applications only fell 3% from the previous week. Purchase applications actually managed a small uptick of 1% after last week’s more substantial 9% improvement. But context matters.

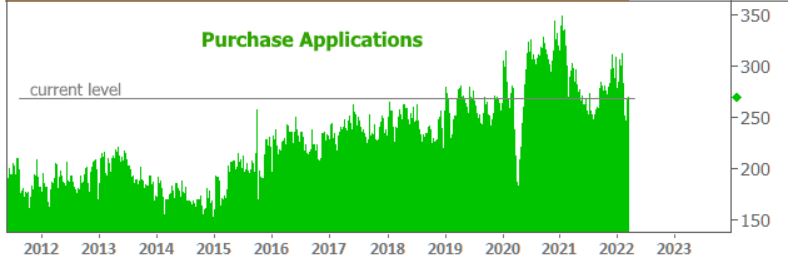

As seen in the following chart, refi applications have declined massively from Summertime highs and even more massively from the high levels at the beginning of 2021. MBA notes this week’s tally is 49% lower than the same week last year. The news is less dire on the purchase side. Applications are still lower than most of the past few months, but higher than most of the late summertime months from 2021:

Speaking of context mattering, a longer term chart of the same data really helps put the magnitude of this most recent rate spike into perspective. It’s not an exaggeration to say it’s now the sharpest move higher that any of us have seen in more than a decade (the overall size is about the same as 2016-2018, but this one has happened in roughly 6 short months… not only that, but 2016-2018 was really a 2-parter).

The other takeaways from the chart include the notion that the purchase market is still firing on all cylinders relative to most of the past decade (even then, we can responsibly conclude it would be even higher if not for the low inventory situation) and that refi demand doesn’t have much farther to fall before hitting the historical bottom. In fact, due to the immense equity build-up of the past 2 years, the doldrums of 2017-2018 may not be a relevant baseline this time around.

https://www.mortgagenewsdaily.com/news/03162022-mba-applications-purchase-refi-refinance

Mortgage rates are based on movement in the bond market, and bonds have lost ground every day for 8 straight days. Today was merely the latest in that losing streak.

The weakness was in place from the outset, but it was modest at first. The average mortgage lender was only 0.02-0.04% higher in rates versus yesterday in effective terms (mortgages are typically offered in 0.125% increments with fine-tuning adjustments seen in closing costs. “Effective rate” is a term that translates the closing cost changes to a hypothetical interest rate).

At that time of day, lenders (and everyone else for that matter) was waiting to hear the scheduled policy statement from the Federal Reserve. It was a foregone conclusion that the Fed would hike its policy rate by 0.25%, but other details were a bit of a moving target. Specifically, this was one of the 4 meetings per year where the Fed publishes updated projections for the Fed Funds Rate (that’s the thing everyone is talking about when they reference hikes or cuts).

The Fed Funds Rate doesn’t have a direct bearing on mortgages or other long term rates, but the outlook for future Fed hikes/cuts can certainly have an impact. The market was well aware that Fed members would be expecting significantly higher rates than the last round of forecasts showed in December. When the new forecasts showed a median expectation for SEVEN hikes in 2022 (as opposed to the 5-6 that the average market participant expected), bonds responded with a sharp rise toward higher yields/rates.

Most mortgage lenders recalled the day’s initial rate sheets and “re-priced” with less favorable terms. Conventional 30yr fixed rates for top tier scenarios are up to 4.5% in many cases although the timing and magnitude of rate changes vary widely from lender to lender. As this is a general rate article that draws on data from multiple lenders, the best way to use it is to focus on the change from certain points in the past. So here you go:

Rates are UP:

more than a quarter point this week,

more than half a percent from the lowest levels in March following the onset of the Ukraine war,

almost 7/8ths of a point since Feb,

1.25% so far in 2022,

and almost 1.75% from the lows of last summer.

Even before today (but especially after), this is the sharpest move higher in rates in more than a decade.

Why have rates been rising so quickly? First off, they were always destined to rise as the world moved past the brunt of the pandemic. That may have been a more orderly process, but unexpectedly relentless inflation and an abrupt passing of the omicron surge increased the Fed’s sense of urgency. It was already talking about removing rate friendly policies in Q4 2021, but that removal accelerated immensely as the new year began.

Then the war in Ukraine added major fuel to inflationary fires due to its effect on oil and other commodities prices (inflation is bad for bonds/rates). The Fed had a choice today to focus on the global economic uncertainty created by the Ukraine situation or to reiterate its fear/respect of the associated inflation implications. It chose the latter, and that likely added even more urgency to the upward pressure on rates and the robust rate hike outlook for the remainder of 2022.

Rising rates will not slay our local real estate market. A bear market for companies domiciled in Silicon Valley will help reduce the Bay Area invasion plaguing North County. “ Poof and it’s gone.”